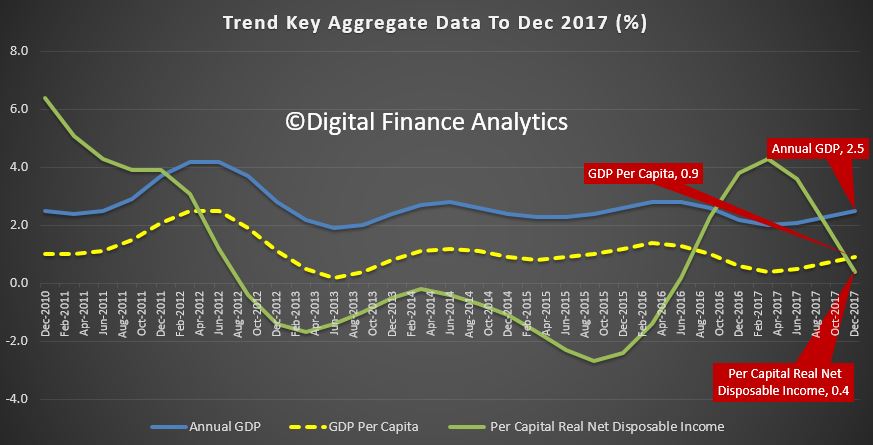

The ABS has released the account aggregates to December 2017. Overall the trend data on an annualised basis is still pretty weak. GDP has moved up just a tad, but GDP per capital is growing at 0.9% per annum, and continues to fall. Much of the upside in to do just with population growth. But net per capital disposable income rose at just 0.4% over the past year. Housing business investment and trade were all brakes on the economy.

These are not indicators of an economy in prime health!

Real remuneration is still growing at below inflation, so incomes remains stalled. More than two in three households have seen no increase. It rose by 0.3% in the December quarter and was up just 1.3% over the year to December 2017, compared with inflation of 1.9%.

Real remuneration is still growing at below inflation, so incomes remains stalled. More than two in three households have seen no increase. It rose by 0.3% in the December quarter and was up just 1.3% over the year to December 2017, compared with inflation of 1.9%.

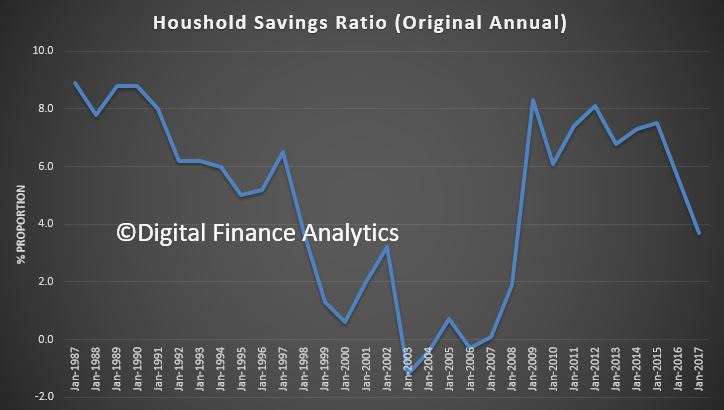

In fact households continue to raid their savings to support a small increase in consumption, but this is not sustainable. The household savings ratio recovered slightly to 2.7% from 2.5% in seasonally adjusted terms. Debt remains very high.

The Australian economy grew 0.4 per cent in seasonally adjusted chain volume terms in the December quarter 2017, according to figures released by the Australian Bureau of Statistics (ABS) today.

Chief Economist for the ABS, Bruce Hockman, said: “Growth this quarter was driven by the household sector, with continued strength in household income matched by growth in household consumption.”

Compensation of employees (COE) increased 1.1 per cent in the December quarter, the fourth consecutive quarter of solid growth. “The increase in wages is consistent with stronger employment data reported in Labour Force, as well as a lift in the growth rate in the wage price index observed over the past two quarters.” Mr Hockman added.

Household consumption rebounded to 1.0 per cent this quarter with strength recorded in discretionary spending on hotels, cafés and restaurants and recreation and culture. Private investment detracted from growth due to a decline in dwellings and a sharp fall in new engineering construction. However, private investment in machinery and equipment remained strong, as did construction of non-residential buildings.

Net trade detracted from growth due to declines in exports of rural goods, transport equipment and travel services. This is reflected in the Agriculture and Manufacturing industries which were the largest detractors from GDP this quarter. Healthcare and service based industries continued to grow reflecting increased demand from the household sector.