Global bond yields could see upward pressure if net capital outflows from the eurozone start to subside when the ECB ends its quantitative easing (QE) in December 2018, according to Fitch Ratings.

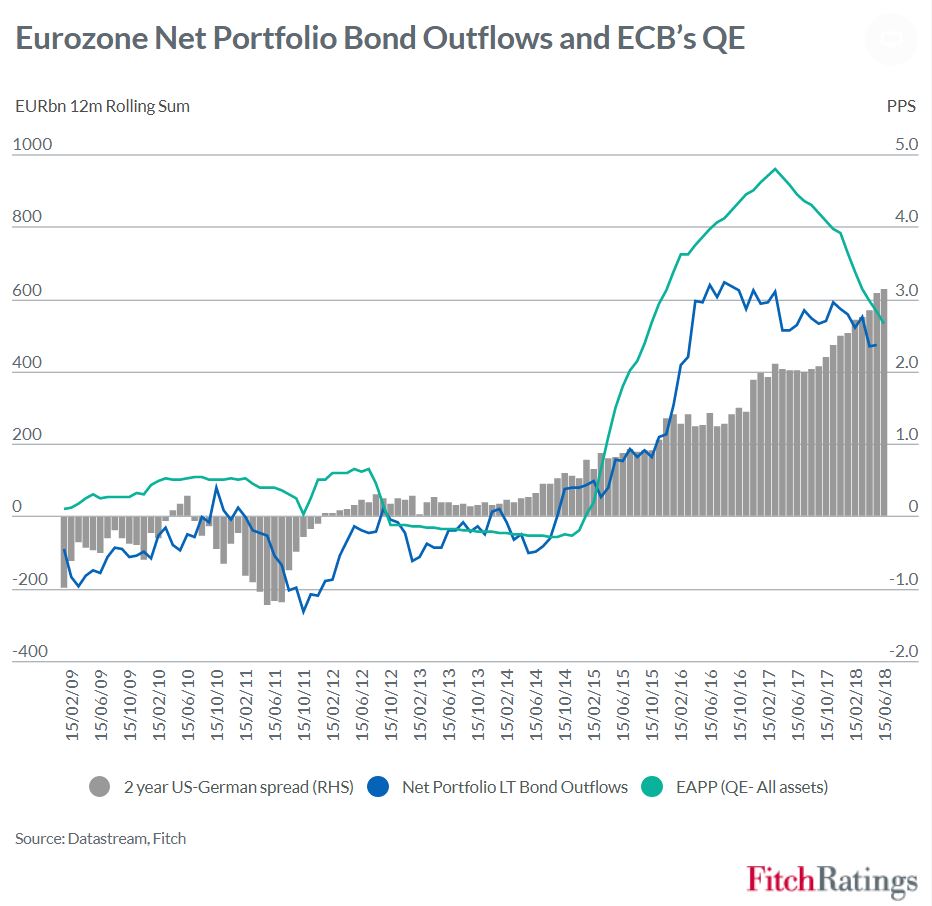

The latest chart of the month from Fitch’s economics team shows net outflows of capital from the eurozone in the form of long-term portfolio debt instruments. This is calculated as purchases of foreign bonds by eurozone residents minus foreigners’ purchases of eurozone bonds. Net portfolio debt outflows rose sharply after the ECB commenced government bond purchases in early 2015. ECB purchases were substantially greater than the net issuance of new debt to fund eurozone government deficits, implying reduced exposures by existing holders of eurozone government debt. In an environment of increasing scarcity, existing bondholders moved capital to other geographies.

This large net capital outflow has likely helped cap benchmark long-term bond yields in the US (and elsewhere) and a reversal of these flows could drive yields upwards. Since the start of the ECB’s sovereign QE programme, it has bought over EUR2 trillion of bonds while net bond outflows from the eurozone have amounted to EUR1.5 trillion. Eurozone investors now own as many US bonds as Japan and China combined. However, with net QE purchases set to end this year net outflows have already recently started to lose some momentum with foreign selling of eurozone bonds moderating since the start of this year. The risk is that eurozone net bond outflows could drop away sharply when the ECB QE ends in December 2018, reducing demand for US Treasuries and pushing up US (and global) yields.

One factor that could temper such a shock is the ongoing yield advantage of owning US bonds. This is likely to remain a strong pull factor for eurozone investors, as the chart shows. The spread between two-year US Treasuries and German Bunds is at the widest in three decades. The large stock of ECB QE holdings is expected to continue to contain Bund yields, which will remain further anchored by ECB’s negative deposit rate. We believe the ECB deposit rate will be on hold until late next year while the central bank awaits confirmation of firmer underlying inflation trends. Meanwhile the Fed will continue to raise rates.

While the ECB’s dampening influence on global bond yields is likely to weaken significantly from next year, it is unlikely to go away completely.