Moody says that on 23 September, German bank regulator Bundesanstalt fuer Finanzdienstleistungsaufsicht (BaFin) and the German central bank, the Deutsche Bundesbank, published the results of their biennial stress test applied to 1,412 small and midsize German banks that fall under BaFin’s direct oversight. The tested banks represent 38% of German banking system assets. The stress test scenario was designed well ahead of the recent decision of the European Central Bank (ECB) to lower the rate on its deposit facility to a negative 0.50%.

Instead, the scenario tests the banks for a severe economic downturn combined with rising interest rates and credit spreads. The capital buffers of the tested German banks remained robust under stress with a Common Equity Tier 1 ratio of 13.0% on average, down 3.5 percentage points from the year-end 2018 starting point of 16.5%. The drawback of this scenario is that it does not address the more plausible future environment of weakening economic growth combined with extended low interest rates.

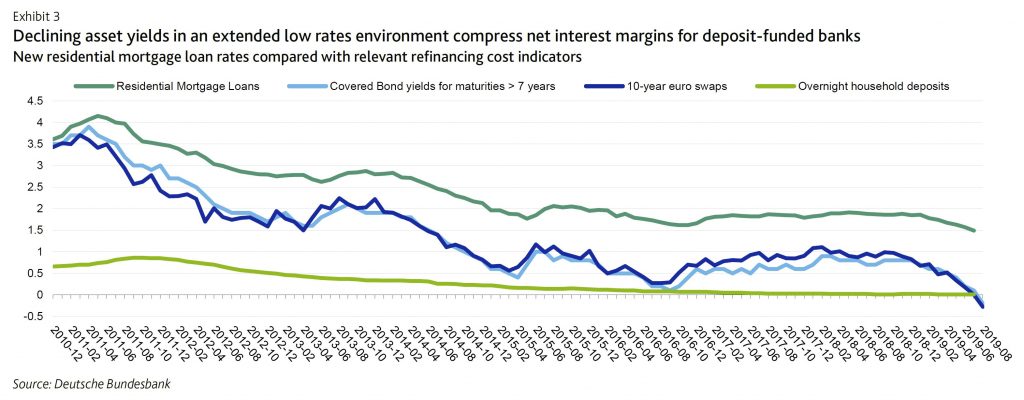

A return on equity survey that accompanied the stress test, however, was more revealing. The survey required the banks to contrast their five-year base-case assumptions for return on equity evolution (from 2018 to 2023) with five defined interest-rate scenarios.

The closest interest rate scenario to current market expectations simulates the present ultra-low interest rates lasting throughout the five years. In terms of potential to impair the banks’ profitability, it is also the most severe. Based on the assumption of a static balance sheet,2 banks would see their profitability falling by more than 50%. The high probability of this interest rate scenario unfolding suggests that the banks need to materially increase their focus on cost management to protect their credit profiles.

Unchanged rate environment is the most severe scenario. The survey results show improved forecasts for base-case profitability at the end of the five-year horizon against the same survey two years ago (2016-21). In part, this reflects moderate progress in trimming high cost bases. The German regulators cautioned, however, that the improvement is substantially driven by the fact that about half of the participating banks (Group B) assumed a rise in interest rates over the five-year horizon from year-end 2018 levels.

