The final report [674 pages !] has been released earlier than expect, and contains a series of recommendations which will have significant impact on the industry. It also passes the weight test… A best interests test is recommended in the home loan market (a change from not unsuitable).

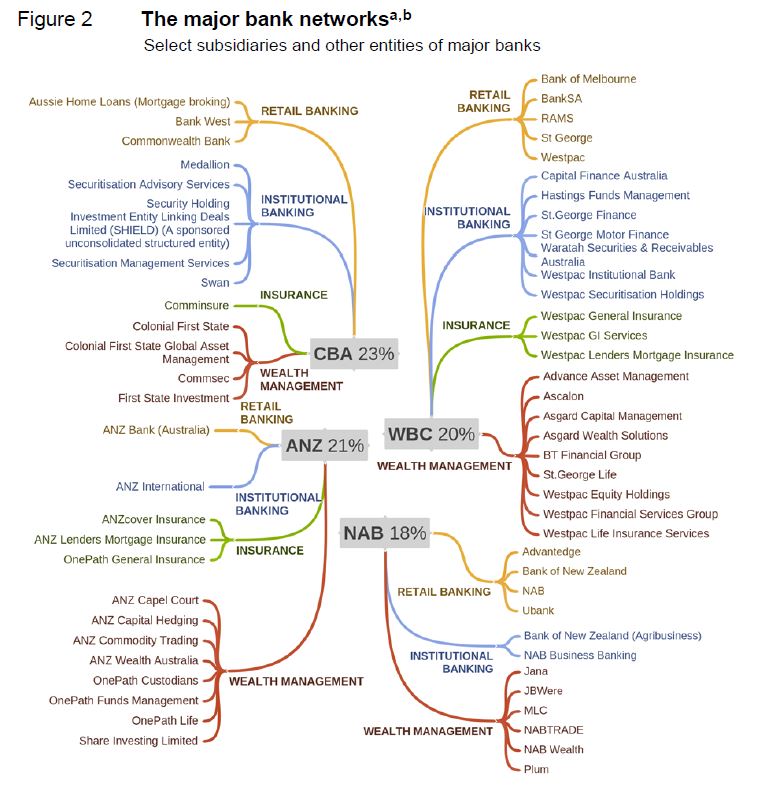

They call out regulatory failure and conflicts of interest across the sector, referring to opaque pricing, unsuitable products, no reward for customer loyalty as well as product complexity and faux competition. Major players have too much market power, and have fingers in multiple segments of the market. Customers lose out as a result.

“It is a fundamentally important fact that no Australian financial system regulator has the responsibility of putting competition first. Indeed, ASIC does not yet even have competition in its objectives. Nor, until this Inquiry, did other members of the Council of Financial Regulators emphasise that interest in a discernible fashion”.

Some of the key recommendations:

Some of the key recommendations:

- The Commission recommends the introduction of a best interest obligation for all providers in the home loans market — whether as a lender or mortgage broker — who interact directly with consumers seeking a home loan.

- Mortgage Brokers trail commissions should be phased out (but not replaced by a fee for service). “At its simplest, brokers have a strong incentive — regardless of what may be in their customer’s best interest — to give preference in their loan recommendations to lenders that pay higher commissions. This may be uncommon, but there is no obligation for transparency of the payment to prove it.”

- ASIC to ensure that the interests of borrowers are adequately safeguarded in the LMI market.

- use of the term ‘advice’ should be limited to effort that is undertaken on a client’s behalf by a professional adviser.

- APRA is singled out for myopic regulation. “Interest rates increased on both new and existing investment loans, boosting lenders’ profit on home loans. Up to half of the increase in lenders’ profit was in effect paid for by taxpayers, as interest on investment loans is tax deductible. We estimated that the cost borne by taxpayers as a result of changes in home loan investor rates following APRA’s intervention on interest-only loans in 2017, was up to $500 million per year (which may be partly offset by increased tax paid by the lending institutions on their profits)”.

- ACCC should focus on encouraging competition across the industry and safeguarding the interests of consumers.

- The new payments system needs a proper access regime.

- The Payments System Board of the RBA should ban, by end-2019, all card interchange fees as a way to reduce distortions in payment choices and the flow-on costs of these distortions to merchants.

Here is their release:

- The Australian economy has generally benefited from having a financial system that is strong, innovative and profitable.

- There have been past periods of strong price competition, for example when the advent of mortgage brokers upset industry pricing cohesion. And technological innovation has given consumers speed and convenience in many financial services, and a range of other non-price benefits.

- But the larger financial institutions, particularly but not only in banking, have the ability to exercise market power over their competitors and consumers.

- Many of the highly profitable financial institutions have achieved that state with persistently opaque pricing; conflicted advice and remuneration arrangements; layers of public policy and regulatory requirements that support larger incumbents; and a lack of easily accessible information, inducing unaware customers to maintain loyalty to unsuitable products.

- Poor advice and complex information supports persistent attachment to high margin products that boost institutional profits, with product features that may well be of no benefit.

- What often is passed off as competition is more accurately described as persistent marketing and brand activity designed to promote a blizzard of barely differentiated products and ‘white labels’.

- For this situation to persist as it has over a decade, channels for the provision of information and advice (including regulator information flow, adviser effort and broker activity) must be failing.

- In home loan markets, the mortgage brokers who once revitalised price competition and revolutionised product delivery have become part of the banking establishment. Fees and trail commissions have no evident link to customer best interests. Conflicts of interest created by ownership are obvious but unaddressed.

- Trail commissions should be banned and clawback of commissions from brokers restricted. All brokers, advisers and lender employees who deliver home loans to customers should have a clear legally-backed best interest obligation to their clients.

- Complementing this obligation, and recognising that reward structures may still at times conflict with customer best interest, all banks should appoint a Principal Integrity Officer (PIO) obliged by law to report directly to their board on the alignment of any payments made by the institution with the new customer best interest duty. The PIO would also have an obligation to report independently to ASIC in instances in which its board is not responsive.

- In general insurance, there is a proliferation of brands but far fewer actual insurers, poor quality information provided to consumers, and sharp practices adopted by some sellers of add-on insurance products. A Treasury working group should examine the introduction of a deferred sales model to all sales of add-on insurance.

- Australia’s payment system is at a crucial turning point. Merchants should be given the capacity to select the default route that is to be used for payments by dual network cards — as is already possible in a number of other countries. The New Payments Platform requires a formal access regime. This is an opportunity — before incumbency becomes cemented — to set up regulatory arrangements that will support substantial competition in services that all Australians use every day.

- More nuance in the design of APRA’s prudential measures — both in risk weightings and in directions to authorised deposit-taking institutions — is essential to lessen market power and address an imbalance that has emerged in lending between businesses and housing.

- Given the size and importance of Australia’s financial system, and the increasing emphasis on stability since the global financial crisis, the lack of an advocate for competition when financial system regulatory interventions are being determined is a mistake that should now be corrected. The ACCC should be tasked with promoting competition inside regulator forums, to ensure the interests of consumers and costs imposed on them are being considered.