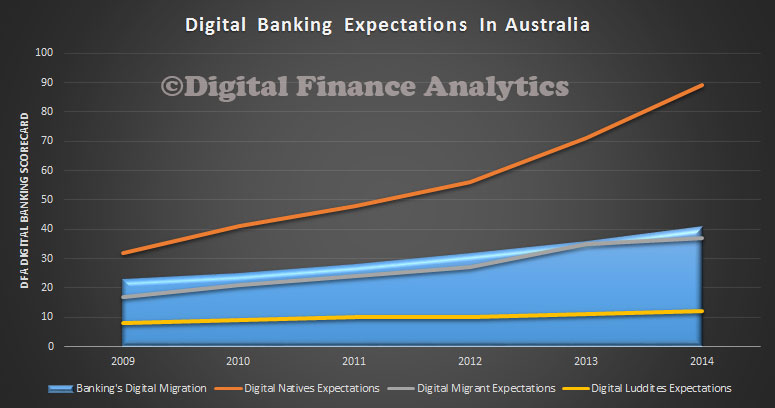

Using the latest data from the DFA channel preferences survey, last published in the report “The Quiet Revolution“, today we chart the top line digital banking scorecard, from the demand side, looking at different household groups, and on the supply side what banks are doing to embrace digital. The rate of change in terms of bank participation in digital, is tracking the rate of adoption of those who are Digital Migrants, and they are moving faster than those households in the Digital Luddite segments. However, it appears that whilst the Australian banking sector is moving towards digital, those who are digitally literate – the Digital Natives – have ever more enhanced desire to do more digitally. Indeed, the digital gap between expectations and delivery is widening. You can read about our digital segmentation here.

The rate of digital migration is closely tracked by the uptake of smart phones and tablets. Digital Natives are the most likely to be using one of these smart devices, and they have a strong desire to manage their entire financial service footprint digitally. This is true whether it is buying a mortgage, making a payment, or checking a transaction. We know from our profitability analysis that Digital Natives are on average more valuable to the industry, tend to be younger, and better educated, and are significantly less likely to enter a bank branch for any purpose. They use social media and online search tools, and trust these information channels more than a typical bank. They also have high expectations in terms of customer service delivery, and personalization. Many banking players are not meeting these expectations.

The rate of digital migration is closely tracked by the uptake of smart phones and tablets. Digital Natives are the most likely to be using one of these smart devices, and they have a strong desire to manage their entire financial service footprint digitally. This is true whether it is buying a mortgage, making a payment, or checking a transaction. We know from our profitability analysis that Digital Natives are on average more valuable to the industry, tend to be younger, and better educated, and are significantly less likely to enter a bank branch for any purpose. They use social media and online search tools, and trust these information channels more than a typical bank. They also have high expectations in terms of customer service delivery, and personalization. Many banking players are not meeting these expectations.

DFA is of the view that banks need to accelerate their rate of migration to the digital world, and position to respond to the rising number of new entrants which have the potential to disrupt significantly. We recently discussed Apple Pay, PayPal and Ratesetter. Each of these have potentially disruptive impact. As we said recently:

“DFA has just updated the 26,000 strong household survey examining their channel preferences. This report summarises the main findings.

We conclude that the move towards digital channels continues apace, facilitated by new devices including smartphones and tablets, and the rise of “digital natives” – people who are naturally connected.

We outline the findings across each of our household segments, and also introduce our thought experiment, where we tested household’s attitudes to the various existing and emerging brands in the context of digital banking. We found a strong affinity between digital natives and the emerging electronic brands, and a relative swing away from the traditional terrestrial bank players.

These trends create both threat and opportunity. The threat is that traditional channels, especially the branch, become less relevant to digital natives, and becomes the ghetto of older, less connected, less profitable customers. The future lays in the digital channels, where the more profitable and digitally aware already live. Players need to migrate fast, or they will be overtaken by the next generation of digital brands who are looking towards becoming players in financial services. The game is on!”