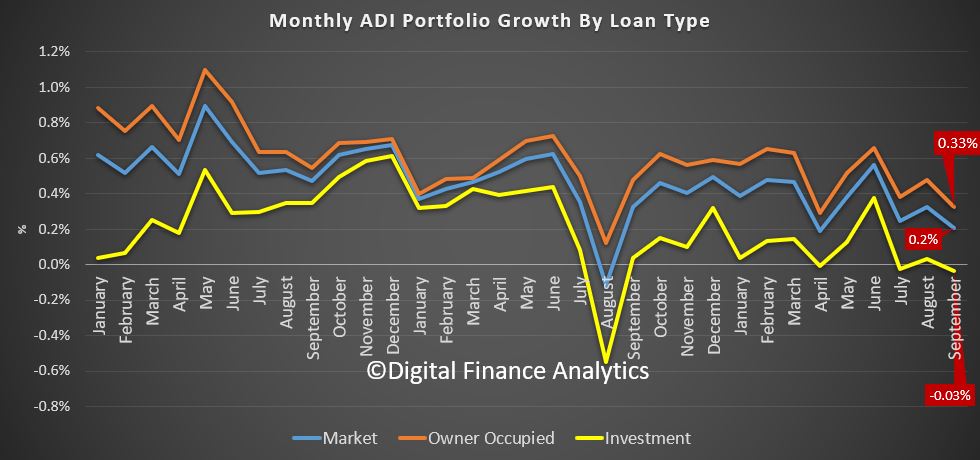

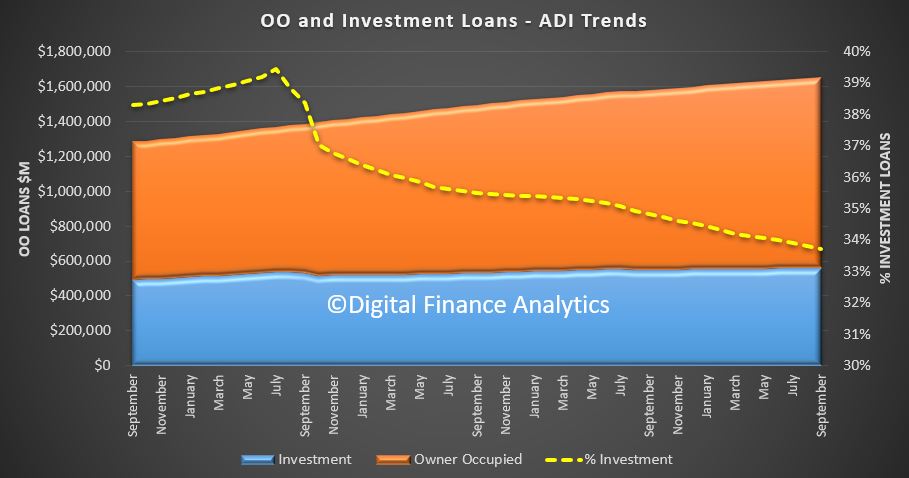

APRA released their monthly banking statistics for September 2018. This includes the total balances by ADI broken by investor and owner occupied lending. Total lending grew by 0.21% in the month to a total of $1.65 trillion, or 2.5% annualised. Within that lending for owner occupation rose by 0.36% to $1.09 trillion and investor loans fell 0.03% to $557.4 billion.

Investment loans now comprise 33.72% or the portfolio.

Investment loans now comprise 33.72% or the portfolio.

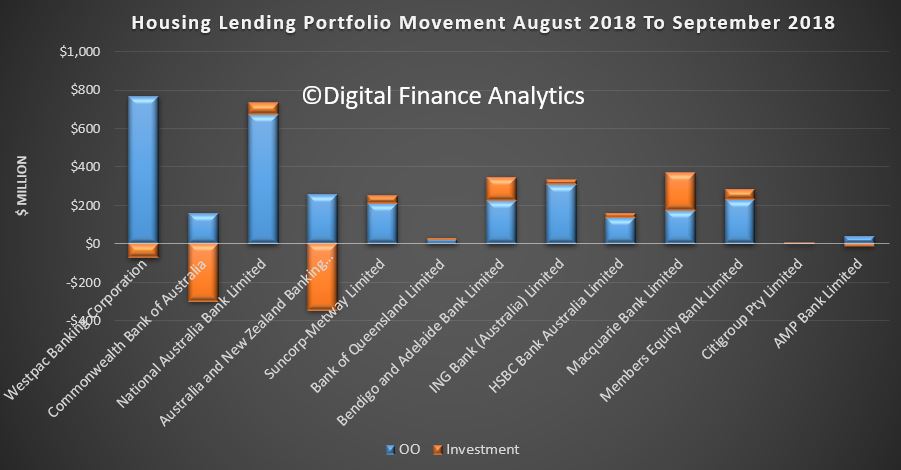

Looking at the individual major players, we see that only NAB grew their investment loan portfolio in the month, among the big four. Macquarie and Bendigo are lifting investor loans the most by value. ANZ dropped their balances the most.

Looking at the individual major players, we see that only NAB grew their investment loan portfolio in the month, among the big four. Macquarie and Bendigo are lifting investor loans the most by value. ANZ dropped their balances the most.

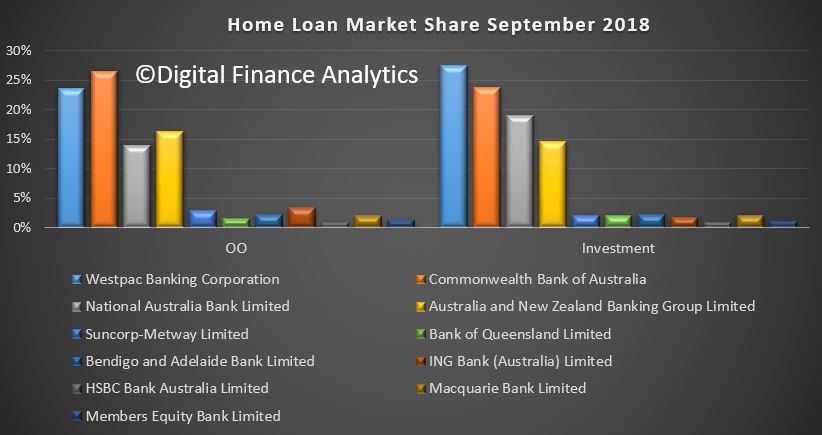

This had little impact on overall market shares.

And the investor loan portfolio at the market level grew 1.35%.

![]() We will look at the RBA aggregates in a separate post, but investor lending momentum continues to drift lower. Its surprising the owner occupied lending remains so strong, but that may change ahead.

We will look at the RBA aggregates in a separate post, but investor lending momentum continues to drift lower. Its surprising the owner occupied lending remains so strong, but that may change ahead.