Genworth Mortgage Insurance Australia Limited reported its 2017 full year (FY17) financial results. As a major player in the LMI sector, we get an insight into the overall market. Today’s Productivity Commission report of course highlights that LMI’s should refund unused premiums. This could impact the market further, but for now, as LVR’s fall, LMI’s need to tweak their business models. Meantime, new business is falling, though claims also eased a little.

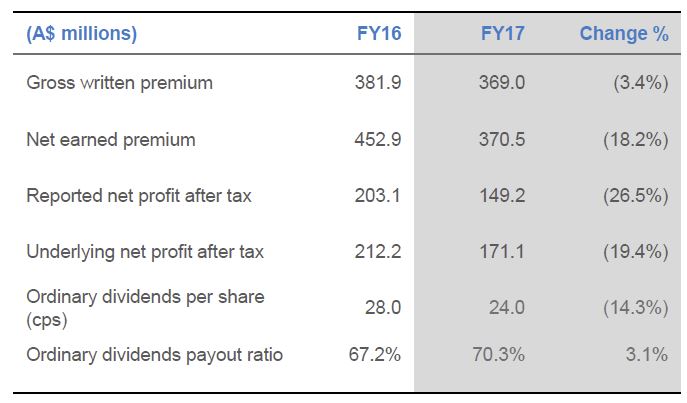

Statutory net profit after tax (NPAT) for the year ended 31 December 2017 was $149.2 million compared with $203.1 last year, down 26.5% and underlying NPAT was $171.1 million down 19.4%. This was in line with guidance.

The Genworth Board declared a fully franked final ordinary dividend of 12 cents per share payable on 16 March 2018 to shareholders registered on 2 March 2018. The total ordinary dividend for 2017 was 24 cents per share and represents a payout ratio of 70.3%, up from 67.2% in 2016.

The Genworth Board declared a fully franked final ordinary dividend of 12 cents per share payable on 16 March 2018 to shareholders registered on 2 March 2018. The total ordinary dividend for 2017 was 24 cents per share and represents a payout ratio of 70.3%, up from 67.2% in 2016.

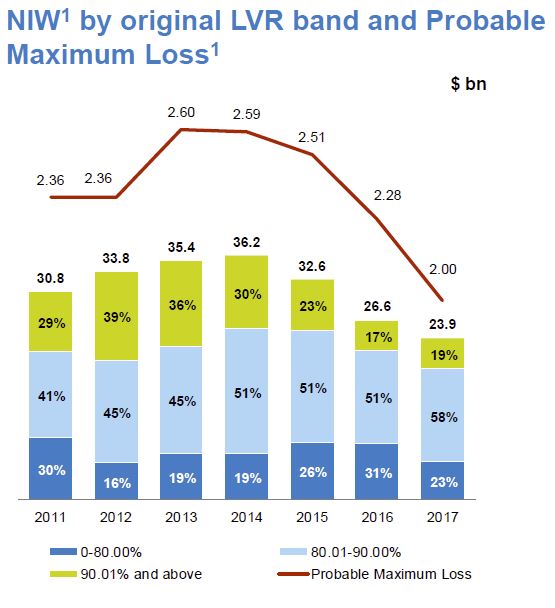

New business volume, as measured by New Insurance Written (NIW), of $23.9 billion in 2017, decreased 10.2% compared with $26.6 billion in the prior year.

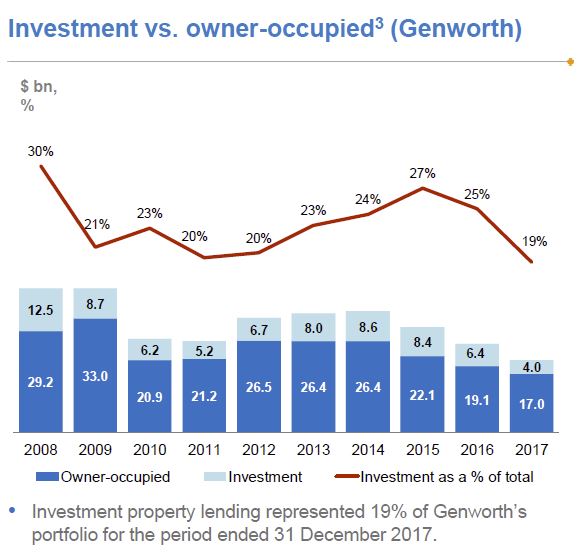

The mix of business is aligned to owner occupied borrowers, with 19% of loans in 2017 for investment purposes.

The mix of business is aligned to owner occupied borrowers, with 19% of loans in 2017 for investment purposes.

Gross Written Premium (GWP) decreased 3.4% to $369.0 million in 2017. This decline was partially offset by the impact of the premium rate actions taken in 2016 and reflects changes in the customer portfolio and changes in business mix during the year.

Gross Written Premium (GWP) decreased 3.4% to $369.0 million in 2017. This decline was partially offset by the impact of the premium rate actions taken in 2016 and reflects changes in the customer portfolio and changes in business mix during the year.

