New data released today by the Australian Financial Complaints Authority (AFCA) has shown that complaints about home loans have increased by 20 per cent in the last six months of 2019.

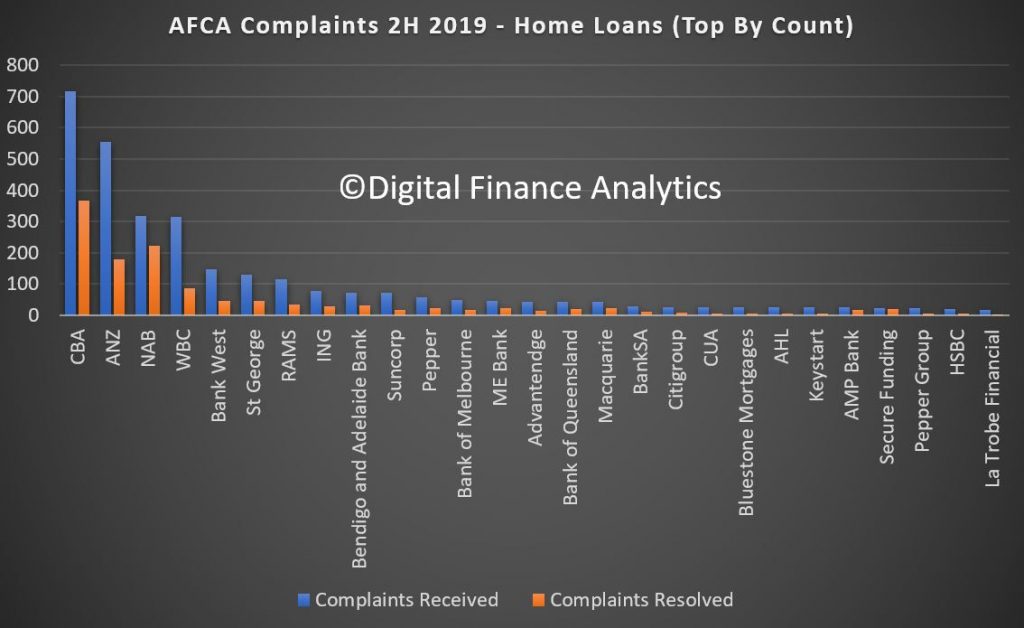

The data shows that CBA and Westpac have the largest proportion of complaints, with the CBA Group at 890 and Westpac Group 639 of the complaints made.

This increase has been driven by financial firms failing to respond to requests for assistance, the conversion of loans from interest only to principal and interest and issues with responsible lending.

Credit card complaints were 2,750 in the same period.

The data, which has been made freely available to the public through AFCA’s Datacube shows that between July and December last year, the financial services ombudsman received 2,201 complaints about home loans, that’s 367 per month, on average.

AFCA Chief Operating Officer Justin Untersteiner said that it was disappointing to see the increase but making the data available to the public was an important step in increasing transparency.

“Every six months, AFCA releases data which allows Australians to see how many complaints their insurer, bank, financial adviser, superannuation fund or other financial firm has received and how they have responded to those complaints,” Mr Untersteiner said.

“Rebuilding trust in the Australian financial services will be a long journey and one that requires effort across the entire sector.

“Transparency is key in this transformation and we have made significant changes in the way we report our data and decisions to make them more accessible to the public.

“The data also shows that we are getting very few complaints about financial advice, just 30 per month, and complaints against debt buyers or collectors rose by just five per cent. “Our hope by releasing this data is that we see improvements and the industry takes action to reduce the number of complaints that end up at AFCA.”