Good article from McKinsey on the revolution catalysed by the combination of machine learning and new payment systems as part of big data. The outline some of the opportunities to expand the use of machine learning in payments range from using Web-sourced data to more accurately predict borrower delinquency to using virtual assistants to improve customer service.

Machine learning is one of many tools in the advanced analytics toolbox, one with a long history in the worlds of academia and supercomputing. Recent developments, however, are opening the doors to its broad-scale applicability. Companies, institutions, and governments now capture vast amounts of data as consumer interactions and transactions increasingly go digital. At the same time, high-performance computing is becoming more affordable and widely accessible. Together, these factors are having a powerful impact on workforce automation. McKinsey Global Institute estimates that by 2030 47 percent of the US workforce will be automated.

Payments providers are already familiar with machine learning, primarily as it pertains to credit card transaction monitoring, where learning algorithms play important roles in near real-time authorization of transactions. Given today’s rapid growth of data capture and affordable high-performance computing, McKinsey sees many near- and long-term opportunities to expand the use of machine learning in payments. These include everything from using Web-sourced data to more accurately predict borrower delinquency to using virtual assistants to improve customer service performance.

Machine learning: Major opportunities in payments

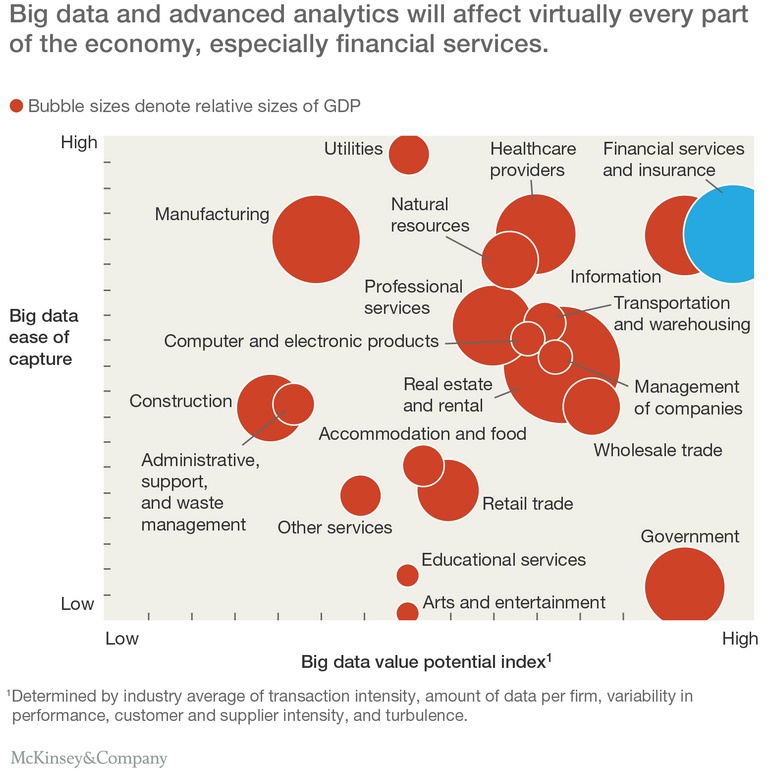

Rapid growth in the availability of big data and advanced analytics, including machine learning, will have a significant impact on virtually every part of the economy, including financial services (exhibit). Machine learning can be especially effective in cases involving large dynamic data sets, such as those that track consumer behavior. When behaviors change, it can detect subtle shifts in the underlying data, and then revise algorithms accordingly. Machine learning can even identify data anomalies and treat them as directed, thereby significantly improving predictability. These unique capabilities make it relevant for a broad range of payments applications.

What is machine learning?

What is machine learning?