Net Earned Premium (NEP) of $370.5 million in 2017 decreased 18.2% compared with $452.9 million in the prior year reflecting the $37.3 million impact of the 2017 Earnings Curve Review and lower earned premium from current and prior book years. Without the 2017 Earnings Curve Review adjustment, NEP would have declined 10.0%.

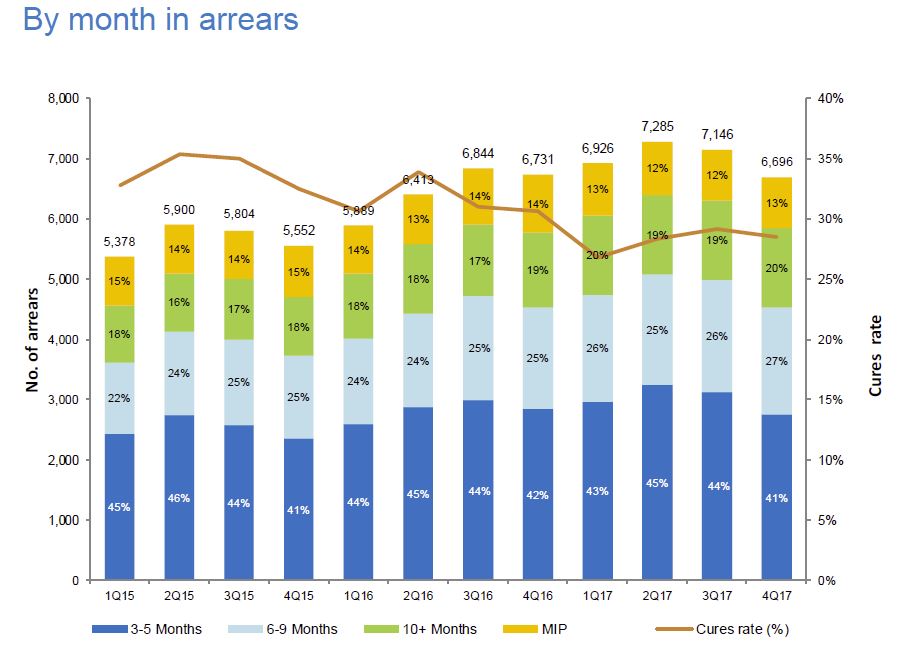

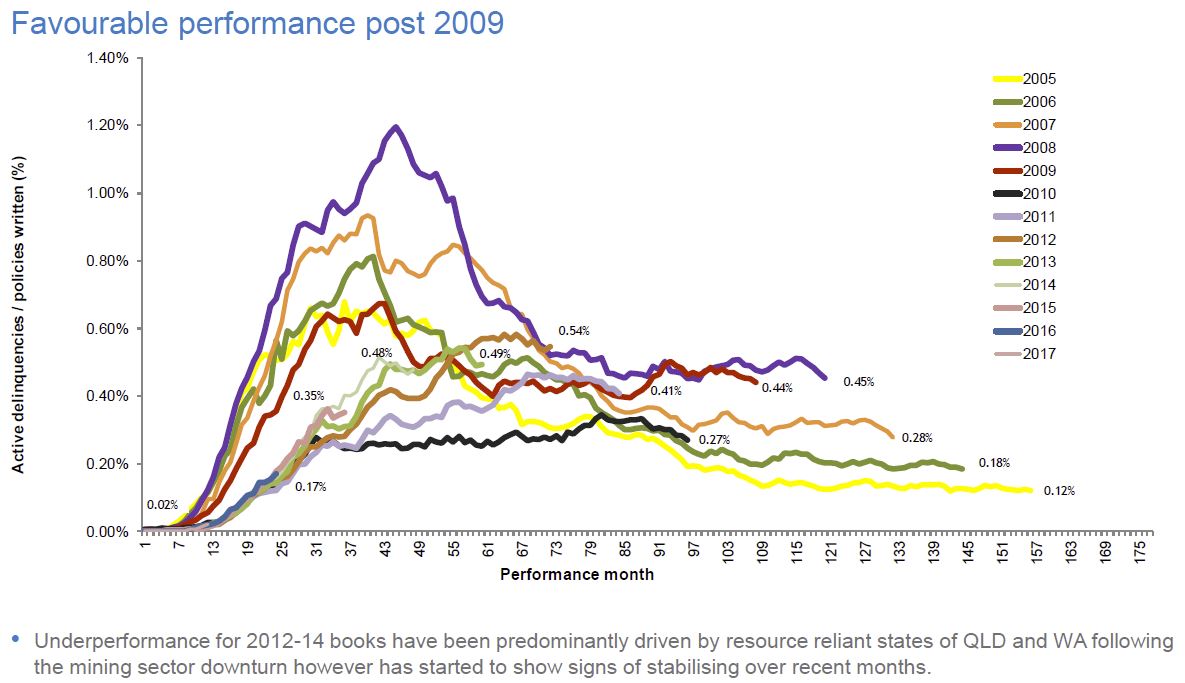

New delinquencies decreased in both mining and non-mining areas. The proportion of new mining delinquencies has been increasing in Western Australia while Queensland mining experience has been quite stable. Cures increased, particularly in non-mining areas. The number of claims paid in FY17 was higher than FY16, mainly driven by a higher proportion of claims in mining areas.

