We ran a successful live event last night, which included an exploration of our finance and property scenarios, driven from our Core Market Models.

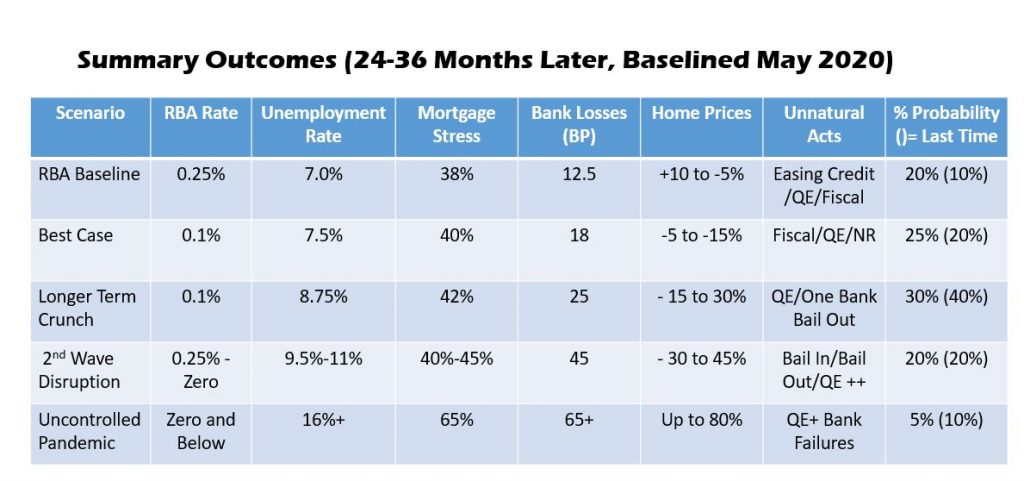

Given the amount of money being thrown to the construction and property sector and incentives (or bribes as they should be called) to prospective purchasers, there is a path to higher home prices, especially away from the high-rise disasters in our main urban centres. We now give this a 20% probability, as the Government and Regulators attempt to keep the balloon in the air until after the next election.

However, at the other end of the spectrum falls of more than 30%, or worse are are in the cards if we get a second wave of COVID, or if the Central Bank support for the financial system starts to trigger a range of unintended consequences. Perhaps the truth lays somewhere in between, but anyone who takes a definitive stance on where prices will be ahead, are not understanding what is really going on.

You can watch our edited HQ edition of the show here:

Alternatively, you can watch the entire event, including the pre-show and and live chat replay.

Finally, note that our next live event – Tuesday 23rd June will be a real-time Q&A session with Robbie Barwick from the Citizens Party. This discussion will centre on banking reform and its implications. So mark your diary!