The latest housing finance data from the ABS underscores the renewed momentum in home mortgage lending, especially in the investment sector, and there was also a rise in first time buyers accessing the market.

- The trend estimate for the total value of dwelling finance commitments excluding alterations and additions rose 0.6%. Investment housing commitments rose 1.7%, while owner occupied housing commitments was flat. In seasonally adjusted terms, the total value of dwelling finance commitments excluding alterations and additions rose 2.2%.

- In trend terms, the number of commitments for owner occupied housing finance fell 0.1% in November 2016 whilst the number of commitments for the purchase of new dwellings rose 0.7%, the number of commitments for the construction of dwellings rose 0.2%, and the number of commitments for the purchase of established dwellings fell 0.2%.

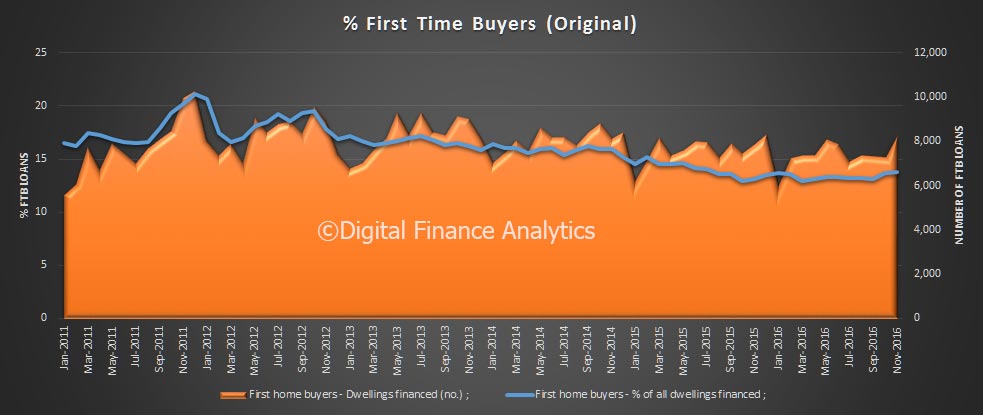

- In original terms, the number of first home buyer commitments rose by 13.4% to 8,281 in November from 7,302 in October; the number of non-first home buyer commitments also rose. The number of first home buyers as a percentage of total owner occupier commitments rose from 13.7% to 13.8%.

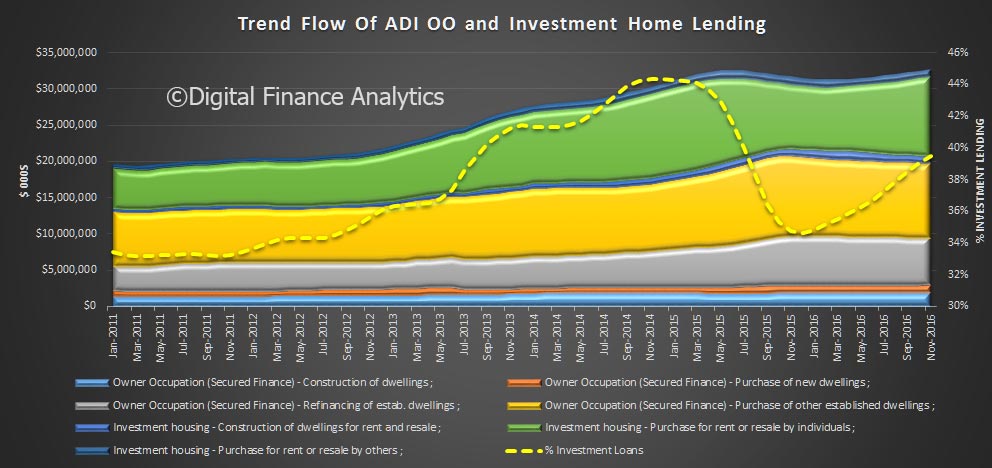

Total commitments in trend terms was $32.7 billion, of which $19.8 billion was owner occupied loans, and $12.9 billion for investment purposes. 39.5% of new lending was for investment purposes, and we see the proportion of investment loans continuing to rise, it is already too high.

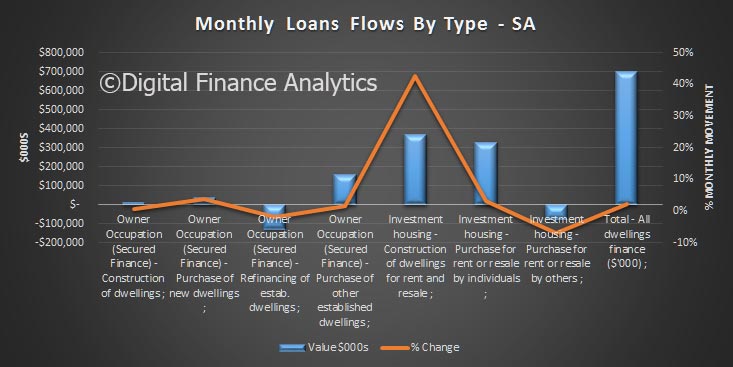

Looking at the month on month movements, the seasonally adjusted changes highlight the rise in the investment funding for new construction, with a 40% rise on last month. Owner occupied refinancing fell.

