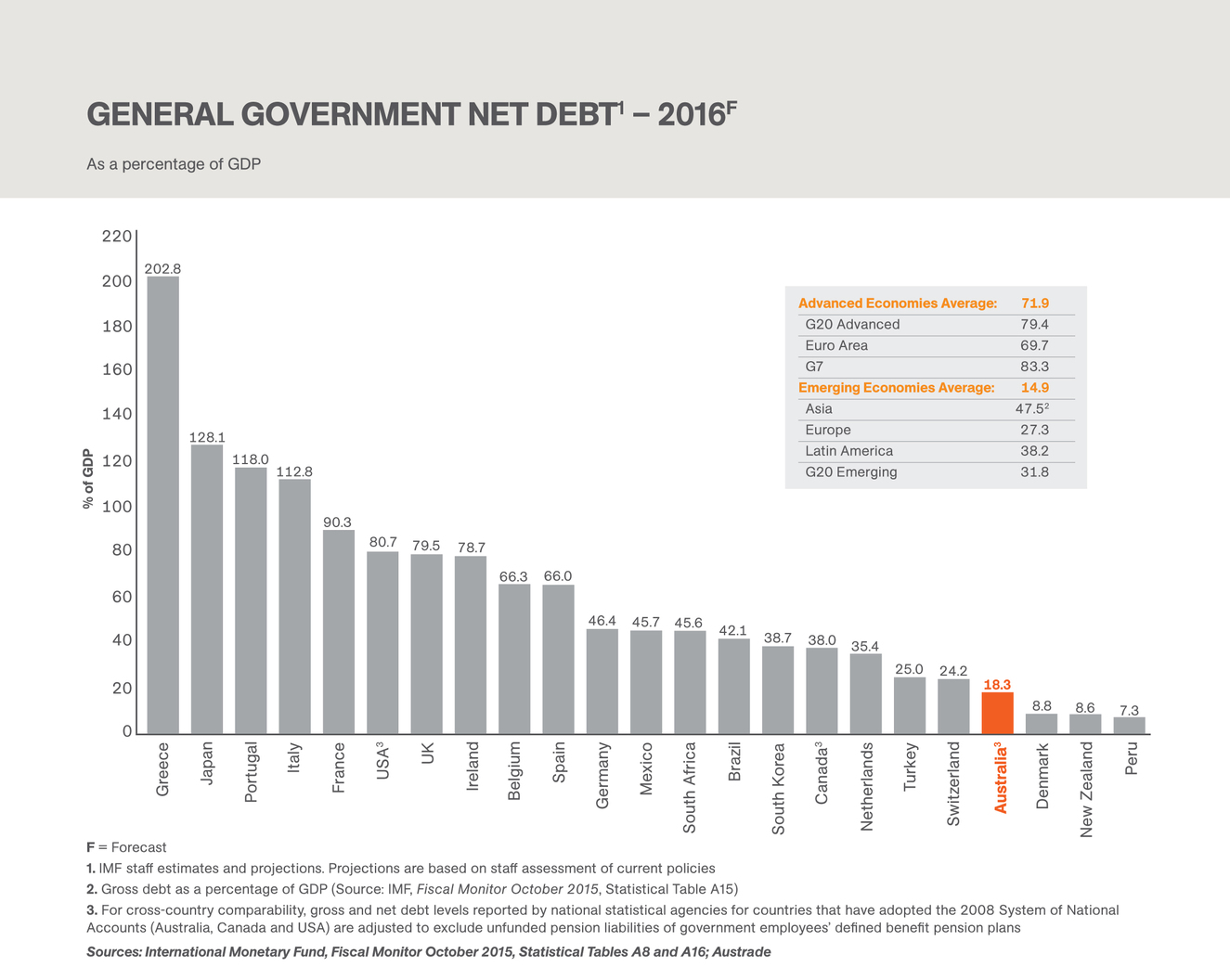

A good piece in today’s The Conversation, examines the claim that the current government has lifted net government debt by $100 billion. This is proved to be correct, with caveats. However, some perspective is required in the debate. As highlighted in the piece, an important measure is debt to GDP. On that basis, on an international comparison, Australia is still well placed.

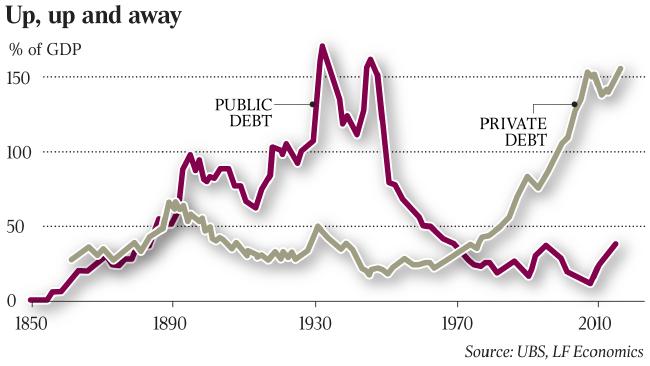

However, a recent report from LF Economics highlights that “while mainstream commentary and attention is firmly focused on public debt, the nation has accumulated a dangerously high level of private debt, including a moderately high level of external debt. Globally, Australia ranks near the top of indebted households. The exponential surge in mortgage debt issuance over the last two decades has generated the largest housing bubble in Australian economic history”. “Australia’s household debt ratio has grown above peaks established in countries where housing bubbles formed and burst, as in Ireland, Spain and the United States,” say report authors Philip Soos and Lindsay David. “So highly leveraged is the housing market that even small declines in residential land prices will have adverse consequences.”

