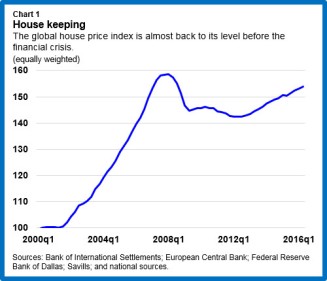

During 2007-08, house prices in several countries collapsed, marking the onset of a global financial crisis. The IMF’s Global House Price Index, a simple average of real house prices for 57 countries, is now almost back to its level before the crisis (Chart 1). Is it time to worry again about a global fall in house prices?

The classic study of financial crises by Carmen Reinhart and Ken Rogoff has taught us the folly of claiming “this time is different.” Still, there are several reasons to think that the present conjuncture is a time for vigilance but not panic.

- First, unlike the boom of the 2000s, the current boom in house prices is not synchronized across countries. And within countries, the boom is often restricted to one or a few cities. In many cases, the booms are not being driven by strong credit growth: some house price increases, particularly at the city level, are due to supply constraints.

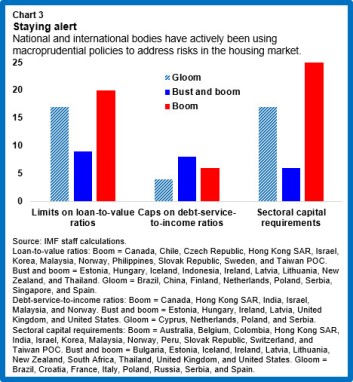

- Second, countries are now more active in the use of macroprudential policies to tame housing booms. As our former Deputy Managing Director Min Zhu declared: “The era of benign neglect of house price booms is over.”

Lack of synchronicity

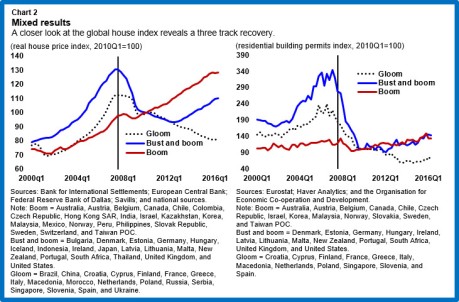

A closer look at the global index reveals three clusters of countries (Chart 2, left panel).

- The first cluster—gloom—consists of 18 economies in which house prices fell substantially during the global financial crisis and have remained on a downward path.

- The second—bust and boom—consists of 18 economies in which housing markets have rebounded since 2013 after falling sharply during 2007-12.

- The third—boom—comprises 21 economies in which the drop in house prices in 2007–12 was quite modest and was followed by a quick rebound.

Not only are there differences across countries, but the situation differs within countries. China offers a good example. While land prices overall have kept up a steady upward march, this masks tremendous variation at the city level. Beijing has “experienced one of the greatest booms ever seen in housing markets,” according to Joe Gyourko, an expert at the University of Pennsylvania. With his co-authors, Gyourko has constructed a residential land price index for 35 large cities in China based on government sales of land to private developers. These data show that prices have increased in inflation-adjusted terms by about 80 percent a year in Beijing over the past decade but by only 10 percent a year in Xian. Whether this pattern of price increases will continue depends on the balance between supply and demand, which varies across cities as well. Some other examples are those of Amsterdam, Oslo, and Vienna, where house prices are rising far more than the national averages.

Supply constraints

Many of the past housing booms were driven by excessive credit growth. But this time supply constraints appear to be playing a big role in driving some of the price booms. Residential permits have grown only modestly in the “boom” and “bust and boom” country clusters (Chart 2, right panel). The impact of supply constraints is evident in the case of many of cities. In Copenhagen and Stockholm, the increase in the housing stock has not kept up with population growth, feeding some of the price increase observed there. In recent years, the IMF has also flagged the role of supply constraints in some cities in Australia and Canada, as well as in many European countries—France, Germany, the Netherlands, Norway, and the United Kingdom.

Increased vigilance

Another difference from the pre-crisis period is that national and international regulators are being more vigilant about monitoring house price booms and using macroprudential policies to tame them. The use of such policies has been quite extensive in the period since the crisis, particularly in the “gloom” and “boom” clusters (Chart 3).

The IMF has been urging macroprudential measures, alongside measures to boost supply, in many countries including Australia, Canada, and several European countries. This is because, even if house price increases are due to supply constraints, their impact of household indebtedness could have adverse implications for financial stability.

Just last week, the European Systemic Risk Board published a set of country-specific warnings on medium-term vulnerabilities in the residential sector for eight member states: Austria, Belgium, Denmark, Finland, Luxembourg, the Netherlands, Sweden, and the United Kingdom. This provides a good example of the kind of vigilance that will be needed to keep the past from again becoming prologue.