According to the latest modelling from Digital Finance Analytics, around half of all households in rental accommodation are struggling to pay their rent on time.

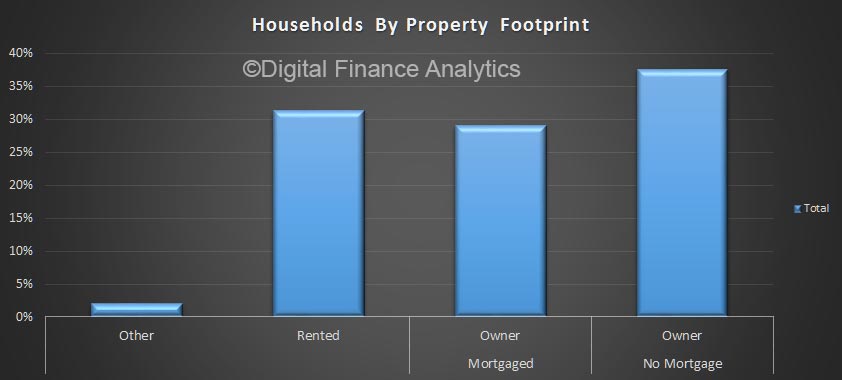

Across all households, more than 30% are renting, and this has been rising as the costs of property escalate, mirroring the rise in mortgaged households.

Within the rental sector, around half are fine, but 37% are in mild rental stress (meaning they are making their rental payments by cutting back on other spending, putting more on credit cards and generally hunkering down). An additional 13% are in serve rental stress (meaning they are struggling to pay their rent on time and are likely to fall behind). We look at total cash flow, not a set proportion going on the rent (e.g. 30%).

Within the rental sector, around half are fine, but 37% are in mild rental stress (meaning they are making their rental payments by cutting back on other spending, putting more on credit cards and generally hunkering down). An additional 13% are in serve rental stress (meaning they are struggling to pay their rent on time and are likely to fall behind). We look at total cash flow, not a set proportion going on the rent (e.g. 30%).

Static incomes, underemployment and rising costs of living all add to the pressure, despite an overall fall in rental yields.

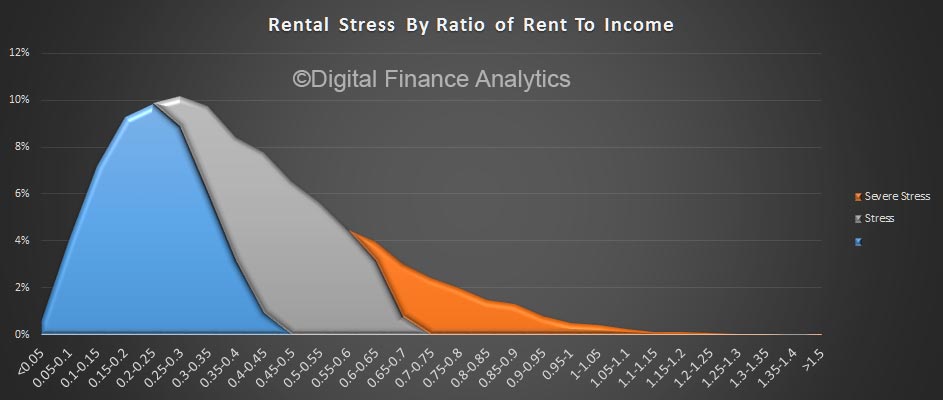

There is a strong correlation between rental stress and the proportion income going to make rental payments. In some cases of severe stress, there is not enough income from all sources directly to cover the rent, and they are forced to borrow to fill the gap, or use savings.

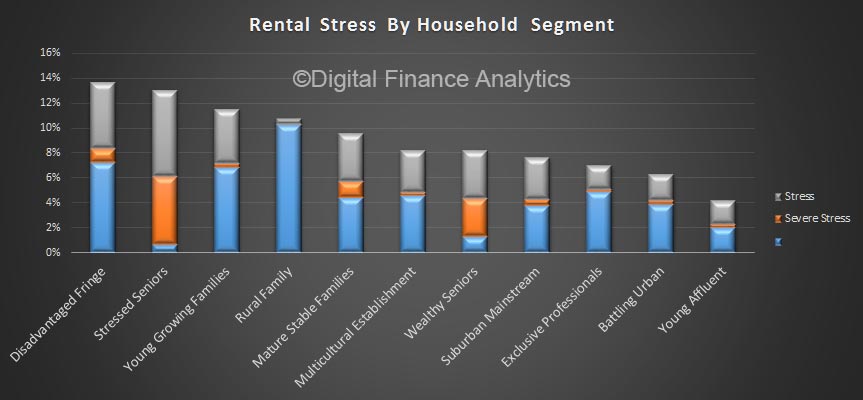

We can also look across the rental sector by our household segments. Seniors are most likely to be in severe stress, but other groups are also being hit by rental stress. Many wealth seniors are tapping into savings to survive but stressed seniors do not necessarily have this option. Fuel bills are a particular concern for many.

This analysis shows that we cannot just focus on housing affordability for owner occupied purchasers; housing policy must also cover the rental sector, where the supply of affordable rental property is a major issue. Once again joined-up strategic thinking is required to tackle this intractable problem.

This analysis shows that we cannot just focus on housing affordability for owner occupied purchasers; housing policy must also cover the rental sector, where the supply of affordable rental property is a major issue. Once again joined-up strategic thinking is required to tackle this intractable problem.