The Federal Reserve released the minutes relating to the 26th September decision to lift rates. The impression from the more detailed disclosures is that more hikes are likely, and perhaps quicker than originally expected. Members agreed to remove the sentence indicating that “the stance of monetary policy remains accommodative.”

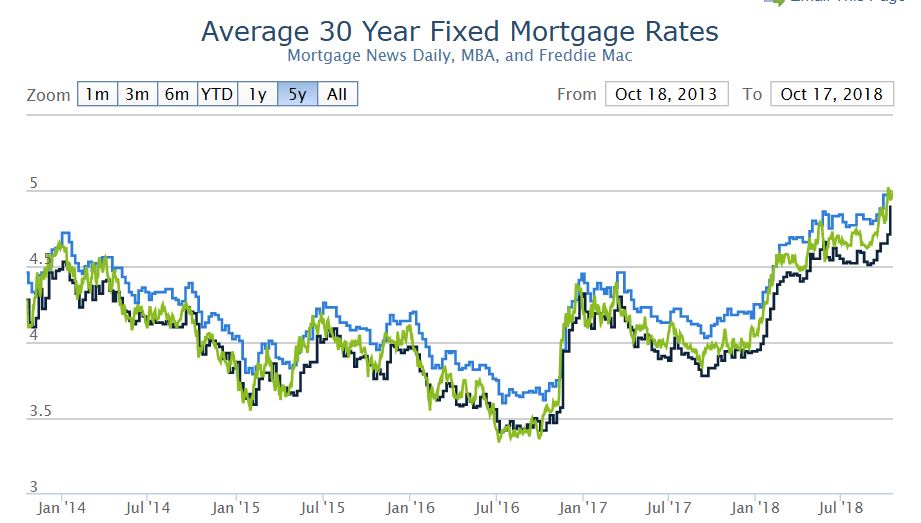

US Mortgage Rates continue higher.

In their discussion of monetary policy for the period ahead, members judged that information received since the Committee met in August indicated that the labor market had continued to strengthen and that economic activity had been rising at a strong rate. Job gains had been strong, on average, in recent months, and the unemployment rate had stayed low. Household spending and business fixed investment had grown strongly. On a 12-month basis, both overall inflation and inflation for

items other than food and energy remained near 2 percent.Indicators of longer-term inflation expectations were little changed on balance.

Members viewed the recent data as consistent with an economy that was evolving about as they had expected. Consequently, members expected that further gradual increases in the target range for the federal funds rate would be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term. Members continued to judge that the risks to the economic outlook remained roughly balanced.

After assessing current conditions and the outlook for economic activity, the labor market, and inflation, members voted to raise the target range for the federal funds rate to 2 to 2¼ percent. Members agreed that the timing

and size of future adjustments to the target range for the federal funds rate would depend on their assessment of realized and expected economic conditions relative to the Committee’s maximum-employment objective and symmetric 2 percent inflation objective. They reiterated that this assessment would take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.With regard to the postmeeting statement, members agreed to remove the sentence indicating that “the stance of monetary policy remains accommodative.” Members made various points regarding the removal of the sentence from the statement. These points included that the characterization of the stance of policy as “accommodative” had provided useful forward guidance in the early stages of the policy normalization process, that this characterization was no longer providing meaningful information in light of uncertainty surrounding the level of the neutral policy rate, that it was appropriate to remove the characterization of the stance from the Committee’s statement before the target range for the federal funds rate moved closer to the range of estimates of the neutral policy rate, and that the Committee’s earlier communications had helped prepare the public for this change.

In choppy trading in the US on Wednesday, it appears the markets are coming to accept higher rates ahead. The Dow Jones Industrial Average fell 91.74 points, or 0.36 percent, to 25,706.68.

The Fear Index eased a little to 17.40, down 1.25%, but volatility still stalks the halls.

The Fear Index eased a little to 17.40, down 1.25%, but volatility still stalks the halls.

The S&P 500 lost 0.71 points, or 0.03 percent, to 2,809.21.

The S&P 500 lost 0.71 points, or 0.03 percent, to 2,809.21.

The Nasdaq Composite dropped 2.79 points, or 0.04 percent, to 7,642.70.

The Nasdaq Composite dropped 2.79 points, or 0.04 percent, to 7,642.70.

The 10-Year Bond rate continued higher ending at 3.207, up 0.88%.

The 10-Year Bond rate continued higher ending at 3.207, up 0.88%.