On 19 March, the Haut Conseil de la Stabilité Financière (HCSF), the French macroprudential authority, announced it would increase banks’ countercyclical capital buffer on their exposures to French counterparties to 0.50% from 0.25% by no later than 2 April 2020.

The increase, the first since the HCSF established the buffer in June 2018 to stem the potential for excessive credit growth, raises banks’ capital requirements, a credit positive, says Moody’s.

The countercyclical capital buffer was introduced with Articles 136-140 of the European Union’s (EU) Capital Requirement Directive IV (CRD IV) to build up extra capital in boom periods and pre-empt the credit risks that accumulate during economic upswings. The buffer applies to all French, EU and European economic area banks’ that have exposures to French counterparties.

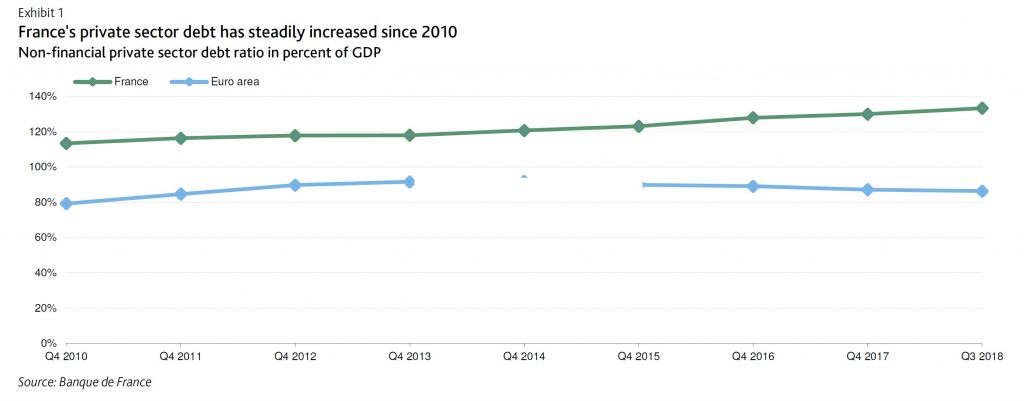

Last Monday’s increase aims to dampen continuing credit growth : non-financial private sector debt increased to 133.3% of GDP as of third-quarter 2018 (one of the highest levels in the EU) from 131.0% as of first-quarter 2018 and 113.4% at year-end 2010.

Since 2016 credit to corporates and households has increased at a 4%-6% annual rate amid relaxed lending standards (especially on housing loans with higher loan-to-value ratios and longer maturities), rising house prices and increasing leveraged buyout transactions (up 3.6% in February 2019 compared to February 2018). Moreover corporate debt issuance also drove the increase in indebtedness, in particular at large corporates, which prompted the HCSF to express some concern.

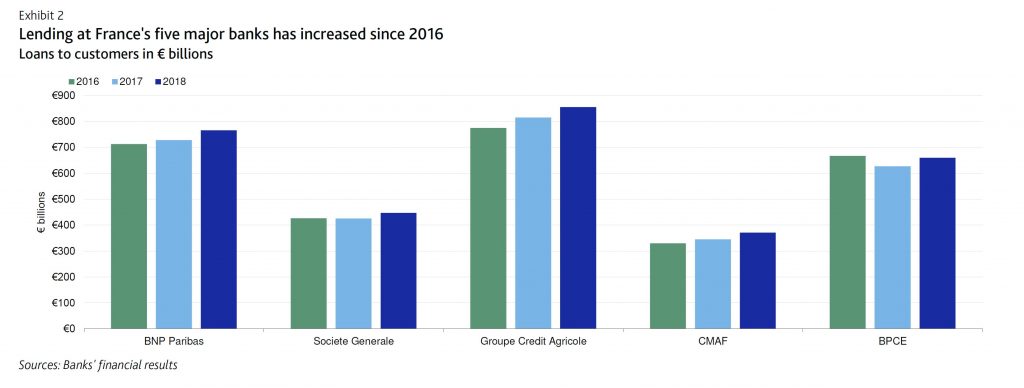

Total lending (domestic and international) among France’s five major banks – BNP Paribas, Societe Generale, Credit Agricole S.A., Banque Federative du Credit Mutuel, BPCE – grew 5.6% year over year as of year-end 2018, with bank loans to SMEs growing a robust +6.3% for the same period.

Additionally, France’s credit-to-GDP gap (measuring the difference between the credit-to-GDP ratio and its long-term trend) was 2.7 percentage points in fourth-quarter 2018, versus the euro area average of negative 12.4 percentage points at the same time.

The HCSF’s decision will be submitted to the ECB on a non-objection basis and will be adopted before 2 April 2019 for an effective implementation of this requirement a year later (April 2020).

The 2018 decision to set a CCyB at 0.25 % has not resulted in a more moderate lending growth at French banks hence the decision to tighten it at 0.50%. It remains to be seen whether or not a higher capital add-on will be successful in materially curbing lending at banks. If not successful the official sector may consider tightening the 0.5 % CCyB once again.

We assign a one-notch downward adjustment for credit conditions in France’s macro profile, which reflects the macro- risks faced by banks, to account for the material growth of private sector indebtedness in France since 2015 and the risk that a too rapid rise in corporate and household debt could eventually increase the vulnerability of borrowers to an economic downturn.

Many European have imposed much higher countercyclical capital buffers, up to 2.5% (for example, Sweden). The growing use of CCyBs in European countries – 11 countries have resorted to this prudential measure – points to a potential accumulation of excessive credit risk throughout the region.