Experts have warned against predicting that property prices have peaked just yet.

A flurry of headlines this week generated by UBS analysts, Australian Financial Review columnists and others all warned that Sydney and possible Melbourne prices had peaked and we should brace for a correction.

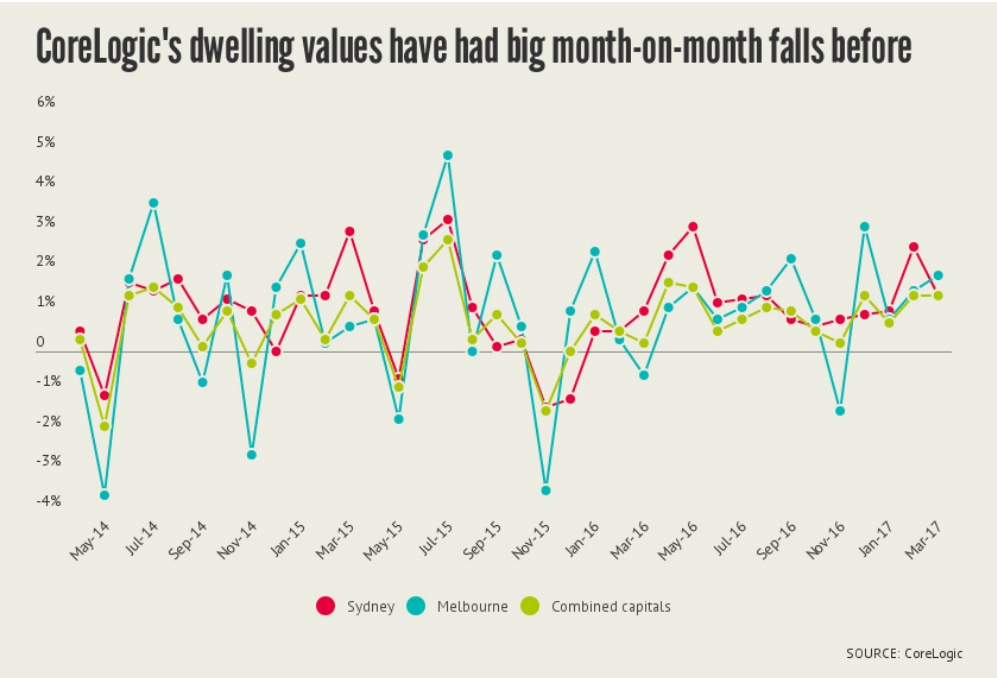

Most were based on slower price growth in Sydney dwelling values and slight reductions in auction clearance rates compiled by CoreLogic, a property data firm.

However, CoreLogic director of research Tim Lawless cautioned against reading into the results (especially dwelling values, which are yet to be officially released for April) because April and May are generally weaker periods.

“Potentially there is some seasonality creeping into these numbers and that’s one of the reasons why I would probably suggest caution calling the peak right now before we see a few more months and see if the trend actually develops,” Mr Lawless told The New Daily.

“When we look at, say, a year ago or any sort of seasonality in the marketplace, yeah, we do generally see some easing in our reading around April and May.”

A further complication is that CoreLogic adjusted how it calculated dwelling values in May 2016 to account for seasonality. The result, according to Mr Lawless, is that “technically speaking, there are some challenges and complexities making a year-to-year comparison”, although he said the adjustments were “quite minor” and values could still be compared.

The change sparked a scandal last year, with the Reserve Bank ditching the company as its preferred data source after claiming it had overstated dwelling values in April and May.

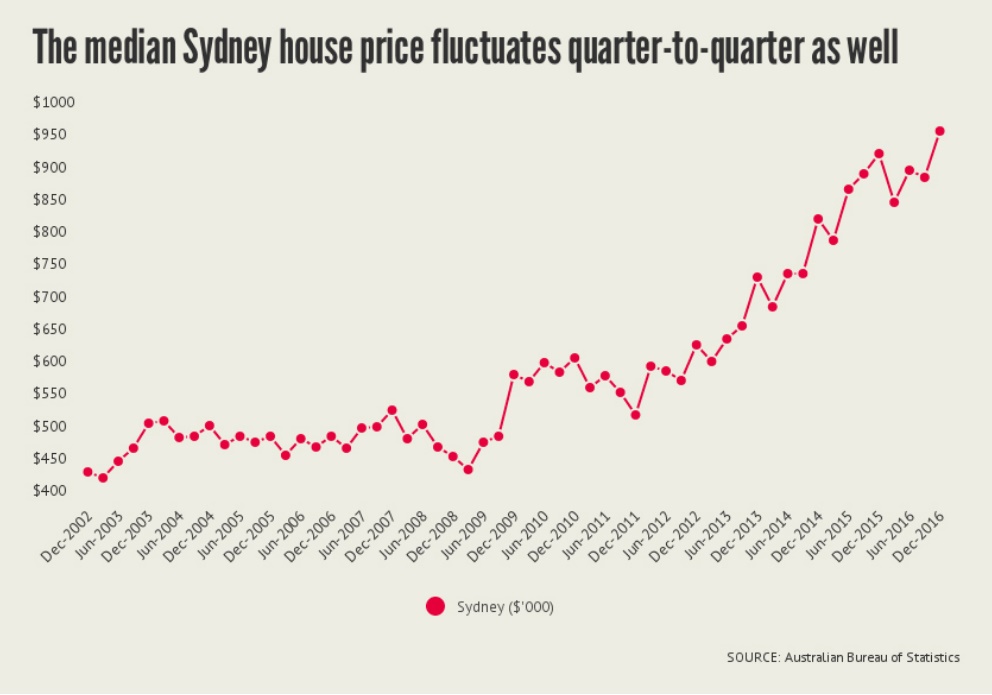

Despite this, CoreLogic remains the most widely cited property data source because it reports dwelling values daily. But the most authoritative is the Australian Bureau Statistics, which has measured similar quarter-on-quarter falls in the past, especially between the December and June quarters. And yet, the trend has been ever upwards.

IFM chief economist Dr Alex Joiner agreed we shouldn’t jump to conclusions based on the latest statistics.

“I wouldn’t suggest that anyone looks at any month-to-month data in Australia and makes firm conclusions from it,” Dr Joiner told The New Daily.

“People might want to rush to call the top, but the trends are for gradually decelerating growth, and I think that’s about right.”

But if this is not the peak, the market is “very much approaching it” because the Reserve Bank and the banks are likely to lift interest rates even as wage growth stays low, Dr Joiner said.

“When that actually decelerates price growth, whether it’s this month or later in the year, I don’t know. But we’re certainly eeking out the very last stages of price growth in the property market.”