Looking at the month on month movements, the seasonally adjusted changes highlight the rise in the investment funding for new construction, with a 40% rise on last month. Owner occupied refinancing fell.

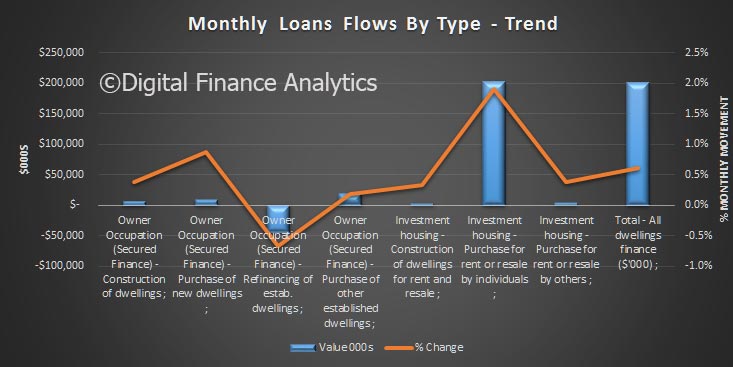

The more reliable trend analysis shows the monthly movements, with a strong surge in investment loans by individuals, and a stronger fall in owner occupied refinancing.

The more reliable trend analysis shows the monthly movements, with a strong surge in investment loans by individuals, and a stronger fall in owner occupied refinancing.

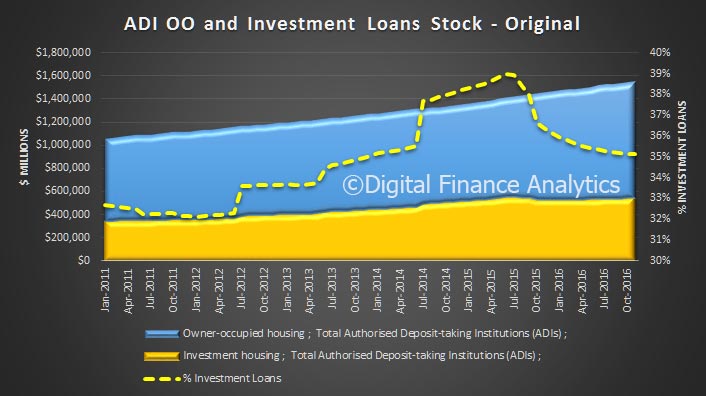

Looking at total loan stock (in original terms) around 35% of all loans outstanding are for investment purposes, and the slide we saw late 2015 appears to be easing.

Looking at total loan stock (in original terms) around 35% of all loans outstanding are for investment purposes, and the slide we saw late 2015 appears to be easing.

Turning to the first time buyer, original data, the number of first time owner occupied buyers rose compared with last month, and the overall mix also increased.

Turning to the first time buyer, original data, the number of first time owner occupied buyers rose compared with last month, and the overall mix also increased.

Combining the first time buyer property investor data from our surveys, we see a spike in overall first time buyer activity.

Combining the first time buyer property investor data from our surveys, we see a spike in overall first time buyer activity.

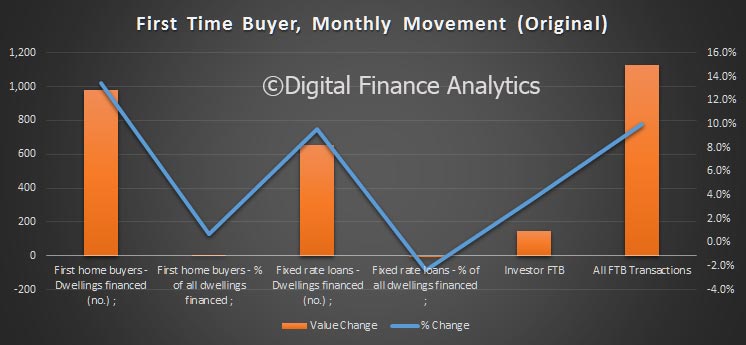

![]() Last month, around 1,100 more first time buyers entered the owner occupied market than the prior month (12%), and around 150 more in the investment sector. We also saw a rise in the fixed rate loans, as borrowers try to lock in lower rates ahead of expected rises.

Last month, around 1,100 more first time buyers entered the owner occupied market than the prior month (12%), and around 150 more in the investment sector. We also saw a rise in the fixed rate loans, as borrowers try to lock in lower rates ahead of expected rises.

So overall, still strong momentum in the housing sector, and powered largely by an overheated investment sector.

So overall, still strong momentum in the housing sector, and powered largely by an overheated investment sector.