Genworth reported their 1H19 results today. As the most transparent Lenders Mortgage Insurer in Australia it provides an important, if myopic sense of what is happening at the mortgage portfolio coalface. And pressure is still building.

They reported a NPAT of $88.1 million includes after tax unrealised gain of $45.4 million on investment portfolio (1H18: after tax unrealised loss of $8.4 million), and an underlying NPAT 1 of $43.1 million includes after tax realised gain of $5.8 million (1H18: $9.1 million).

Their loss ratio was 54.1% (1H18: 53.3%) in line with the Company’s FY19

guidance reflecting they say a seasonal uptick in delinquencies historically experienced in the first half of the year.

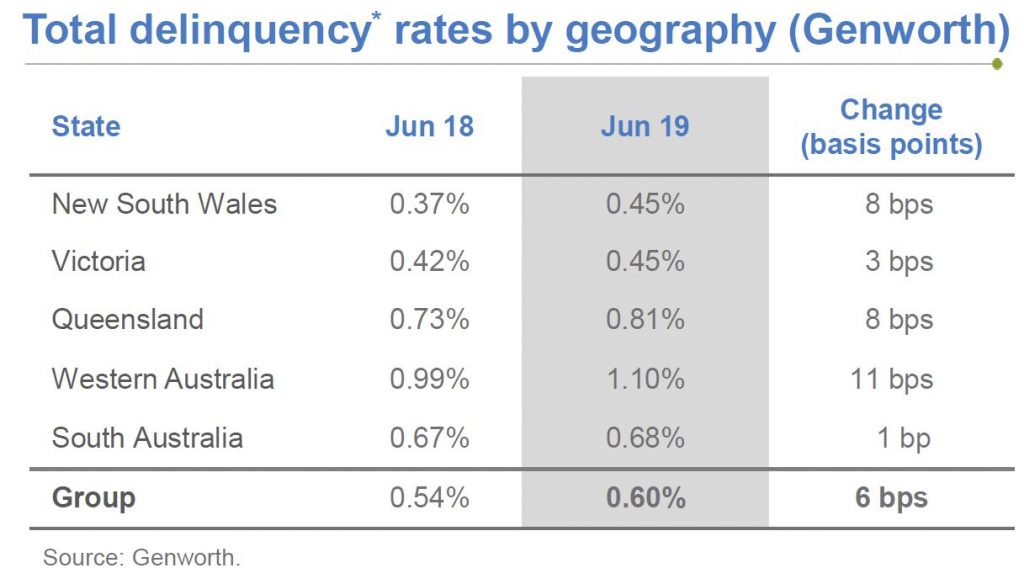

Delinquencies were up, by 6 basis points, with WA leading the way at 11 basis points, followed by NSW and QLD. This is consistent with DFA mortgage stress analysis.

They said that overall portfolio delinquency performance deteriorated marginally quarter on quarter, in-line with seasonal expectations, but also impacted by ageing delinquency portfolios as a result of slower loss mitigation processes by lenders.

This is code for lenders choosing NOT to press stressed borrowers to foreclose, in my view.

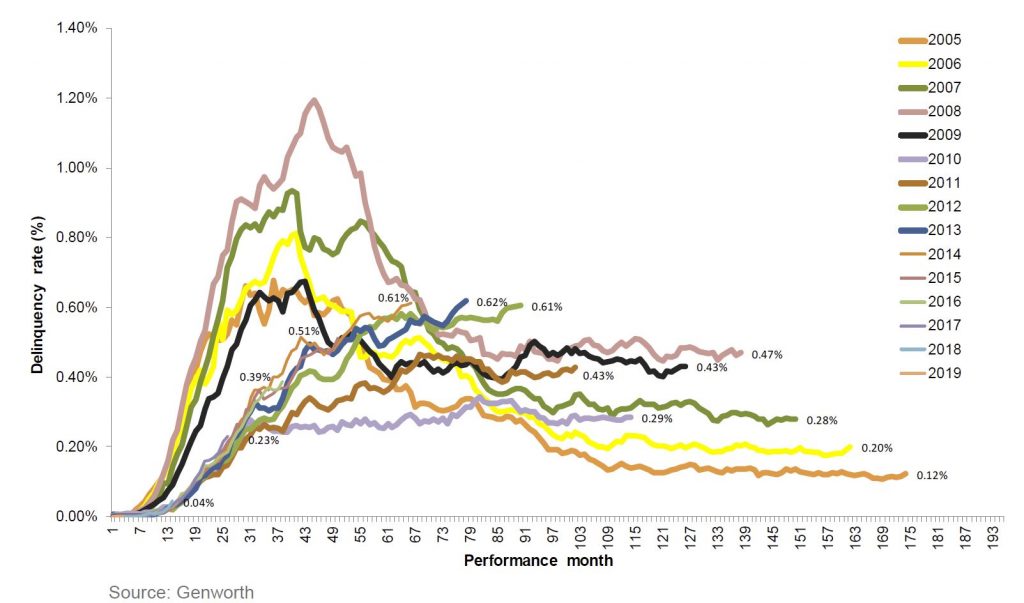

Their 2006 and prior book years performances were affected by higher proportion of low doc lending which reduced significantly in 2009 following policy changes and decommissioning of the low docs product in the latter part of 2009

