The Bank for International Settlements has just published a special report on Early Warning Indicators Of Banking Crises.

Household and international debt (cross-border or in foreign currency) are a potential source of vulnerabilities that could eventually lead to banking crises. We explore this issue formally by assessing the performance of these debt categories as early warning indicators (EWIs) for systemic banking crises. We find that they do contain useful information. In fact, over the more recent subsample, for household and cross-border debt indicators the information is similar to that of the more commonly used aggregate credit variables regularly monitored by the BIS. Confirming previous work, combining these indicators with property prices improves performance. An analysis of current global conditions based on this richer information set points to the build-up of vulnerabilities in several countries.

Early warning indicators (EWIs) of banking crises are typically based on the notion that crises take root in disruptive financial cycles. The basic intuition is that outsize financial booms can generate the conditions for future banking distress. The narrative of financial booms is well understood: risk appetite is high, asset prices soar and credit surges. Yet it is difficult to detect the build-up of financial booms in real time and with reasonable confidence. It is here that EWIs come in.

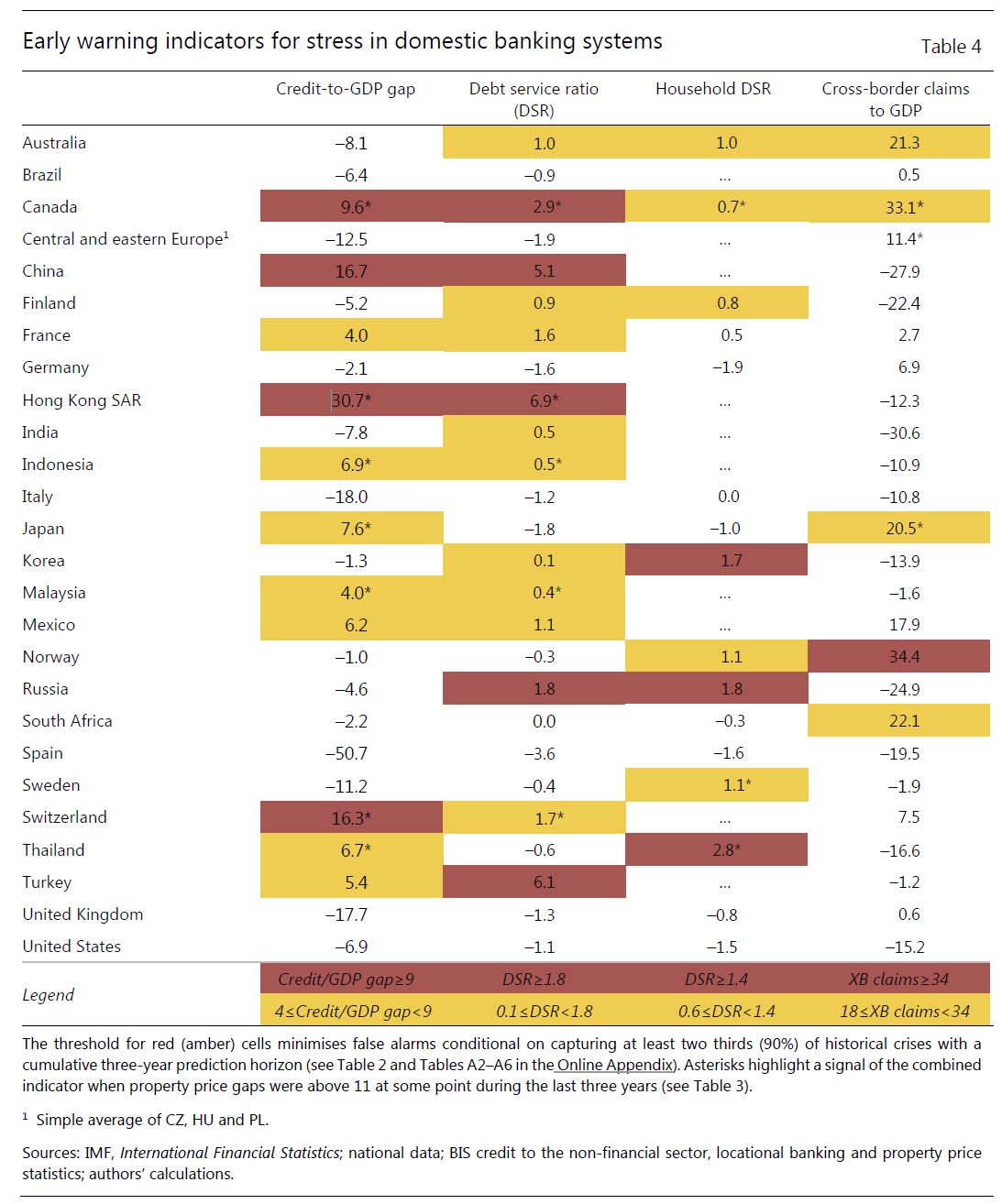

Table 4 takes a closer look at the status of the various indicators as of June 2017. Cells are marked in red if the indicator has breached the threshold for predicting at least two thirds of the crises. Those marked in amber correspond to the lower threshold required to predict at least 90% of the crises. This avoids a false sense of precision and captures the very gradual build-up in vulnerabilities. Asterisks indicate that the corresponding combined credit-cum-property price indicator has breached its critical threshold. The picture that emerges is a varied one.

Aggregate credit indicators point to vulnerabilities in several jurisdictions Canada, China and Hong Kong SAR stand out, with both the credit-to-GDP gap and the DSR flashing red. For Canada and Hong Kong, these signals are reinforced by property price developments. The credit-to-GDP gap also flashes red in Switzerland, whereas the total DSR flashes red in Russia and Turkey.

Credit conditions are also quite buoyant elsewhere. Credit-to-GDP gaps and/or the total DSR send amber signals in some advanced economies, such as France, Japan and Switzerland, as well as in several emerging market economies (EMEs). In Indonesia, Malaysia and Thailand, as well as some other countries, property price gaps underscore this signal.

Some jurisdictions also exhibit some signs of high household sector vulnerabilities. In Korea, Russia and Thailand, the household sector DSR flashes red (Table 4, third column). In Thailand, the red signal for the household DSR is underlined by the property price indicator. Property prices have also been in elevated in Sweden and Canada, which exhibit an amber signal for the household DSR.

The cross-border claims indicator supports the risk assessment for several countries and flags some potential external vulnerabilities for others (Table 4, fourth column). The indicator flashes red for Norway, and is amber for a number of economies.

While providing a general sense of where policymakers may wish to be especially vigilant, these indicators need to be interpreted with considerable caution. As always, they have been calibrated based on past experience, and cannot take account of broader institutional and economic changes that have taken place since previous crises. For example, the much more active use of macroprudential measures should have strengthened the resilience of the financial system to a financial bust, even if it may not have prevented the build-up of the usual signs of vulnerabilities. Similarly, the large increase in foreign currency reserves in several EMEs should help buffer strains. The indicators should be seen not as a definitive warning but only as a first step in a broader analysis – a tool to help guide a more drilled down and granular assessment of financial vulnerabilities. And they may also point to broader macroeconomic vulnerabilities, providing a sense of the potential slowdown in output from financial cycle developments should the outlook deteriorate.