ASIC has released new guidance and waivers to further facilitate businesses providing disclosures through digital channels and to encourage innovative communication of information about financial products and services. It is essentially a ‘digital first’ option, meaning that consumers can expect electronic delivery as the default option. It recognises the significant online migration underway, and will be welcomed by many. Two points, this is a departure from “omnichannel” strategies, and it may not provide suffice protection for those who choose not to, or cannot use digital channels. The digital divide does still exist, and disadvantaged households will be least well served.

ASIC Commissioner John Price said, ‘The measures announced today respond to changing consumer preferences, with ever increasing numbers of people transacting digitally. Almost 15 million Australians now have a home internet connection and 68% of those online are using three or more devices to access the internet.

‘The changes mean product disclosure statements (PDS) and other financial services disclosure documents will be delivered to consumers digitally as the default option, unless the consumer opts out. This will reduce the costs of printing and mailing for businesses while preserving choice for those consumers who wish to receive paper.’

‘ASIC wants industry to harness the opportunities of digitisation and is encouraging the use of more engaging forms of communication using digital media – interactive, video and audio. This can boost consumer understanding of financial services and products,’ Mr Price said.

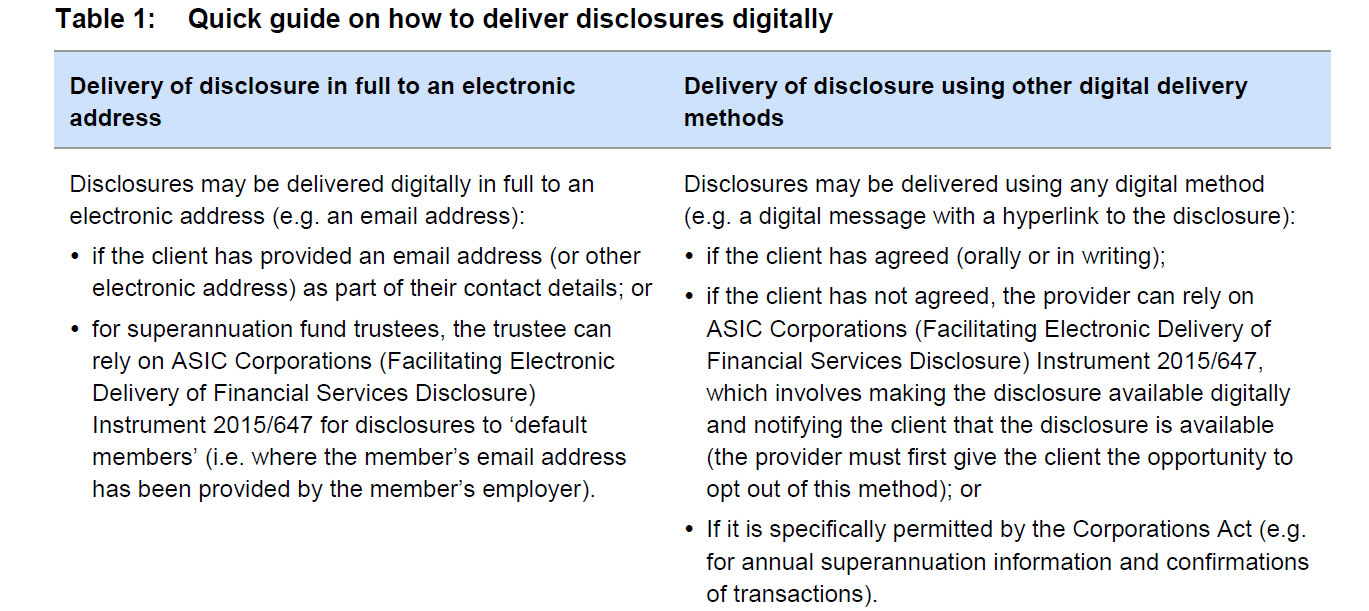

ASIC has given relief to enable providers to make many disclosures available digitally, and notify the client the disclosure is available, without the need for client agreement to receive the disclosures in that manner (‘publish and notify’ method). This relief allows for disclosure by, for example, sending clients:

(a) an email, SMS, app notification, social media notification or other digital message with a hyperlink or similar connection, or instruction to access the disclosure; or

(b) a notification that the disclosure is available digitallyThe publish and notify method of delivery is available for the following disclosures:

(a) FSGs and SOAs;

(b) PDSs;

(c) ongoing disclosure of material changes and significant events;

(d) periodic statements; and

(e) information statements for CGS depository interests.Rather than seeking agreement to deliver in this way, the provider must merely notify the client that they intend to make disclosures available digitally, and will notify the client when those disclosures are available. The client must then be given at least seven days to opt out of this publish and notify method, should they choose to do so

They say:

- An advantage of digital disclosure for clients is that it can incorporate more engaging forms of media and can be interactive. This can make the information more attractive and easier to understand for clients. It can also be more timely, convenient and reliable.

- Digital disclosure also has advantages for providers in reducing the costs of printing and mailing.

- ASIC has taken a technologically neutral approach to disclosures and do not mandate the delivery of disclosures digitally. It is for providers to determine the method of delivering disclosures that best suits their clients or their products and that will not expose those clients to undue risk of scams and fraud. For example, a margin-lending product might work particularly well online because clients are likely to be monitoring their investments online.

- While the Corporations Act expressly permits the electronic delivery of financial services disclosures, we understand that some providers have been discouraged from doing so because of uncertainty about what specific practices the law allows.

- Consumer protection under digital delivery still exists

Further evidence of the digital revolution. As we said recently:

“DFA has just updated the 26,000 strong household survey examining their channel preferences. Our report summarises the main findings.

We conclude that the move towards digital channels continues apace, facilitated by new devices including smartphones and tablets, and the rise of “digital natives” – people who are naturally connected.

We outline the findings across each of our household segments, and also introduce our thought experiment, where we tested household’s attitudes to the various existing and emerging brands in the context of digital banking. We found a strong affinity between digital natives and the emerging electronic brands, and a relative swing away from the traditional terrestrial bank players.

These trends create both threat and opportunity. The threat is that traditional channels, especially the branch, become less relevant to digital natives, and becomes the ghetto of older, less connected, less profitable customers. The future lays in the digital channels, where the more profitable and digitally aware already live. Players need to migrate fast, or they will be overtaken by the next generation of digital brands who are looking towards becoming players in financial services. The game is on!”