Historical performance of 2008-09 book year was affected by the economic downturn experienced across Australia and heightened stress experienced among self-employed borrowers, particularly in Queensland, which has been exacerbated by recent natural disasters.

2010-12 book year delinquencies at lower levels driven by stronger credit policies

Deterioration in 2013-14 book years reflect downturn in mining regions resulting in ongoing economic and housing market challenges

They announced a new product offering – a regular monthly premium LMI to lenders as an alternative to the current upfront single premium product. This may lower the sticker shock on premiums for LMI.

Their outlook is predicated on metropolitan housing market conditions stabilising, but Perth is likely to continue to experience challenging market conditions. They think unemployment levels will remain reasonably stable throughout 1H19 though with continued excess capacity in the labour market ahead.

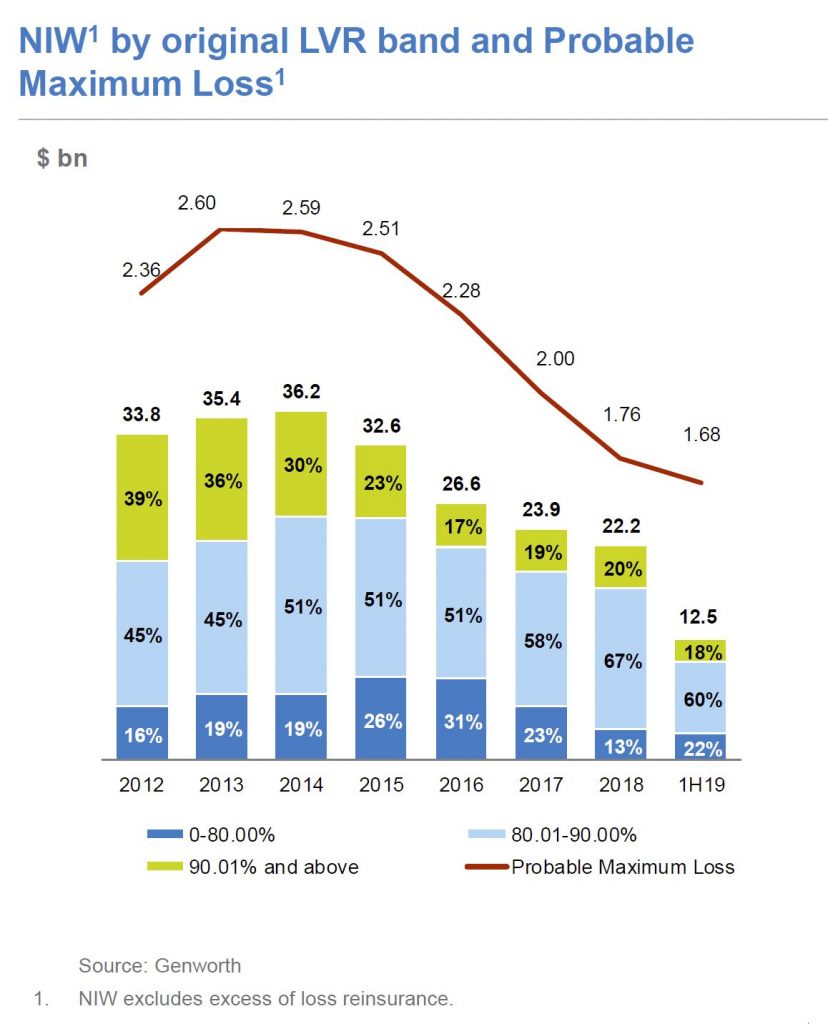

Genworth still has a strong capital base with total assets as at 30 June 2019 at $3,648.2 million. The 1.6% increase is due to share buy-backs, unrealised gains in investments and changes in accounting.

Total liabilities as at 30 June 2019 were $1,925.9 million, which is a 3.9%

increase of $73.1 million from 31 December 2018.

Since listing in 2014, Genworth has paid out 100% of after tax profits by way of ordinary and special dividends to shareholders.

So LMI remains a tricky business, with new competitors, internal bank alternatives, and the Government 95% scheme coming next year, so no surprise that some rating agencies have recently downgraded.