Rounding out our survey findings, we look briefly at the first time buyer market segment. We noted in the summary that there was still demand – and we see this translated into both owner occupied and investment property purchases. The “Bank of Mum and Dad” is becoming an important factor, with more than half of first time buyers saying they had some financial help from the wider family. In some cases this translated into a deposit, in other transaction costs, but the most common mode appears to be a loan – often at cheap rates. We also know that banks look for a savings behaviour, so a windfall gift is not necessarily the most successful mode of assistance.

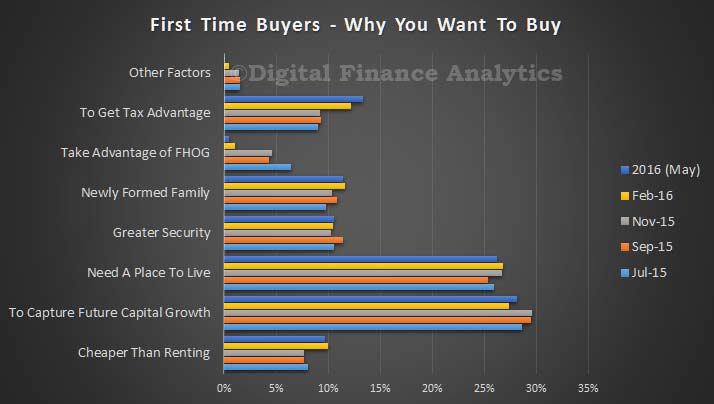

The latest data shows that first time buyers are as interested in capital gains, and tax advantage as meeting a need for a place to live. The tax advantage benefit registered more strongly this time around (thanks to all the recent publicity around negative gearing and capital gains benefits). On the other hand, the first home owner grant structures have largely been dismantled, and in any case they simply pushed prices higher, so were an expensive and ultimately ineffective lever.

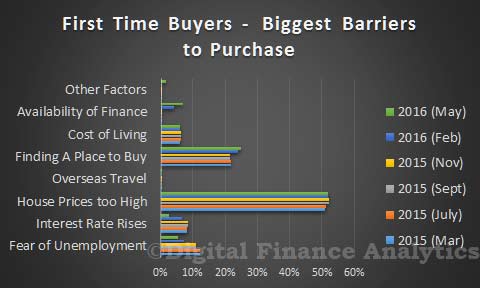

The barriers to purchase – which vary by state to some extent – centre on the fact that simply house prices are too high. As a result finding a place to buy, especially competing with investors (who we saw yesterday are back in the game) is hard. We also see a spike in households unable to find finance, as lending criteria have tightened. Lower interest rates do not translate automatically to a larger loan, as the banks are using a floor of 7.25% or more for serviceability assessment – and this has not changed since the recent rate cut. Our modelleing shows that there are much deeper rate discounts for existing buyers wanting to refinance, compared with first time buyers. In addition, the maximum LVR has lowered, so larger deposits are needed – at a time when interest rates on deposits continue to grind lower. Thus first time buyers are squeezed, at a time when incomes are static in real terms.

The barriers to purchase – which vary by state to some extent – centre on the fact that simply house prices are too high. As a result finding a place to buy, especially competing with investors (who we saw yesterday are back in the game) is hard. We also see a spike in households unable to find finance, as lending criteria have tightened. Lower interest rates do not translate automatically to a larger loan, as the banks are using a floor of 7.25% or more for serviceability assessment – and this has not changed since the recent rate cut. Our modelleing shows that there are much deeper rate discounts for existing buyers wanting to refinance, compared with first time buyers. In addition, the maximum LVR has lowered, so larger deposits are needed – at a time when interest rates on deposits continue to grind lower. Thus first time buyers are squeezed, at a time when incomes are static in real terms.

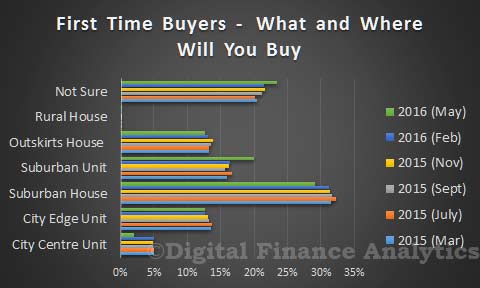

Looking at the types of property first time buyers are considering, we see that 23% are simply not sure what to go for. Our surveys show that price is the main determinate, and the style, or location of property is somewhat secondary. They simply want to “get on the ladder” – despite the fact we are probably close to peak house prices, and peak household debt! Nationally, the suburban house remains the most attractive option, though more are now having to settle for a suburban unit (20%).

Looking at the types of property first time buyers are considering, we see that 23% are simply not sure what to go for. Our surveys show that price is the main determinate, and the style, or location of property is somewhat secondary. They simply want to “get on the ladder” – despite the fact we are probably close to peak house prices, and peak household debt! Nationally, the suburban house remains the most attractive option, though more are now having to settle for a suburban unit (20%).

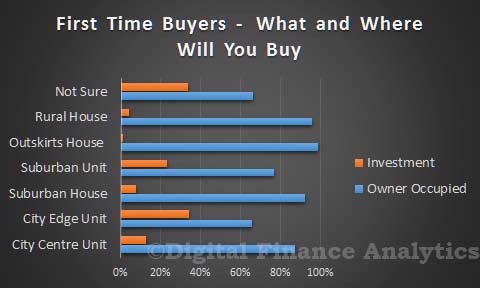

If we ask about whether they will go for an investment property or an owner occupied property, we see that most of those going the investment route are considering a unit, on the fringe of the City. About one third of first time buyers will likely end up as an investor, not living in their own owner occupied home.

If we ask about whether they will go for an investment property or an owner occupied property, we see that most of those going the investment route are considering a unit, on the fringe of the City. About one third of first time buyers will likely end up as an investor, not living in their own owner occupied home.

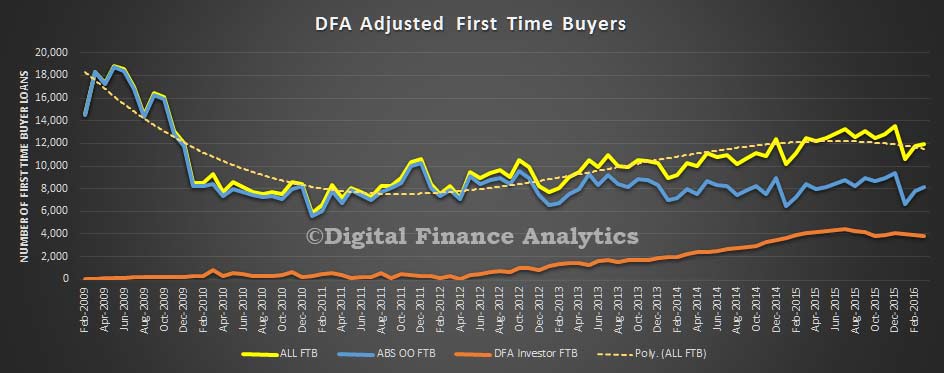

We have discussed the drivers of first time buyer investors before, and track the monthly approvals – a gap which remains in the ABS data sets.

We have discussed the drivers of first time buyer investors before, and track the monthly approvals – a gap which remains in the ABS data sets.

You can read more detailed analysis in our report – The Property Imperative, which is released twice each year. The last edition was released in March 2016.

You can read more detailed analysis in our report – The Property Imperative, which is released twice each year. The last edition was released in March 2016.