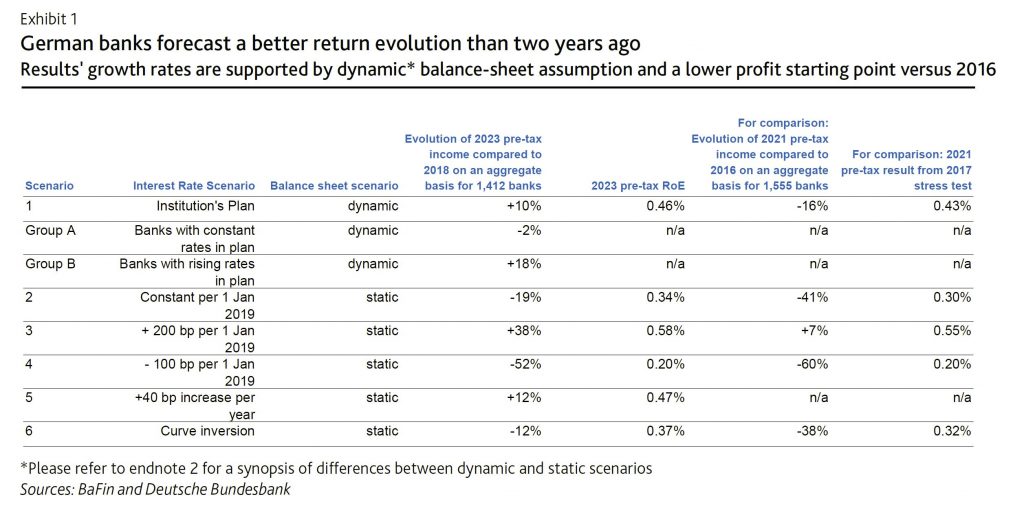

They added that even the flat interest rate assumption employed by the other half (Group A) based on year-end 2018 interest rates has become an optimistic scenario. Exhibit 2 shows that long-term interest rates have in fact declined by around 100 basis points since the end of 2018, broadly in line with Scenario 4 (the most severe scenario), with an even more pronounced decline in longer-term rates.

The banks’ simulated results are better under the assumption of dynamic balance sheets. This is because active management intervention to counteract interest rate-driven income declines remains an important lever to reduce the profitability pressure on German banks. Close to half the bank managers surveyed indicated that under Scenario 4, an interest rate drop of 100 basis points, they would consider applying negative interest rates to the deposits of retail clients. Less than one third excluded this for retail and corporate clients under this scenario.

Managers of banks that participated in this year’s stress test expect a combination of weaker deposit margins and a reduced contribution from maturity transformation business to outweigh moderately improving lending margins. This was the case even in Scenario 1 (based on year-end 2018 institutions’ plans with a dynamic balance sheet). It illustrates that banks with lower dependence on maturity transformation results (i.e. with higher fees and commissions income) and with more flexible funding options are better positioned to defend their profitability during a period of extended low interest rates.

As in prior years, the stress test exercise excluded the 21 large German banking groups that are under the direct supervision of the ECB.

We believe that, on aggregate, these larger banks benefit from their access to more diversified funding sources.

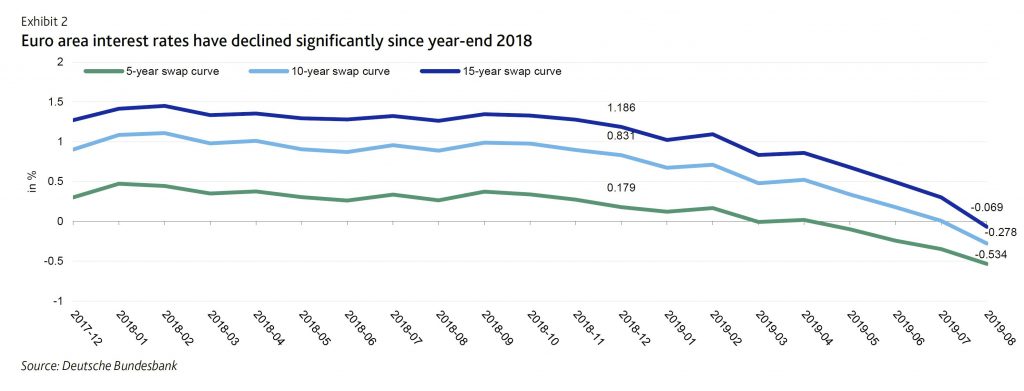

The low interest rate environment has particularly compressed the net interest margin on newly originated loans if these new loans have been financed with retail deposits. This is because banks have so far felt unable to charge for retail deposits and these deposits have effectively been floored at 0% interest, even as lending rates have continued to fall.

In contrast, the use of secured or unsecured market funding sources (where costs have continued to fall) available to the larger banks, enables them to substantially offset the decline in interest rates earned on their newly originated loans. This is illustrated in Exhibit 3 using residential mortgage loans as an example. On the other hand, despite economies of scale, large banks’ cost efficiency materially lags the efficiency of smaller German banks – and in turn the efficiency of small German banks lags international peers.