The Bank For International Settlements (BIS) has released a released a consultative document on the implications of fintech for the financial sector. Sound practices: Implications of fintech developments for banks and bank supervisors assesses how technology-driven innovation in financial services, or “fintech”, may affect the banking industry and the activities of supervisors in the near to medium term.

The Basel Committee on Banking Supervision (BCBS) set up a task force to examine Fintech. Their report makes a number of observations about the way Fintechs may disrupt financial services. They also highlight the potential risks which regulators and players will need to consider.

The BCBS notes that, “despite the hype, the large size of investments and the significant number of financial products and services derived from fintech innovations, volumes are currently still low relative to the size of the global financial services sector. That being said, the trend of rising investment and the potential long-term impact of fintech warrant continued focus by both banks and bank supervisors”.

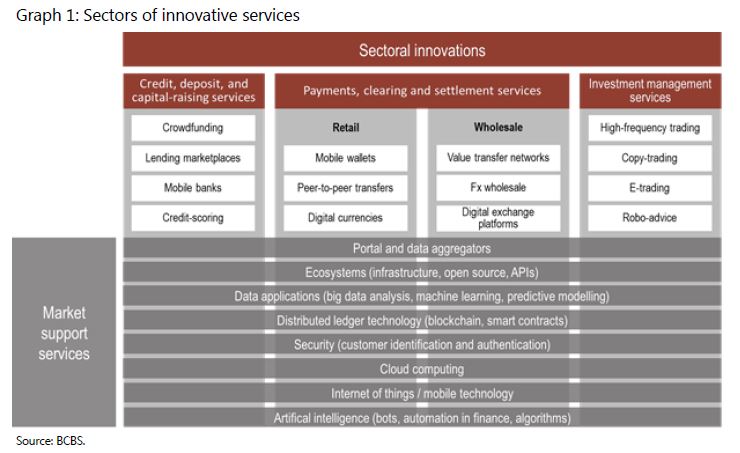

They developed a meta-model showing the range of elements across the financial services value chain where Fintech may play.

They say that “while some market observers estimate that between 10–40% of revenues and 20–60% of retail banking profits are at risk over the next 10 years, others claim that banks will be able to absorb the new competitors, thereby improving their own efficiency and capabilities”.

They say that “while some market observers estimate that between 10–40% of revenues and 20–60% of retail banking profits are at risk over the next 10 years, others claim that banks will be able to absorb the new competitors, thereby improving their own efficiency and capabilities”.

Various future potential scenarios are considered, with their specific risks and opportunities. In addition to the banking industry scenarios, three case studies focus on technology developments (big data, distributed ledger technology, and cloud computing) and three on fintech business models (innovative payment services, lending platforms and neo-banks).

Although fintech is only the latest wave of innovation to affect the banking industry, the rapid adoption of enabling technologies and emergence of new business models pose an increasing challenge to incumbent banks in almost all the scenarios considered.

Banking standards and supervisory expectations should be adaptive to new innovations, while maintaining appropriate prudential standards. Against this background, the Committee has identified 10 key observations and related recommendations on the following supervisory issues for consideration by banks and bank supervisors:

- the overarching need to ensure safety and soundness and high compliance standards without inhibiting beneficial innovation in the banking sector;

- the key risks for banks related to fintech developments, including strategic/profitability risks, operational, cyber and compliance risks;

- the implications for banks of the use of innovative enabling technologies;

- the implications for banks of the growing use of third parties, via outsourcing and/or partnerships;

- cross-sectoral cooperation between supervisors and other relevant authorities;

- international cooperation between banking supervisors;

- adaptation of the supervisory skillset;

- potential opportunities for supervisors to use innovative technologies (“suptech”);

- relevance of existing regulatory frameworks for new innovative business models; and

- key features of regulatory initiatives set up to facilitate fintech innovation.