In their latest release, HIA is essentially calling for an easing of lending practices, suggesting that investors need encouragement to come back into the market.

“A growing list of disincentives are deterring investors from Australia’s housing market,” stated HIA economist, Diwa Hopkins.

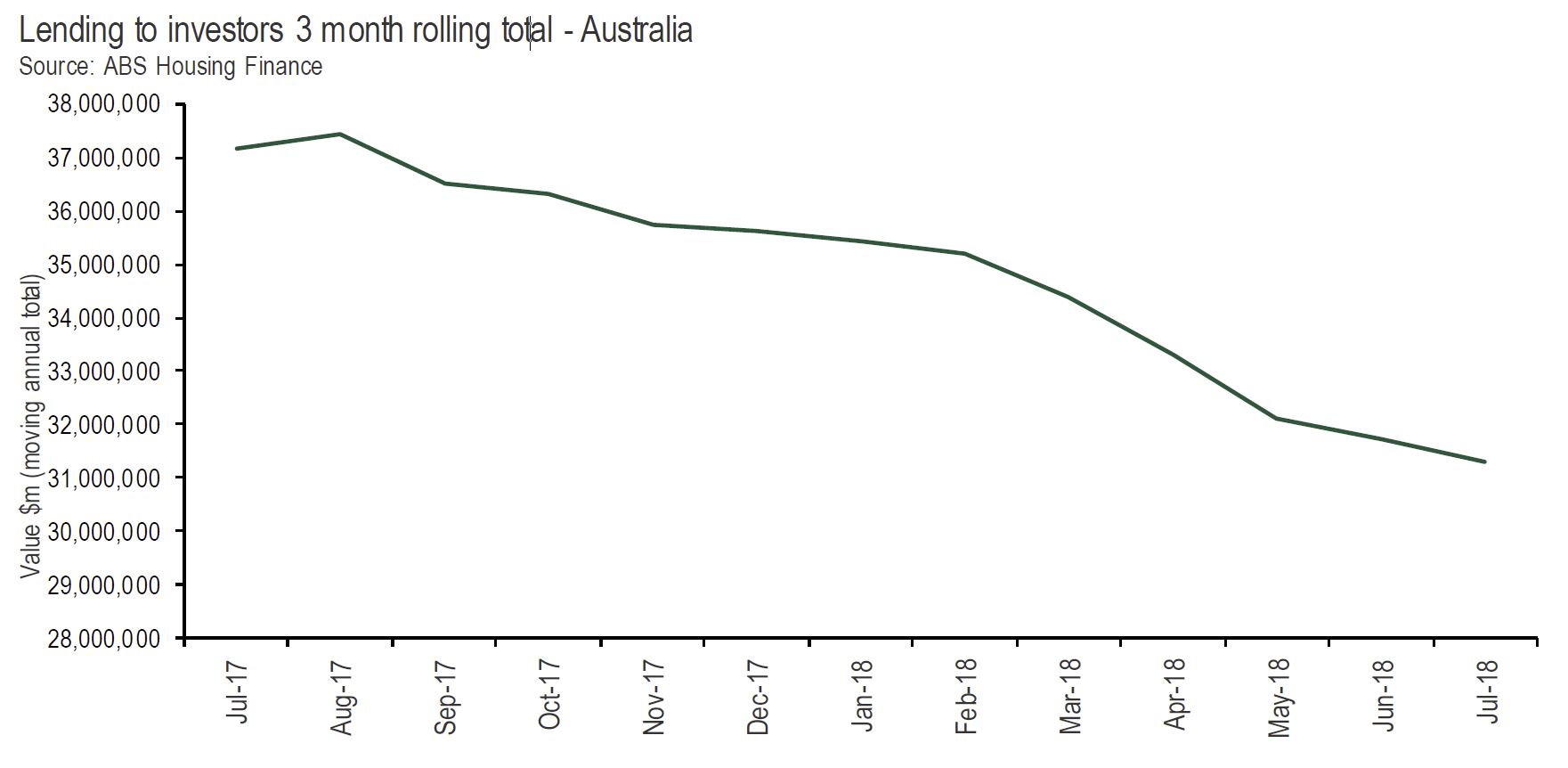

Today the ABS released data on housing finance for the month of July 2018. These figures show the value of lending to investors declined by a further 1.3 per cent in the month. The value of lending in July 2018 is now 15.7 per cent lower than in July 2017.

“Investors played a significant role in the record levels of new home building that occurred in recent years. By the same token their retreat from the market will weigh on activity over the near to medium term,” said Ms Hopkins.

“The exiting of investors from the housing market can be traced back to well-documented APRA interventions at the end of 2014 and then again in early 2017.

“In addition, state and federal governments have acted to deter foreign investors by levying additional taxes and charges on their investments in the domestic market.

“More recently the Banking Royal Commission has seen lenders further tighten their practices beyond APRA’s initial requirements and yesterday two of the other major banks joined Westpac in raising their variable mortgage rates.

“Add to this, a situation of falling dwelling prices in the key Sydney and Melbourne markets as well as the prospect of increased taxes on investment housing through negative gearing restrictions and increased capital gains tax, and the list of deterrents to investors in the housing market is comprehensive.

“Overall, most of these factors are having the effect of limiting credit availability.

“The concern now is APRA’s interventions appear to have run beyond their usefulness,” said Ms. Hopkins.