New delinquencies decreased in both mining and non-mining areas. The proportion of new mining delinquencies has been increasing in Western Australia while Queensland mining experience has been quite stable. Cures increased, particularly in non-mining areas. The number of claims paid in FY17 was higher than FY16, mainly driven by a higher proportion of claims in mining areas.

Net Claims incurred fell 10.7% from $158.8 million in FY16 to $141.8 million in FY17. The loss ratio in FY17 was 38.3%, up from 35.1% in FY16 reflecting the impact of lower NEP due to the 2017 Earnings Curve Review. Without this adjustment the FY17 loss ratio would have been 34.8%.

Net Claims incurred fell 10.7% from $158.8 million in FY16 to $141.8 million in FY17. The loss ratio in FY17 was 38.3%, up from 35.1% in FY16 reflecting the impact of lower NEP due to the 2017 Earnings Curve Review. Without this adjustment the FY17 loss ratio would have been 34.8%.

The expense ratio in FY17 was 29.3% compared with 25.7% in the prior year, reflecting the lower NEP and expenditure on the Strategic Program of Work. This is in line with the expected target range of between 28% and 30%.

Investment income in FY17 was $103.3 million and included a pre-tax realised gain of $36.4 million ($25.5 million after tax) and a mark-to-market loss of $31.3 million ($21.9 million after-tax). After adjusting for the mark-to-market movements, the FY17 investment return was 2.82% per annum, down from 3.41% per annum in FY16.

As at 31 December 2017, the value of Genworth’s investment portfolio was $3.4 billion, more than 86% of which continues to be held in cash and highly rated fixed interest securities. The Company had invested $237.4 million in Australian equities as at year-end in line with the previously stated strategy to improve investment returns on the portfolio within acceptable risk tolerances. In 2017, the Board approved a strategy to diversify the Company’s assets by investing in non-AUD fixed income securities. This will be implemented in 2018.

As at 31 December 2017 Genworth’s regulatory solvency ratio was 1.93 times the Prescribed Capital Amount (PCA) which is above the Board’s target capital range of 1.32 to 1.44 times.

Throughout the year the Company embarked on a number of capital management initiatives designed to bring Genworth’s solvency ratio more in line with the Board’s target range. A fully franked special dividend of 2 cents per share and fully franked ordinary dividends totalling 24 cents per share were declared by the Board. This equates to a yield of 8.7% based on the share price of $3.00 as at 31 December 2017.

In 2017 the Company also commenced an on-market share buy-back up to a maximum value of $100 million. As at 31 December 2017, $51 million of shares had been acquired as part of this initiative. Genworth intends to continue the buy-back of shares in 2018, up to a maximum total value of $100 million, subject to business and market conditions, the prevailing share price, market volumes and other considerations.

The Company will continue to actively manage its capital position and proactively evaluate potential uses for its excess capital.

Genworth has commercial relationships with over 100 lender customers across Australia and Supply and Service Contracts with 10 of its key customers. Our top three customers accounted for approximately 60% of our total NIW and 72.7% of GWP in 2017. We estimate that we had approximately 25% of the Australian LMI market by NIW in 2017.

On 10 March 2017 Genworth announced that the exclusivity agreement for the provision of LMI with its then second largest customer would terminate in April 2017. The Company has been successful in entering into new business with this customer that assists them in managing mortgage default risk through alternative insurance arrangements.

On 20 September 2017 Genworth announced that it had extended its Supply and Service Contract with National Australia Bank (NAB) for the provision of LMI for NAB’s broker business. The term of the contract has been extended for one year to 20 November 2018.

The Company’s Strategic Program of Work is designed to address evolving lender and consumer expectations (resulting from technological and regulatory change) by leveraging Genworth’s existing core competencies in managing mortgage credit default risk.

As part of this work program a number of initiatives have been identified that focus on improving the Company’s underwriting efficiency, enhancing its product offerings and, where appropriate, leveraging its data and mortgage partnerships along the mortgage value chain.

One such initiative has involved the establishment of an offshore insurance entity based in Bermuda, which provides Genworth with the capability to structure bespoke risk management solutions for portfolio cover across both high and low loan to value ratios (LVR). By leveraging its strong relationships in the global reinsurance market, Genworth has created a consortium and entered into an agreement with a customer to utilise the new structure to manage mortgage default risk. This bespoke solution is a complementary risk management tool to traditional LMI cover.

The second half of 2017 also saw the culmination of work undertaken by Genworth to create and implement risk management solutions for borrower-paid LMI in the less than 80% LVR segment on a micro market basis (Micro Market LMI).