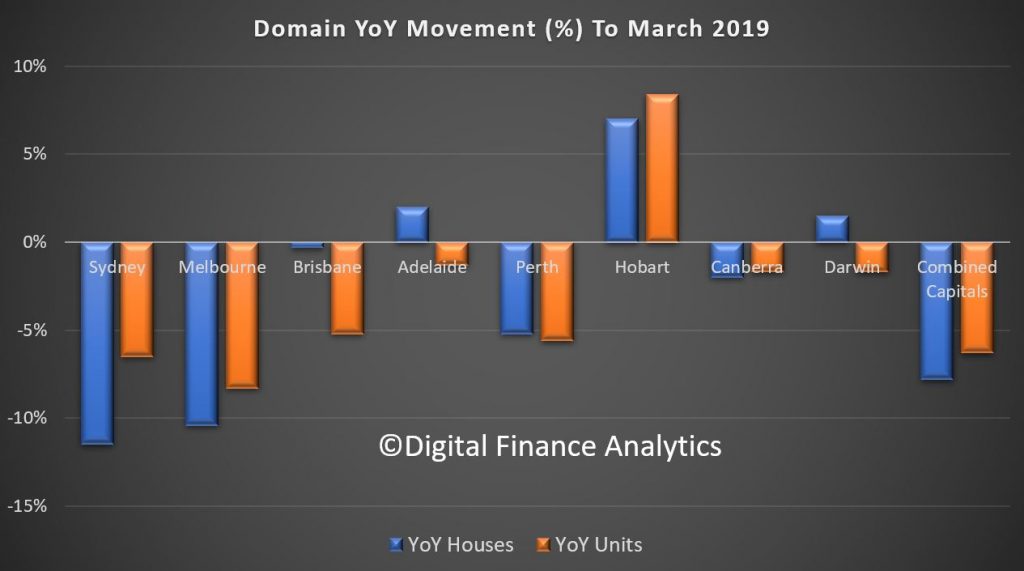

Domain has released their March quarter 2019 house price data. Sydney, Melbourne and Perth are bearing the brunt of the falls, alongside units in Brisbane, according to their statistics. Hobart remains the most buoyant but buyer interest appears to have passed its peak . And of course remember these are average figures which mask local changes.

They says that Sydney’s current property downturn is the sharpest in more than two decades. It is yet to surpass the duration of the 2004-06 slump but it is coming close to being the longest. Sydney house prices have fallen 14.3 per cent from the mid-2017 peak. If the pace of quarterly decline remains, prices are likely to dip below $1 million in the coming quarter. A six-figure median house price has not been recorded in four years. Sydney unit prices have fallen 9.9 per cent from the mid-2017 peak. For the first time in three years unit prices are below $700,000.

Despite further price deterioration to house and unit prices over the quarter, the rate of decline has eased from the quarterly falls recorded last year. House prices are now back to early 2016 and units back to mid-2015. However, house prices are 30.2 per cent higher and unit prices 20.7 per cent higher than five years ago, providing many homeowners with substantial equity gain.

Melbourne is currently facing its steepest downturn in more than two decades. House prices have fallen for five consecutive quarters, down 11 per cent from the peak reached at the end of 2017. Unit prices have held firmer, with price falls shorter and less severe relative to houses. Unit prices have deteriorated for four consecutive quarters, pulling prices back 8.3 per cent from the peak notched a year ago.

The Melbourne property market started 2019 better than 2018 ended, with auction clearance rates nudging higher (admittedly from lower volumes), views per listing rising marginally, and banks now actively seeking new business. The rate of house price declines have eased over the latest quarter.

Greater Brisbane house prices have stalled following six years of continuous annual growth, with prices flatlining over the year. Homeowners may not be reaping equity gain but flat house prices is a better outcome than a fall, which is what’s playing out across most capital cities.

The housing market remains fragmented with houses outperforming units. This has been a trend since mid-2012. Unit prices are 9.6 per cent below the mid-2016 peak, with buyers now able to reap the benefits of purchasing at 2013 prices. Significant supply numbers have weighed heavily on unit prices. Although listing volumes are shrinking, it has not been enough to translate into price growth yet.

House prices in Adelaide have bucked the national downward trend and became one of only three capital cities to rise over the year. Homeowners have reaped the benefit of almost six years of steady annual house price growth. House prices may have flatlined over the quarter, but it is the second best outcome of all the capital cities, behind Hobart. The sustainable pace of annual growth has slowed to a five-and-a-half year low. This weakness provides further evidence that credit access is having an impact on markets that would otherwise have steady growth.

Adelaide is now the third most affordable city to purchase a house, surpassing Perth’s median house price for the first time since 1993. House prices currently remain higher than Hobart, but galloping Hobart prices mean the price gap is at a 12-year low. Adelaide’s unit prices have marginally fallen from the record high achieved last quarter, but remain the most affordable of all the capital cities.

Early indicators previously displayed some encouraging signs of a recovery in Perth’s housing market. However, over the first quarter of this year, house and unit price falls have gathered pace. House prices are now 14 per cent and unit prices 16.6 per cent below the 2014 peak.

Buyers continue to have the upper hand. Improved affordability is providing the ultimate silver lining for prospective homeowners, allowing a purchase to be made at 2011 prices. Perth’s recovery is being hindered by a more restrictive lending environment at a time when local confidence is subdued under weak economic conditions. A sluggish economy is being dragged down by high unemployment, a tight consumer purse, and weak population growth.

Hobart bucked the national downward trend, and remains the best performing city for capital growth. It became the only city to record growth over the quarter and year for both houses and units. Despite this, the pace of house price growth has slowed to half of that recorded over the same period in 2018, providing homeowners the lowest annual growth since mid-2016. In the space of a year-and-a-half, Hobart has gone from the most affordable city to purchase a unit, to more expensive than Adelaide, Darwin and Perth. If the pace of growth continues, Hobart unit prices are likely to overtake Brisbane’s in the coming months.

Hobart became a hotspot for investors, a destination for interstate buyers seeking the ultimate lifestyle location, and tourism flourished helping to drive economic growth and place pressure on housing demand. Buyer interest appears to have passed its peak, with Domain recording a slip in the number of views per listing over the past two months. It is likely that capital gains will be more subdued than the double-digit growth recorded last year.

Canberra’s housing market has shown the first signs of price weakness since 2012. House prices had their steepest annual fall in a decade, following a stint of continuous growth that spanned roughly six years. Despite this, the nation’s capital has a tendency to be the quiet achiever, providing homeowners with steady equity growth. Historically, any pullback in house prices tend to be short and relatively minor, apart from the 1995-97 downturn. Current market conditions are likely to be the same, a short period of softening rather than the correction currently unravelling in Sydney and Melbourne.

Unit prices continue to slide over the quarter and year, with the market failing to produce a steady period of price growth since 2009-10. The outlook for apartment prices has been mixed, providing only subdued capital growth over the past five years, up by 4.5 per cent. Equity growth in houses has been superior at 25.8 per cent.

The peak of Darwin’s housing market is in the rear-view mirror – with prices hitting a high during 2013-14. House and unit prices continue to be impacted from the weak economic conditions that have ensued post the mining boom, with a soft employment sector and lack of migration weighing on the demand for housing. A recovery in Darwin’s housing market largely hinges on the government’s attempts at boosting the population, jobs growth and an improvement in the availability of housing credit.