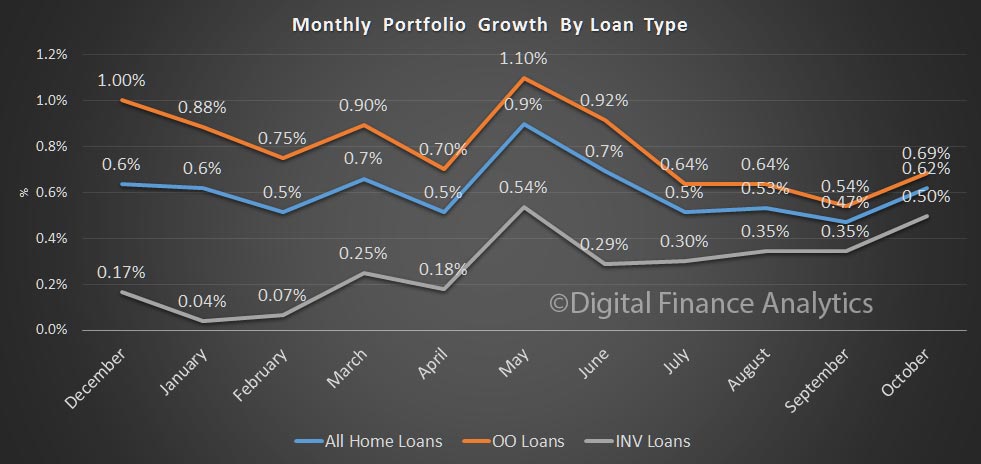

The latest monthly banking statisticsdata from APRA for October 2016 shows the total home lending portfolios held by the ADI’s grew from $1.49 trillion to 1.51 trillion, up 0.62%. Within that, owner occupied loans rose by 0.69% to $970 billion (up $6.6bn) and investment loans rose 0.5% (up $2.6 billion). 35.46% of the portfolio is for investment lending purposes. Momentum is increasing (and matches the high rate of auction clearances we have seen recently).

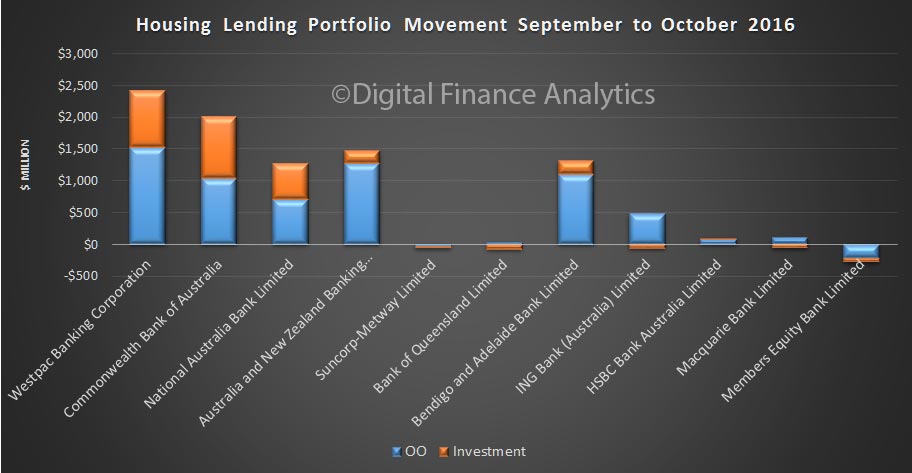

Looking at the individual banks, in value terms, CBA lifted their investment portfolio by $975m, compared with WBC $892m. Bendigo Bank shows an uplift of $1.1bn, thanks to their portfolio acquisition of $1.3bn of loans from WA. Suncorp, Members Equity and Citigroup saw their portfolios fall in value. Macquarie saw a small fall in their investment lending portfolio.

Looking at the individual banks, in value terms, CBA lifted their investment portfolio by $975m, compared with WBC $892m. Bendigo Bank shows an uplift of $1.1bn, thanks to their portfolio acquisition of $1.3bn of loans from WA. Suncorp, Members Equity and Citigroup saw their portfolios fall in value. Macquarie saw a small fall in their investment lending portfolio.

Collectively, the big four grew their investment portfolio by $2.6 billion, and their owner occupied portfolio by $4.5 billion.

