Lenders Mortgage Insurer Genworth reported their 3Q18 earnings today with a statutory net profit after tax (NPAT) of $19.6 million and underlying NPAT of $20.4 million for the third quarter ended 30 September 2018 (3Q18). It is an important bellwether for the mortgage industry, and confirms recent softening. Whilst they have a strong capital position, their net investment returns were also down a little.

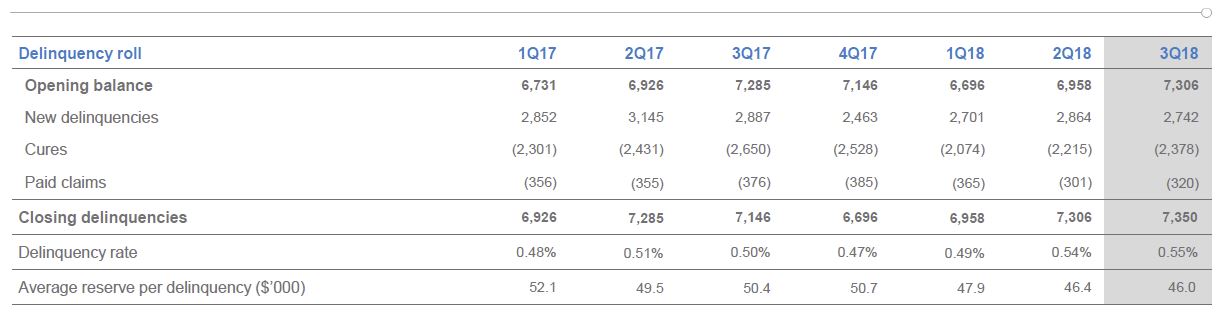

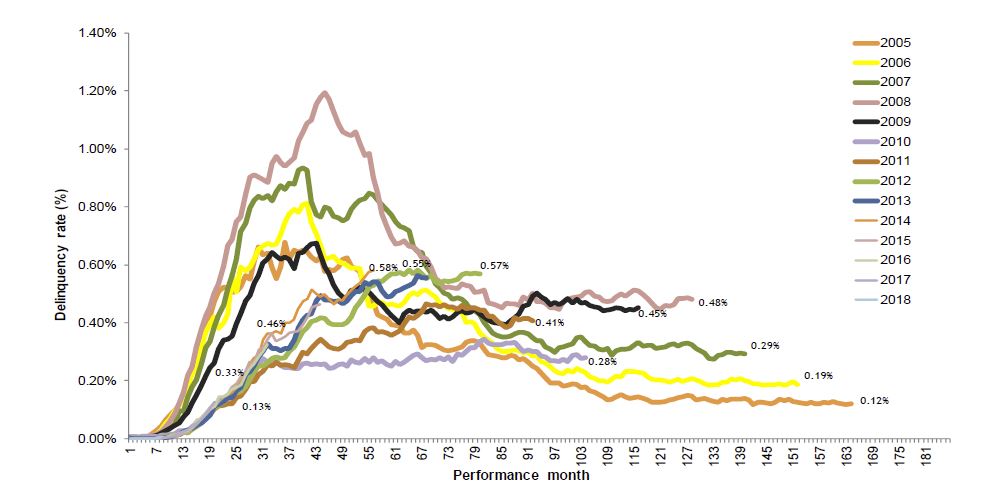

The Delinquency Rate (number of delinquencies divided by policies in force but excluding excess of loss insurance) increased from 0.50% in 3Q17 to 0.55% in 3Q18 (1H18: 0.54%). They called out “the continued trends of softening cure rates from a moderating housing market, tightening credit standards and increases in mortgage interest rates. This has resulted in a more subdued seasonal uplift than has historically been experienced by our business”. As a result, loss ratio guidance was revised higher to 50-55% from 40-50% guidance range previously.

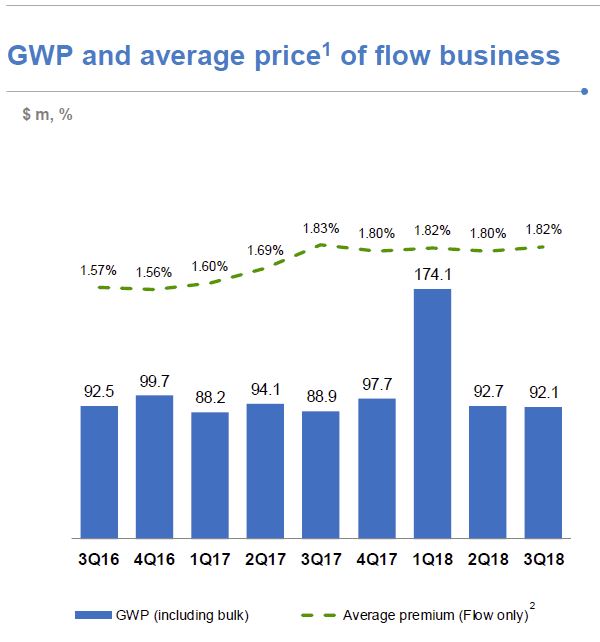

Gross Written Premium increased in 3Q18 reflecting growth in their traditional Lenders Mortgage Insurance (LMI) flow business.

