Recent research by AMP has found three quarters of Australians will be starting the year without a defined and specified budget, which will make sticking to our new financial goals tricky.

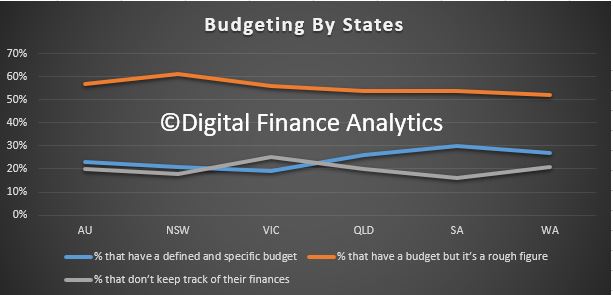

Whilst around half of households do some rough calculations, one fifth do not track spending at all, and this is true across all age bands and states. Our own surveys suggest that half of all mortgage holders do not budget effectively.

Michael Christofides, Director of Retail Solutions at AMP Bank, said the findings are worrying as budgeting is a critical part to achieving financial security.

“Knowing what you earn, owe and spend gives your greater control over your money and lets you quickly identify areas where you could be saving.

“The problem is that many people mistakenly think they are too busy to budget.

“But perhaps this is because many of us are still using back of the envelope and time-consuming techniques to try and track our finances.”

According to AMP’s research, over a third of Aussies (34 per cent) believe budgeting is too much effort and almost one in five Aussies (19 per cent) say budgeting takes too much time.Even if we do start off the year with good intentions – sitting down and creating an initial budget – over a quarter (27 per cent) of us won’t end up sticking to it.

The research also showed that regularly checking our bank accounts (47 per cent), paper (28 per cent) and excel (20 per cent) were the main ways we keep track of our budgets.

Mr Christofides said, “In this era of smart banking applications, Aussies don’t need to be spending time hunched over an excel spreadsheet – not when an application or smart bank account can do all the work for you with far greater accuracy, giving you far greater control.”

So maybe this year, if we are to meet our financial New Year’s resolutions, we should look to use technology to help us. Not only will it take away the time and effort of budgeting, it will help us to achieve our financial goals and resolutions in 2018.