Last Wednesday, the US Senate passed the Economic Growth, Regulatory Relief, and Consumer Protection Act. A key component of this bill increases the asset threshold for a bank to be designated a systemically important financial institution (SIFI) to $250 billion of total consolidated assets from $50 billion, the threshold defined in the Dodd-Frank Act of 2010.

For US banks with assets of less than $250 billion, the higher asset threshold for SIFI designation is likely to lead to a relaxation of risk governance and encourage more aggressive capital management, a credit-negative outcome.

SIFI banks are subject to the enhanced prudential standards of the US Federal Reserve (Fed). The regulatory oversight of SIFIs is greater than for other banks, and SIFIs participate in the Fed’s annual Dodd-Frank Act stress test (DFAST) and the Comprehensive Capital Analysis and Review (CCAR), which evaluate banks’ capital adequacy under stress scenarios. Furthermore, transparency will decline with fewer participants in the public comparative assessment the stress tests provide.

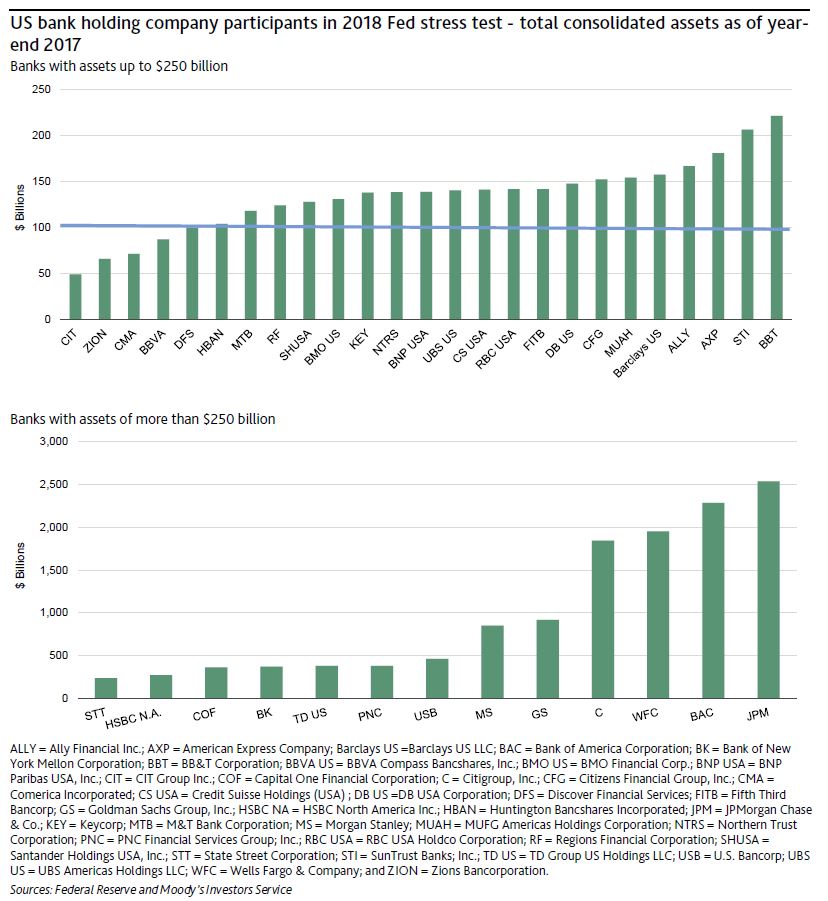

In 2018, the 38 bank holding companies shown in the exhibit below are subject to the Fed’s annual capital stress test. Passage of the bill into law would immediately exempt four banks with less than $100 billion of assets from the Fed’s enhanced prudential standards, which includes the stress test and living will requirements. These banks will have the most leeway in relaxing risk governance practices and managing their capital.

The 21 banks at the right of the top exhibit that have assets of $100-$250 billion1 could become exempt from enhanced prudential standards 18 months after passage of the bill into law. However, the Fed will have the authority to apply enhanced oversight to any bank holding company of this asset size and will still conduct periodic stress tests. In the 18 months after passage into law, it will be up to the Fed to develop a more tailored enhanced oversight regime for the $100-$250 billion asset group. The Fed also could continue to apply the same enhanced prudential standards. Therefore, it is difficult to assess the potential for their easier risk governance practices until more about the regulatory oversight is known.

If many of these banks are no longer required to participate in the public stress tests, it would reduce transparency. The quantitative results of DFAST and CCAR provide a relative rank ordering of stress capital resilience under a common set of assumptions. The loss of such transparency is credit negative.

For the largest banks, those with more than $250 billion in assets that remain SIFIs, there are no changes in the Fed’s supervision. The bill also specifies that foreign banking organizations with consolidated assets of $100 billion or more are still subject to enhanced prudential standards and intermediate holding company requirements.

In order to become law, the bill must also be passed by the US House of Representatives and signed by the president. This year’s annual Fed stress test will proceed as usual with submissions by the banks due 5 April, with results announced in June.