The RBA published a research discussion paper “The Property Ladder after the Financial Crisis: The First Step is a Stretch but Those Who Make It Are Doing OK”. Good on the RBA for looking at this important topic. But we do have some concerns about the relevance of their approach.

This paper investigates how things have changed since the GFC for those stepping onto the property ladder. Is ‘generation rent’ an important trend? Are people buying first homes taking on ‘too much’ debt? And what implications does this have for our understanding of the growing level of aggregate household debt?

They highlight the rise of those renting, and attribute this largely to rising home prices. As a piece of research, it is interesting, but as it stops in 2014, does not tell us that much about the current state of play! However, they conclude:

The results we find in this paper are very much bittersweet. On the one hand, we find that fewer people are making the transition from renters to home owners than prior to the crisis. Given research that links the rise in inequality to changes in home ownership patterns, this could have significant longer-term consequences for the distribution of wealth in Australia. On the other hand, those households that do make the transition are more financially secure than earlier cohorts. So the rise in aggregate and individual debt ratios do not appear to be associated with an increase in household financial vulnerability – at least as far as first home buyers are concerned.

We attribute much of this change to the increase in housing prices and the associated hurdle that deposit requirements represent. While saving a deposit is a stretch, it is also a sign of financial discipline that is associated with fewer subsequent difficulties. Thus, while the first step on the property ladder is more of a stretch than before the crisis, those who do make the step are, on average, better placed to pay off their loans than prior to the crisis.

A few points to note.

First, the RBA paper uses HILDA data to 2014, so it cannot take account of more recent developments in the market – since then, incomes have been compressed, mortgage rates have been cut, and home prices have risen strongly in most states, so the paper may be of academic interest, but it may not represent the current state of play. Very recently, First Time Buyers appear to be more active.

More first time buyers are getting help from parent, and their loan to income ratios are extended, according to our own research.

Also, they had to impute those who are first time buyers from the data, as HILDA does not identify them specifically. Tricky!

The past three wealth modules of the survey (2006, 2010 and 2014) have included a variable, ‘rpage’, which asks the household reference person whether they have ever owned residential property and, if so, the age at which they first acquired, or started buying, this property.

Another variable, ‘hspown’, available in the 2001 and 2002 surveys only, asks households whether they still live in their first home. This variable allows us to identify FHBs directly for these years.

We combine the information from ‘hspown’ and ‘rpage’ into the one variable identifying indebted FHBs. For 2001 and 2002 we use the ‘hspown’ variable and the ‘rpage’ variable is used thereafter.

The percentage of owner-occupier households identified as FHBs in any given year is, on average, between 1 and 2 per cent over the course of the survey, which is broadly in line with aggregate measures. This corresponds to between 50 and 100 households each year.

So a very small sample.

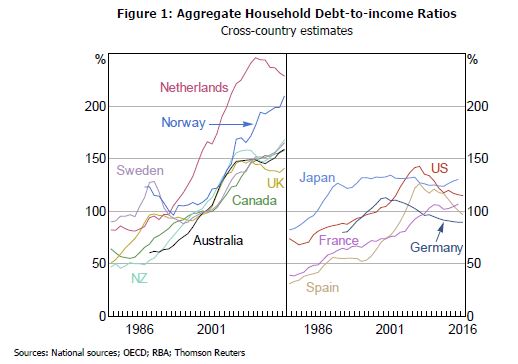

Next, the RBA cited the aggregate household Debt-to-income Ratios cross-country estimates. Rising trends are apparent in many countries.

They then proceeded to explain the drawbacks of this data set.

They then proceeded to explain the drawbacks of this data set.

