A new working paper from the BIS “The real effects of household debt in the short and long run” shows that high household debt (as measured by debt to GDP) has a significant negative long term effect on consumption, and so growth.

A 1 percentage point increase in the household debt-to-GDP ratio tends to lower growth in the long run by 0.1 percentage point. Our results suggest that the negative long-run effects on consumption tend to intensify as the household debt-to-GDP ratio exceeds 60%. For GDP growth, that intensification seems to occur when the ratio exceeds 80%.

Moreover, the negative correlation between household debt and consumption actually strengthens over time, following a surge in household borrowing. What is striking is that the negative correlation coefficient nearly doubles between the first and the fifth year following the increase in household debt.

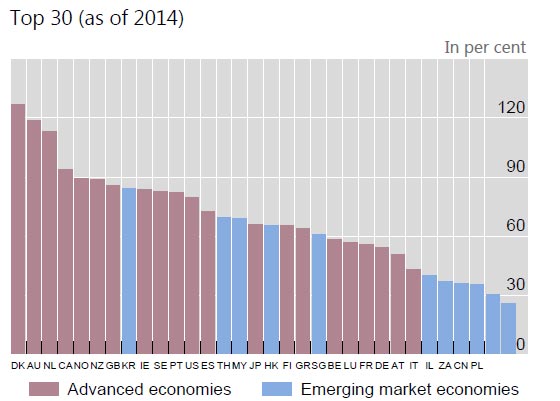

Bad news for Australian households where the ratio is well above 80%, at 130%.

This is explained by massive amounts of borrowing for housing (both owner occupied and investment) whilst unsecured personal debt is not growing. Such high household debt, even with low interest rates sucks spending from the economy, and is a brake on growth. The swelling value of home prices, and paper wealth (as well as growing bank balance sheets) do not really provide the right foundation for long term real sustainable growth.

This is explained by massive amounts of borrowing for housing (both owner occupied and investment) whilst unsecured personal debt is not growing. Such high household debt, even with low interest rates sucks spending from the economy, and is a brake on growth. The swelling value of home prices, and paper wealth (as well as growing bank balance sheets) do not really provide the right foundation for long term real sustainable growth.

Note: BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and from time to time by other economists, and are published by the Bank. The papers are on subjects of topical interest and are technical in character. The views expressed in them are those of their authors and not necessarily the views of the BIS.