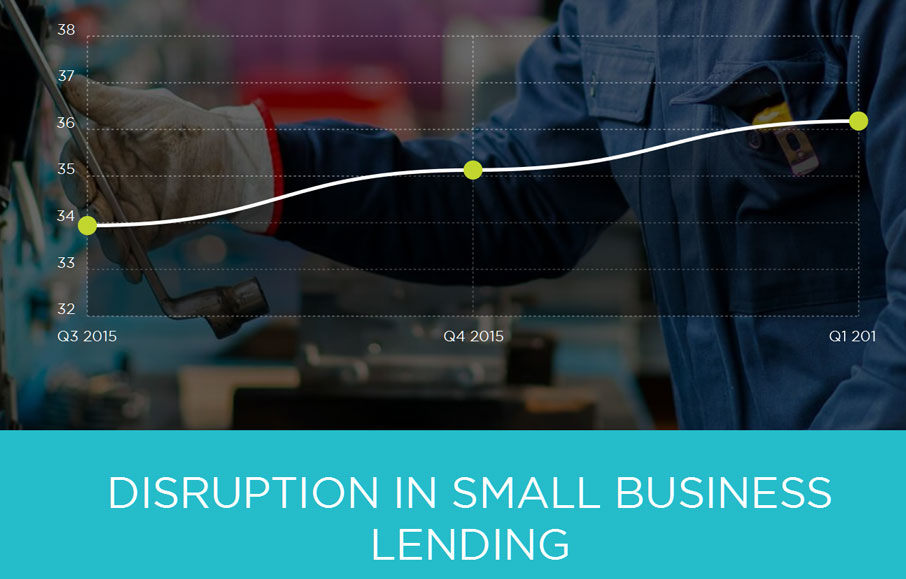

The latest edition of the Disruption Index, a joint initiate between Moula and Digital Finance Analytics, shows disruption continues apace. In the latest results, focussing on small business lending, more of the market is in play, with an overall disruption score of 36.18, up 2.99%.

SME service expectations continue to rise with the continued deployment of online applications and tools, in concert with the ongoing rise in mobile, always on smart devices. There has been a significant rise in awareness of non-traditional funding alternatives this quarter, following recent publicity and government innovation statements on fintech. As a result, a slightly higher proportion of SMEs are willing to trade their data.

Business confidence amongst borrowing SMEs has risen, as a result of the announced budget tax changes, and more favourable business conditions, especially in the east coast states. This was offset by a fall in confidence in WA and SA.

While knowledge of non-bank lenders is starting to increase, we are still seeing low usage of such credit options by small businesses (at less than 10% of all businesses in the sample); with increasing awareness, and increasing focus on the fintech sector by media commentators, we expect that non-bank lending to small businesses will become mainstream in time.

While knowledge of non-bank lenders is starting to increase, we are still seeing low usage of such credit options by small businesses (at less than 10% of all businesses in the sample); with increasing awareness, and increasing focus on the fintech sector by media commentators, we expect that non-bank lending to small businesses will become mainstream in time.

SME expectation of the time it should take to access unsecured finance has continued to collapse, with the most recent observation at 6.5 days. This is reducing quickly, and highlights the small businesses sector’s increasing awareness of alternatives in the market, coupled with the expectation that lending decisions should be fast in an era of data availability.

We are witnessing a significant trend in terms of borrower’s preparedness to provide electronic access to private information, mainly in the form of bank and accounting data feeds. This trend has been evolving quarter on quarter, with the most recent quarter showing an 11% increase in loan applicants that permission data, and a doubling since the Disruption Index began a year ago.

The key interpretation here, we believe, is that consumers and small businesses have accepted that data permissioning and data transfer are:

- necessary to access new financial service offerings, and

- data transfer is generally accepted as being secure.

The Disruption Index is an important tool which will highlight the changing face of financial services in Australia. There is no doubt that new business models are emerging in the context of the digital transformation of the sector, and bank customers are way ahead of where many incumbents are playing. The SME sector in particular is underserviced, and it offers significant opportunity for differentiation and innovation.

Digital Finance Analytics says that in the last three months we have seen a significant shift in attitudes amongst SMEs as they become more familiar with alternative credit options and migrate to digital channels. The attraction of online application, swift assessment and credit availability for suitable businesses highlights the disruption which is underway. There is demand for new services, and supply from new and emerging players to the SME sector.

One thought on “Financial Sector Digital Disruption In Full Swing”