Compared with 12 months ago, First Time Buyers are caught in the jaws created by a combination of tighter mortgage underwriting standards and higher property market prices. Together these forces make the prospect of a purchase significantly less likely. This conclusion is drawn from our updated our household surveys. Looking in detail at the survey results:

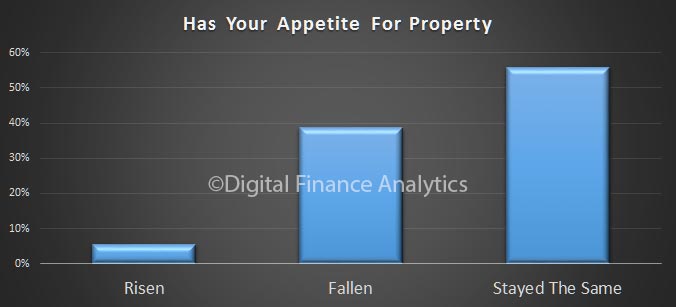

Compared with 12 months ago, 56% of first time buyers still have the same appetite to enter the market, just 5% has a stronger appetite now, whilst 39% have a lower appetite than a year ago.

The fall is driven partly by prices continuing to accelerate out of reach, with 51% saying their target was now more out of reach than a year ago, whilst 43% said there was no real change and 6% said prices has fallen. There were considerable state and regional variations. Prices in WA and areas of QLD are lower, whilst prices in NSW, VIC and ACT are significantly higher.

The fall is driven partly by prices continuing to accelerate out of reach, with 51% saying their target was now more out of reach than a year ago, whilst 43% said there was no real change and 6% said prices has fallen. There were considerable state and regional variations. Prices in WA and areas of QLD are lower, whilst prices in NSW, VIC and ACT are significantly higher.

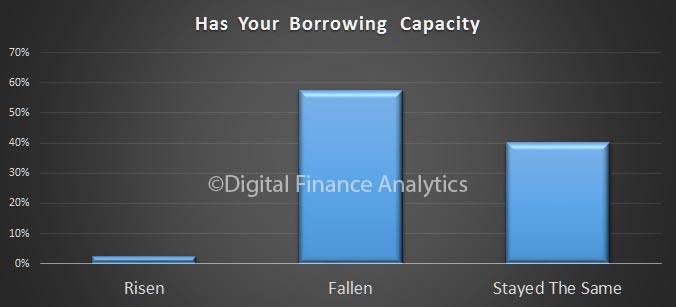

Finally, the combination of flat incomes, and tighter mortgage underwriting standards means that more than half – 58% – said they borrowing capacity had effectively been reduced. Around 40% said there was no change, and just 2% said their borrowing capacity had risen. Once again first time buyers in NSW and VIC were the most under pressure, thanks to high prices, and static incomes.

Finally, the combination of flat incomes, and tighter mortgage underwriting standards means that more than half – 58% – said they borrowing capacity had effectively been reduced. Around 40% said there was no change, and just 2% said their borrowing capacity had risen. Once again first time buyers in NSW and VIC were the most under pressure, thanks to high prices, and static incomes.

No surprise therefore that the latest ABS statistics shows the number of first time buyers continuing to languish.

No surprise therefore that the latest ABS statistics shows the number of first time buyers continuing to languish.