However, a recent report from LF Economics highlights that “while mainstream commentary and attention is firmly focused on public debt, the nation has accumulated a dangerously high level of private debt, including a moderately high level of external debt. Globally, Australia ranks near the top of indebted households. The exponential surge in mortgage debt issuance over the last two decades has generated the largest housing bubble in Australian economic history”. “Australia’s household debt ratio has grown above peaks established in countries where housing bubbles formed and burst, as in Ireland, Spain and the United States,” say report authors Philip Soos and Lindsay David. “So highly leveraged is the housing market that even small declines in residential land prices will have adverse consequences.”

Indeed, Australian households overtook the Swiss as the world’s most indebted this year, with outstanding debt equivalent to 125 per cent of GDP and no let up in sight. Combined owner-occupier and investor loans outstanding have risen from $1.2 trillion to $1.6 trillion in the past five years.

Here is the problem, the economic growth is being stoked by ever higher household debt, which is unsustainable. Why are we not getting better political discussion on this much more important issue during the election? The current economic path which has been set is unsustainable. The chart below makes the point – private debt should be the focus.

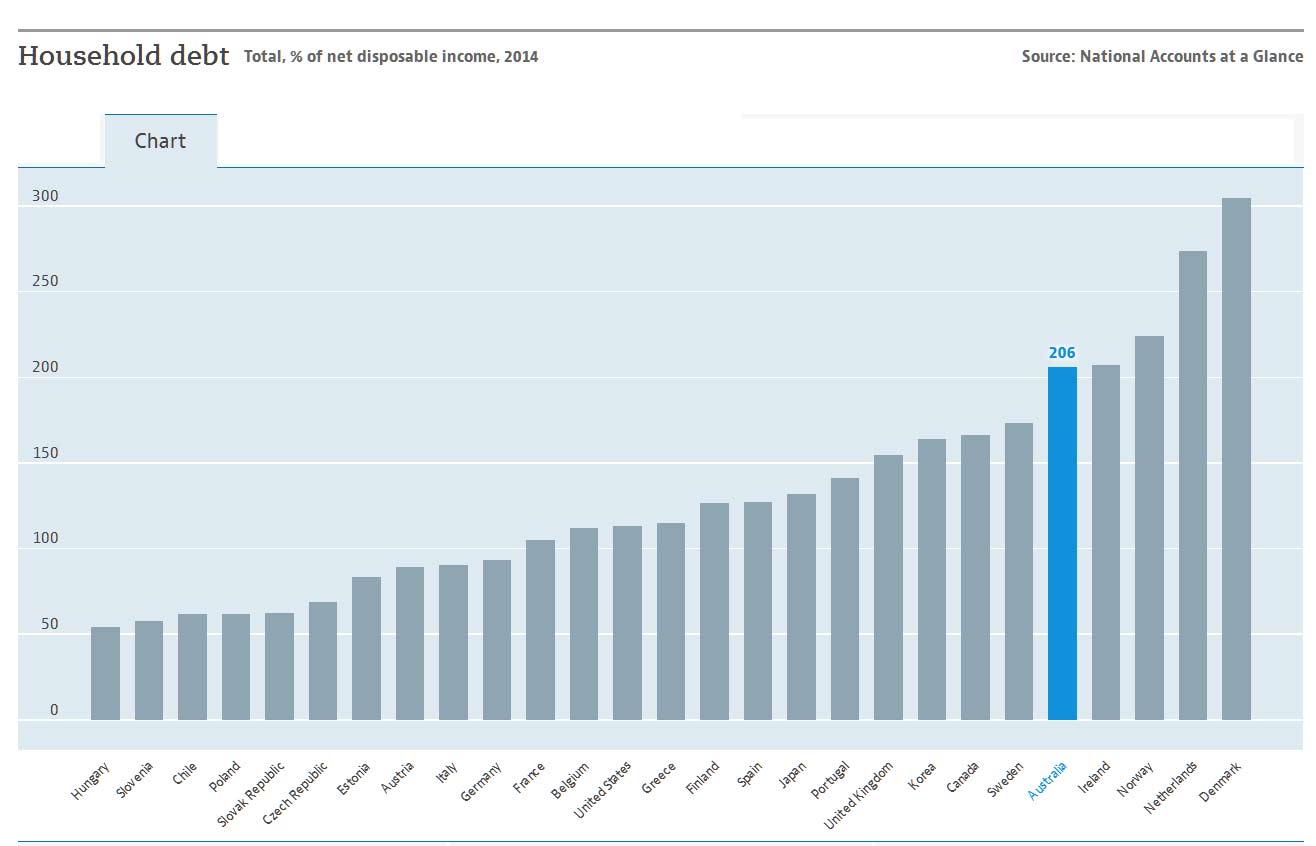

As we highlighted from the recent RBA chart pack, household debt to income is also sky high.

As we highlighted from the recent RBA chart pack, household debt to income is also sky high.

And here is data (from 2014) from the OECD showing the relative ratio of household debt to disposable income for Australia, in comparison with other countries.

And here is data (from 2014) from the OECD showing the relative ratio of household debt to disposable income for Australia, in comparison with other countries.

The issue we SHOULD be talking about is the household debt overhang, and how we are going to deal with it. Government debt, in comparison is a side-show!

The issue we SHOULD be talking about is the household debt overhang, and how we are going to deal with it. Government debt, in comparison is a side-show!