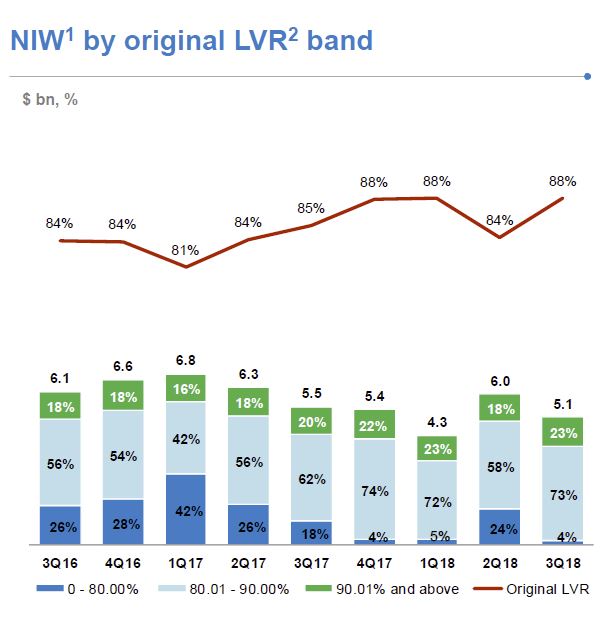

New business volume (excluding excess of loss insurance), as measured by New Insurance Written (NIW), decreased 7.3% to $5.1 billion in 3Q18 compared with $5.5 billion in 3Q17. NIW in 3Q17 included $0.8 billion of

New business volume (excluding excess of loss insurance), as measured by New Insurance Written (NIW), decreased 7.3% to $5.1 billion in 3Q18 compared with $5.5 billion in 3Q17. NIW in 3Q17 included $0.8 billion of

bulk portfolio business versus no bulk portfolio business in 3Q18. Excluding the bulk portfolio business written in 3Q17, flow business NIW increased 8.5% in 3Q18.

Gross Written Premium (GWP) increased 3.6% to $92.1 million in 3Q18 (3Q17: $88.9 million). This does not include any excess of loss business written by Genworth’s Bermudan entity and reflects the greater proportion of traditional LMI flow business written by Genworth lender-customers.

Gross Written Premium (GWP) increased 3.6% to $92.1 million in 3Q18 (3Q17: $88.9 million). This does not include any excess of loss business written by Genworth’s Bermudan entity and reflects the greater proportion of traditional LMI flow business written by Genworth lender-customers.

Net Earned Premium (NEP) decreased 32.0% from $100.1 million in 3Q17 to $68.1 million in 3Q18. This includes the adverse $24.8 million impact of the 2017 Earnings Curve Review, and lower earned premium from current and

prior book years. Excluding the 2017 Earnings Curve Review impact, NEP would have declined 7.2% in 3Q18.

The adverse impact on NEP of the 2017 Earnings Curve Review has been reducing quarter on quarter since it took effect on 1 October 2017. Whilst the 2017 Earnings Curve Review has the effect of lengthening the time-period over which premium is earned, it does not affect the quantum of revenue that will be earned.

Genworth’s Unearned Premium Reserve as at 30 September 2018 was $1.2 billion.

The Delinquency Rate (number of delinquencies divided by policies in force but excluding excess of loss insurance) increased from 0.50% in 3Q17 to 0.55% in 3Q18 (1H18: 0.54%). This was driven by two factors. Firstly, there was a decrease in policies in force following completion of the lapsed policy initiative undertaken by the Company in 2Q18. The second factor was the increase in delinquency rates year-on-year across all States (in particular Western Australia, New South Wales and to a lesser extent South Australia). In terms of number of delinquencies, Western Australia and New South Wales experienced the largest increase with Queensland and Victoria experiencing a decrease in number of delinquencies.

New delinquencies were down in the quarter (3Q18: 2,742 versus 3Q17: 2,887) with mining regions showing signs of improvement. In non-mining regions, the softening in cure rates experienced in 1Q18 and 2Q18 continued in 3Q18 with the traditional seasonal uplift in the third quarter being more subdued than prior years.

New delinquencies were down in the quarter (3Q18: 2,742 versus 3Q17: 2,887) with mining regions showing signs of improvement. In non-mining regions, the softening in cure rates experienced in 1Q18 and 2Q18 continued in 3Q18 with the traditional seasonal uplift in the third quarter being more subdued than prior years.

Net Claims Incurred for the quarter were down 3.2% (3Q18: $35.8 million versus 3Q17: $37.0 million). The Loss Ratio in 3Q18 was 52.6% up from 37.0% in 3Q17, reflecting the impact of lower NEP due to the 2017 Earnings Curve Review. Excluding the impact of the 2017 Earnings Curve Review the loss ratio would have been 38.6%.

Net Claims Incurred for the quarter were down 3.2% (3Q18: $35.8 million versus 3Q17: $37.0 million). The Loss Ratio in 3Q18 was 52.6% up from 37.0% in 3Q17, reflecting the impact of lower NEP due to the 2017 Earnings Curve Review. Excluding the impact of the 2017 Earnings Curve Review the loss ratio would have been 38.6%.

The Expense Ratio in 3Q18 was 32.5% compared with 29.7% in 3Q17, reflecting the lower NEP.

Investment Income of $21.5 million in 3Q18 was up 38% on the prior corresponding period (3Q17: $15.6 million). The 3Q18 Investment Income included a pre-tax mark-to-market unrealised loss of $1.2 million ($0.8 million after-tax) versus a pre-tax mark-to-market unrealised loss of $12.0 million ($8.4 million after-tax) in 3Q17.

As at 30 September 2018 the value of Genworth’s investment portfolio was $3.2 billion, more than 90% of which is held in cash and highly rated fixed interest securities and $169 million of which is invested in Australian equities in line with the Company’s low volatility strategy. After adjusting for mark-to-market movements the 3Q18 investment return was 2.80% p.a. marginally down from 2.88% in 3Q17.