Notwithstanding this statistic’s frequent use, it has a number of drawbacks. First, it compares a stock of debt with a flow of income rather than, say, a stock of debt against a stock of assets or a flow of repayments against a flow of income. This mixing of concepts means that it is not clear what a reasonable benchmark for the level of debt to income might be. There are also important distributional considerations that affect what meaning can be attached to the aggregate values. At heart these issues stem from the fact that, while it is tempting to interpret higher aggregate debt-to-income ratios through a representative consumer lens, it is misleading. Of particular note is that the aggregate ratio places more weight on high-income households, which can be misleading. Higher-income households can support higher debt-to-income ratios than lower-income households. This is primarily because a smaller fraction of a higher-income household’s expenditure needs to be devoted to necessities leaving more available to spend on other things. There are also other dimensions in which borrowers may differ, such as their risk of unemployment and their ability to obtain funds in an emergency, that would affect the inherent riskiness of any given debt level.

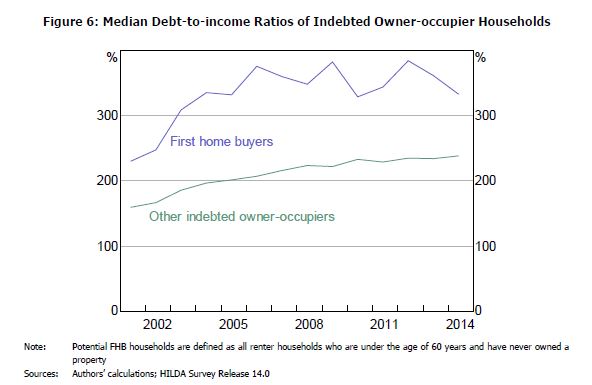

Fourth, they show that first time buyers have a higher mean debt-to-income ratio compared with other borrowers.

Turning first to the aggregated data, we can see in Figure 6 that the debt-to-income ratio of FHBs is substantially higher than that of all other indebted owner-occupiers. This reflects the fact that FHBs are at the beginning of their loan life cycle. That is, before they have had the opportunity to pay down their loan. Comparing the pre- and post-GFC periods, we see that the median FHB debt-to-income ratio was around 330 per cent in 2014, up approximately 40 per cent from the ratio of 230 per cent in 2001. FHBs are taking on more debt than in the past.

Actually, more recent data shows that Debt-to-Incomes are even more extended, with some FTB’s in Sydney at a ratio of 7x income (according to our more recent surveys).

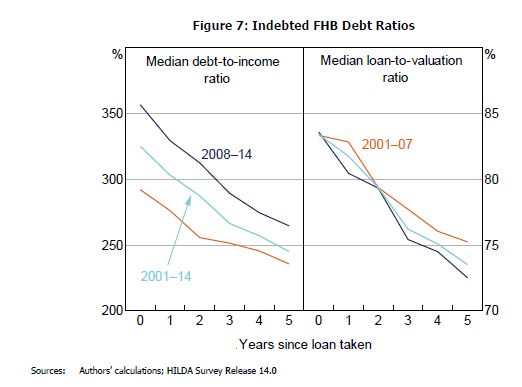

Finally, they show that “despite higher debt levels, households who became indebted FHBs post-2007 appear to be paying down their mortgages and reducing their debt-to-income ratios at the same rate, or slightly faster, than households who took on a mortgage before 2007”.

In the year after taking out a loan, the reduction in the debt-to-income ratio for FHBs in the post-2007 period was around 8 per cent, compared to 5 per cent for the pre-2007 cohort. After three years, the debt-to-income ratio for FHBs in the pre- and post-2007 periods has decreased by 14 and 18 per cent, respectively. Given that these rates of amortisation are significantly higher than those associated with required repayments or interest rate changes over this period, it seems that these are voluntary choices rather than the consequence of changes to required repayment schedules. The median loan-to-valuation ratio of FHBs in the post-financial crisis period also decreases by more than for the previous cohort, although this is likely due to the rise in housing prices increasing the denominator of this ratio over time.

So, while there are some general conclusions, we are not sure the work really adds much to the current debate on housing affordability, housing debt, and the current stresses which households, especially first time buyers are experiencing.