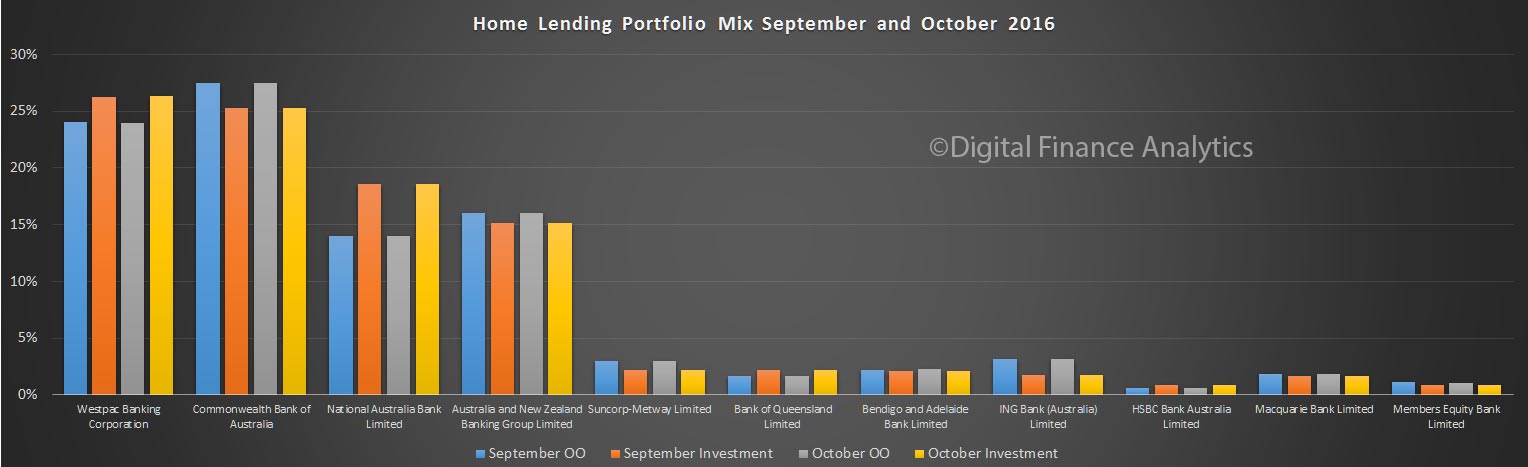

Westpac and CBA remain the largest home lenders.

Westpac and CBA remain the largest home lenders.

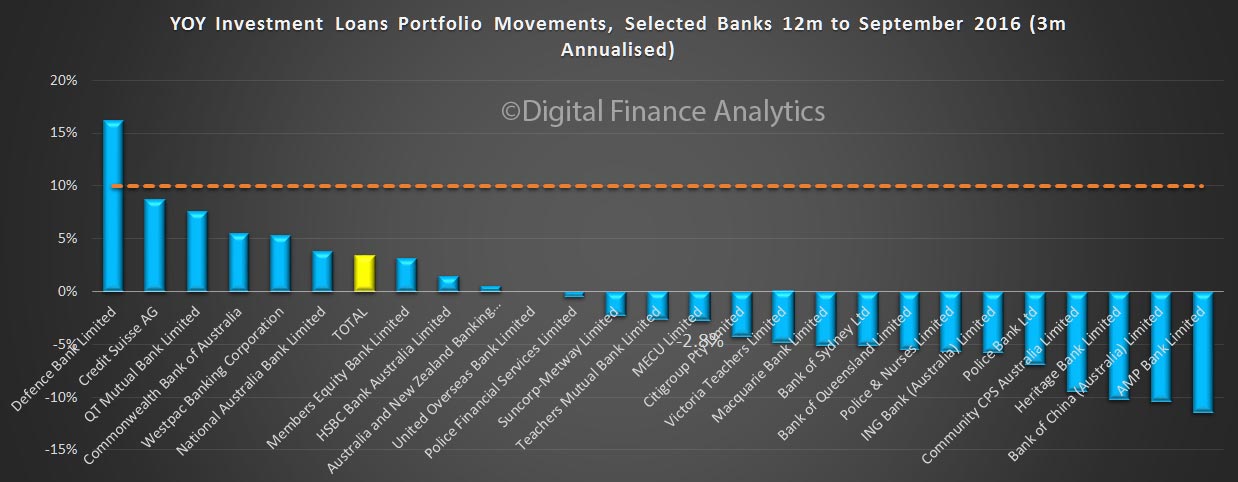

Looking at the APRA 10% speed limit, based on an average annualised 3m growth rate, the market shows a 3.4% growth in investment lending, with CBA, WBC and NAB all growing faster than system, but below the 10% speed limit.

Looking at the APRA 10% speed limit, based on an average annualised 3m growth rate, the market shows a 3.4% growth in investment lending, with CBA, WBC and NAB all growing faster than system, but below the 10% speed limit.

This data would indicate that i) further rate cuts from the RBA are off the agenda and ii) they should consider further tightening, using either macroprudential controls, or a rate rise.

This data would indicate that i) further rate cuts from the RBA are off the agenda and ii) they should consider further tightening, using either macroprudential controls, or a rate rise.

We will get the RBA aggregates later today, and we will be able to assess the growth in the non-bank sector, as well as look at the changed classification which took place in the month between investment and owner occupied loans.

Remember that default rates on mortgages are already rising, especially in the mining heavy states, although overall provisions are low at the moment. The banks remain highly leveraged to the housing sector.