Single-parent families are experiencing a near-unprecedented level of housing stress as soaring house prices force many into unaffordable rental properties.

Analysis conducted by the Melbourne Institute as part of its annual HILDA survey revealed over 20 percent of single-parent families are stretching their budgets further than ever to keep up with annual rent rises or changes in their mortgage.

Amongst all Australians, household stress peaked at an all-time high in 2012, when 11.2 percent of all Australians were classified as having to make “unduly burdensome” mortgage repayments.

In economic terms, housing stress is technically defined as spending more than 30 percent of a household’s disposable income on housing costs, not including council rates.

In 2016, where the HILDA survey data ends, 9.6 percent of the population were experiencing housing stress.

Although single-parent families were found to be under the most dire levels of housing stress, the survey found that single elderly Australians and renters are also suffering under the weight of paying rent or covering their mortgage.

Couples without children were found to have the lowest levels of housing stress.

“Among those with housing costs, private renters have the highest rate of housing stress and owners with mortgages have the lowest rate,” wrote HILDA survey researchers.

“Moreover, over the HILDA Survey period, housing stress has increased considerably among renters—particularly renters of social housing—whereas it has decreased slightly for home owners with a mortgage.”

The survey also found that the type of home you owned or rented was directly correlated to the likelihood of having difficulty in making rent or mortgage repayments.

Australians living in apartments were found to have the highest rates of housing stress, followed by those living in semi-detached houses.

People living in separate, free-standing homes were found to have the lowest rates of housing stress – most likely because they live away from heavily-populated urban centres.

“Housing stress is generally more prevalent in the mainland capital cities, with Sydney in particular standing out,” wrote the researchers.

“However, differences across regions are perhaps not as large as one might expect given the differences in housing costs across the regions.

“Also notable is that housing stress is very high in other urban Queensland. It is only in the last sub-period (2013 to 2016) that it is not the region with the highest rate of housing stress, and even in that period only Sydney has a higher rate.”

The HILDA survey follows the lives of more than 17,000 Australians over the course of their lifetimes and published information on an annual basis on many aspects of their lives including relationships, income, employment, health and education.

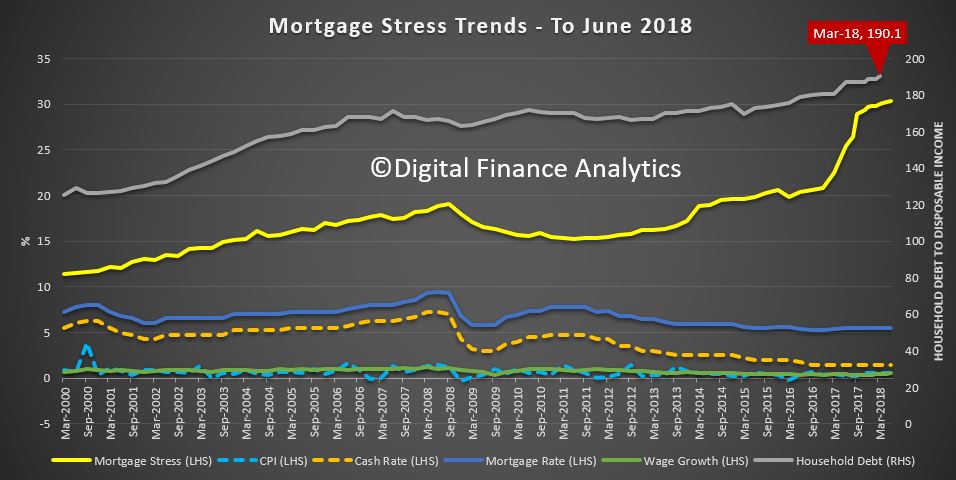

The latest findings back up analysis from Digital Finance Analytics (DFA), which estimates that more than 970,000 Australian households are now believed to be suffering housing stress.

That equates to 30.3 percent of home owners currently paying off a mortgage.

Of the 970,000 households, DFA estimates more than 57,100 families risk 30-day default on their loans in the next 12 months.

“We continue to see households having to cope with rising living costs – notably child care, school fees and fuel – whilst real incomes continue to fall and underemployment remains high,” wrote DFA principal Martin North.

“Households have larger mortgages, thanks to the strong rise in home prices, especially in the main eastern state centres, and now prices are slipping.

“While mortgage interest rates remain quite low for owner occupied borrowers, those with interest only loans or investment loans have seen significant rises.”