Prof Claudia Buch Vice-President of the Deutsche Bundesbank spoke about issues in Germany relating to property prices and financial stability. Sounds familiar, especially about the lack of good data!

One of the lessons of the global financial crisis has been that instabilities in markets for real estate can threaten financial stability. In contrast to price stability, there is no generally agreed metric for “financial stability”. Increases in real estate prices may indicate that risks to financial stability are building up. But other indicators, reflecting credit standards and the build-up of housing debt, need to be considered as well. These include the leverage of households, debt sustainability, amortisation requirements, and loan-to-value ratios.

Traditional statistics often do not reflect these indicators of financial instabilities. The G20 Data Gaps Initiative addresses this.

- In its first phase, a Handbook on Residential Property Price Indices was published in 2013. With regard to residential property prices, the bulk of the conceptual work has been done, and the focus has shifted to compilation and dissemination. Quality adjustment remains a controversial topic and is still a major source of deviations across residential property price indices.

- The initiative is currently in its second phase. Its main objective has shifted to implementing the regular collection and dissemination of reliable and timely statistics for policy use.

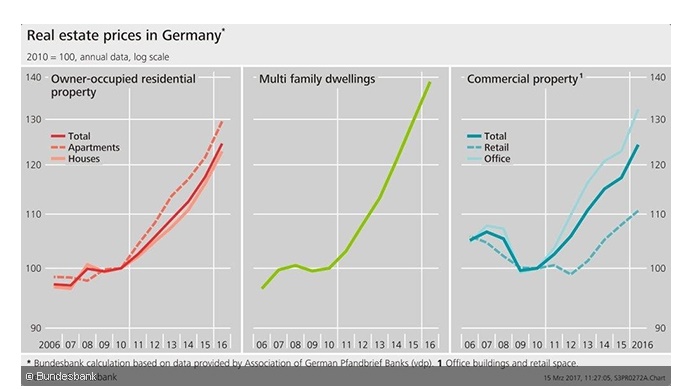

In Germany, prices of real estate property are available from several official and private providers. These indicators differ in terms of representativeness, periodicity, timeliness, breakdowns, and length of the time series. These data show that the prices of both residential and commercial property have risen considerably since 2010. Owner-occupied housing is currently about 25 per cent more expensive than in 2010, and prices for multi-family dwellings have increased by about 40 per cent. On average, commercial property prices have also increased by 25 per cent since 2010, driven mostly by prices for office space.

As regards commercial property prices, however, many conceptual issues still need to be clarified. For example, while office buildings, retail space, and industrial structures are classified as “commercial real estate”, the classification of multi-family dwellings is not clear and depends on whether one follows the perspective of users or investors. Data availability remains challenging, too. The number of transactions is lower than for residential real estate, and heterogeneity is more pronounced. In the absence of official data, analysts rely on private data provided by market observers.

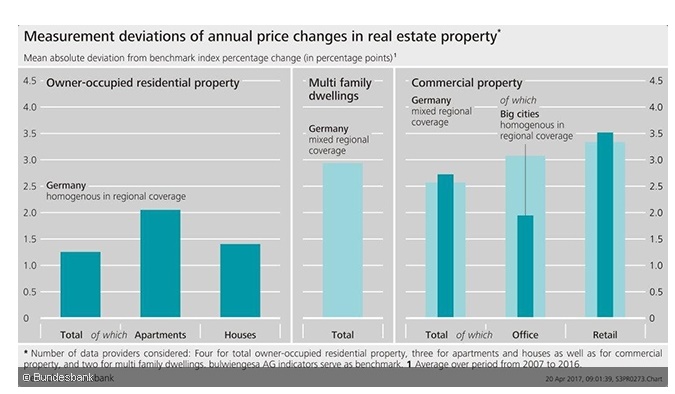

The figure below depicts deviations in the measurement across indicators for price changes in German property markets. With regard to residential property prices in Germany, analysts may consider four main indicators published by different data providers. In this case, they are confronted with measurement deviations of about 1 percentage point for the annual price change of the total market on average (left-hand column). For office and retail space, the mean absolute deviation is considerably larger at 2½ percentage points. This is one of the underlying challenges of assessing such data.

Given that real estate prices have increased strongly, are risks to financial stability building up? Two issues need to be considered.

First, changes in prices need to be compared to changes in fundamentals such as income expectations, demographics, and the macroeconomic environment. These factors may indeed explain a significant share of the price increases in Germany. But there is still an unexplained component, and that component seems to have increased over time.

Second, risks to financial stability emerge if a strong rise in real estate prices coincides with a strong expansion in credit volumes and an easing of credit standards. The house price momentum has caused credit growth, too, to accelerate since the beginning of the upswing on the German property market. Housing credit to households increased by 3.7 per cent in 2016. This is lower than the long-run average: since the early 1980s, the growth rate of housing credit has been about 5 per cent annually.

It is important to note that Germany currently has no consistent reporting on credit standards, eg the loan-to-value ratio or the debt service-to-income ratio.

The relevance of and urgent need for progress in the measurement of real estate prices is widely acknowledged. I am looking forward to the contributions that will be presented at this conference and encourage the statistical community to push ahead with this strand of research and practical implementation