US consumers are making more “remote” payments according to new payments data collected by the Federal Reserve. Remote general-purpose credit card payments, including online shopping and bill pay; all enabled by digital.

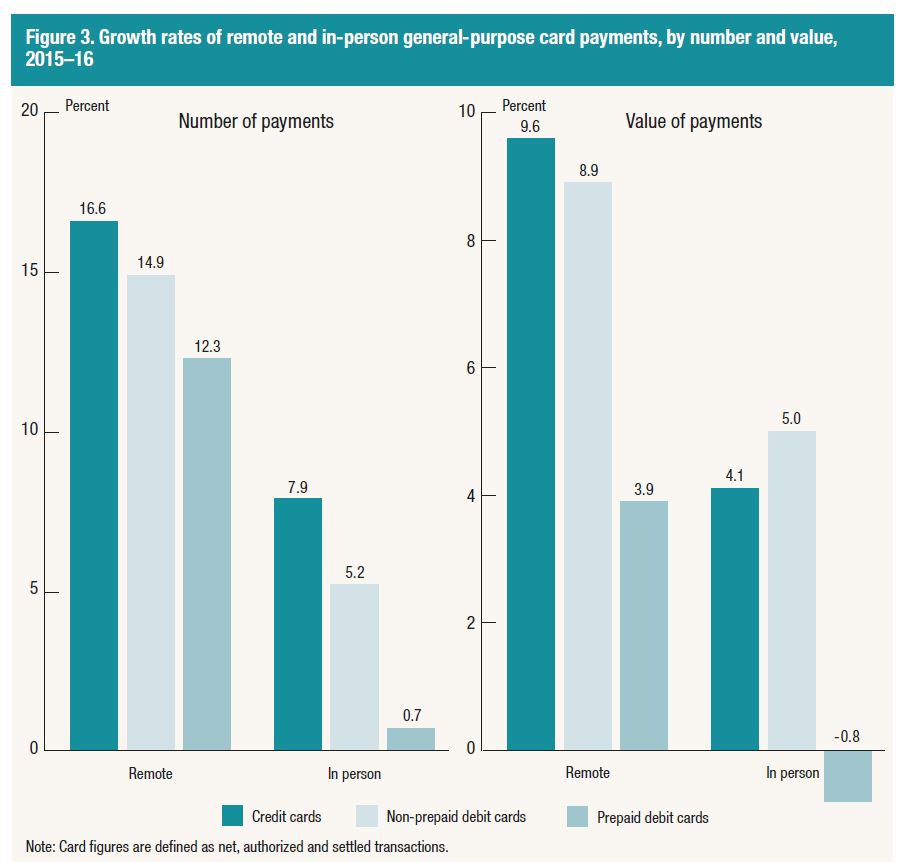

The number of credit card payments grew 10.2 percent in 2016 to 37.3 billion with a total value of $3.27 trillion. The increase in the number of payments compares with an 8.1 percent annual rate from 2012 to 2015 and was boosted by continued strong growth in the number of payments made remotely. Remote general-purpose credit card payments, including online shopping and bill pay, rose at a rate of 16.6 percent in 2016. More broadly, remote payments in 2016 represented 22.2 percent of all general-purpose credit and prepaid debit card payments, up 1.5 percentage points from an estimated 20.7 percent in 2015. By value, remote payments represented 44.0 percent of all general-purpose card payments, a slight increase from an estimated 42.9 percent in 2015.

The 2016 data on trends in card payments, as well as Automated Clearing House (ACH) transactions and checks, are the product of a new annual collection effort that will supplement the Federal Reserve’s triennial payments studies. Information released today compares the annual growth rates for noncash payments between 2015 and 2016 with estimates from previous studies.

Key findings include:

- Total U.S. card payments reached 111.1 billion in 2016, reflecting 7.4 percent growth since 2015. The value of card payments grew by 5.8 percent and totaled $5.98 trillion in 2016. Growth rates by number and value were each down slightly from the rates recorded from 2012 to 2015.

- Debit card payment growth slowed by number and value from 2015 to 2016 as compared with 2012 to 2015, growing 6.0 percent by number and 5.3 percent by value compared with a previous annual growth rate of 7.2 percent by number and 6.9 percent by value.

- Use of computer microchips for in-person general-purpose card payments increased notably from 2015 to 2016, reflecting the coordinated effort to place the technology in cards and card-accepting terminals. By 2016, 19.1 percent of all in-person general-purpose card payments were made by chip (26.9 percent by value), compared with only 2.0 percent (3.4 percent by value) in 2015.

- Data also reveal a shift in the value of payments fraud using general-purpose cards from predominantly in person, estimated at 53.8 percent in 2015, to predominantly remote, estimated at 58.5 percent in 2016. This shift can also be attributed, in part, to the reduction in counterfeit card fraud, the sort of fraud that cards and card-accepting terminals using computer chips instead of magnetic stripes help to prevent.

- From 2012 to 2015, ACH network transfers, representing payments over the ACH network, grew at annual rates of 4.9 percent by number and 4.1 percent by value. Growth in both of these measures increased for the 2015 to 2016 period, rising to 5.3 percent by number and 5.1 percent by value. The average value of an ACH network transfer decreased slightly from $2,159 in 2015 to $2,156 in 2016.

- Data from the largest depository institutions show the number of commercial checks paid, which excludes Treasury checks and postal money orders, declined 3.6 percent between 2015 and 2016. By value, commercial checks are estimated to have declined 3.7 percent during the same period. The steeper decline in value versus volume suggests the average value of a commercial check paid has declined slightly since 2015.