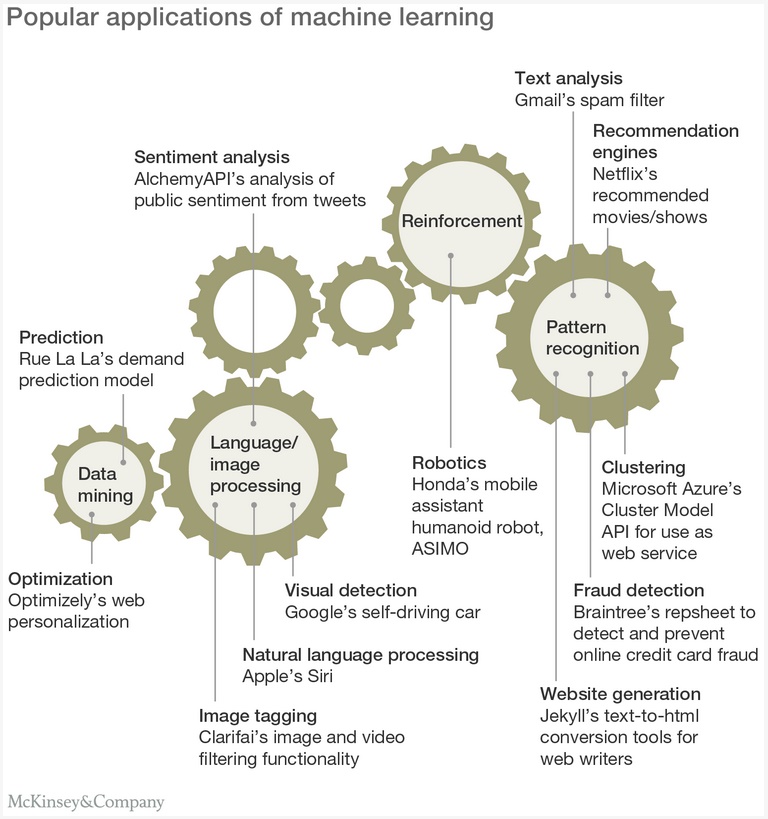

Machine learning is the area of computer science that uses large-scale data analytics to create dynamic, predictive computer models. Powerful computers are programmed to analyze massive data sets in an attempt to identify certain patterns, and then use those patterns to create predictive algorithms (exhibit). Machine learning programs can also be designed to dynamically update predictive models whenever changes occur in the underlying data sources. Because machine learning can extract information from exceptionally large data sets, recognize both anomalies and patterns within them, and adjust to changes in the source data, its predictive power is superior to that of classical methods.

Machine learning has already established a strong foothold in credit cards, particularly in fraud management. PayPal’s Braintree Auth payments tool, for example, uses PayPal’s consumer transaction data in conjunction with software developer Kount’s fraud detection capabilities to authorize high volumes of transactions and verifications in near real-time. Each credit card transaction or verification is analyzed in milliseconds using hundreds of fraud detection tests.

There are several other areas in the payments value chain where machine learning is adding significant value:

- Product sales: Machine learning can be a powerful tool for developing deeper insights about customers and sales prospects because it can draw upon a wider variety of internal and external data than marketers have traditionally used. It can more accurately cluster customers and prospects into segments according to their profiles and probable needs. This deeper insight can reveal new opportunities for cross-selling and up-selling among both customers and prospects. McKinsey finds that with machine learning payments providers can increase revenue from existing customers by 10 to 15 percent.

- Customer retention: Companies typically monitor and forecast customer churn based on changes in account status; when churn rates rise they take steps to address the problem. Now, through machine learning, they can identify those customers they are at risk of losing and act quickly to retain valuable customers. For example, 47Lining, an Amazon Web Services partner, uses a combination of site behavior, demographics, and media-sentiment measures to predict customer churn with 71 percent accuracy. Companies using machine learning to address customer churn have achieved reductions of as much as 25 percent.

- Collections: Collection practices and debt restructuring work best when closely aligned with borrowers’ changing circumstances and propensity to pay. Machine learning can help companies build robust dynamic models that are better able to segment delinquent borrowers, and even identify self-cure customers (that is, customers that proactively take action to improve their standing). This enables them to better tailor their collection strategies and improve their on-time payment rates. TrueAccord’s HeartBeat, for instance, is a machine learning tool that helps lenders customize personal interactions in real time, based on its ability to detect why a customer’s payments are late. Companies using machine learning have been able to reduce their bad debt provision by 35 to 40 percent.

- Treasury pricing: In commercial payments, companies can capture 10 to 15 percent more revenue through optimized treasury pricing. In the near term, advanced analytics can identify quick-win opportunities to reduce price leakage (such as discounts exceeding authorized limits) and billing errors. Over the long term, clustering techniques built on machine learning can significantly improve customer segmentation and lead to more appropriate pricing models.

- Customer care: Over time, McKinsey expects to see a gradual increase in the automation of many customer services. This is an area in which the cognitive intelligence capabilities of machine learning are particularly well suited. Among the benefits are: lower servicing costs, enhanced agent performance, more efficient capacity management, improved digital customer experience, reduced risk, and elimination of waiting times. A variety of relevant applications are already available, including virtual assistants that use natural language processing, deep insight tools like IBM’s Watson, and cognitive engines that can do things presently handled by humans, such as IPSoft’s Amelia, which can understand and interact with people (see sidebar, “Cognitive agents”).

Machine learning in the card collection environment

Cognitive agents

Cognitive agents like IPSoft’s Amelia combine natural language and deep insight technologies to complete tasks typically handled by humans. Using a three-step process, they help companies intelligently automate a variety of tasks:

- Understand: Cognitive agents can rapidly absorb and comprehend a diverse range of data sets, from complex manuals to call logs and flow charts.

- Learn: Cognitive agents absorb data from the customer language they process, and can refer the customer to a live agent language they process, and can refer the customer to a live agent when uncertain about how to react. They also learn from cases they refer to agents, further improving effectiveness as they continue to record interactions and data.

- Resolve: Finally, cognitive agents can directly resolve customer inquiries received through online chat, mobile, and voice channels. Alternatively, when connected to a backend system they can support live agents in resolving customer issues.

Service automation tools can help payments providers increase customer satisfaction, enhance financial performance, and improve compliance.

In card issuing, machine learning is already having a valuable impact. This is especially true in collections, where McKinsey has seen 10 to 15 percent improvements in recovery rates and 30 to 40 percent increases in collections efficiency. To minimize delinquencies, issuers can use individual-account pattern recognition technologies, and develop contact guidelines and strategies for accounts that are already delinquent. Following an account delinquency, issuers allow a brief time window (usually 90 days) before they write off the receivables and turn collection over to third-party providers. This brief period is an ideal time for issuers to apply collection strategies that draw heavily on the capabilities of machine learning.