In the final part of our October 2019 Household Survey we look at the results through the lens of our segmentation models. What is clear is there is a disconnect between future home price expectations (much more positive) and proposed activity (lower demand for credit, and intentions to transact). This is at the heart of the weirdness in the market at the moment, and it helps to explain the low levels of listings and transactions (and hence the high auction clearance rates on those low volumes). There is nothing in the latest results however which flags significant momentum increases ahead.

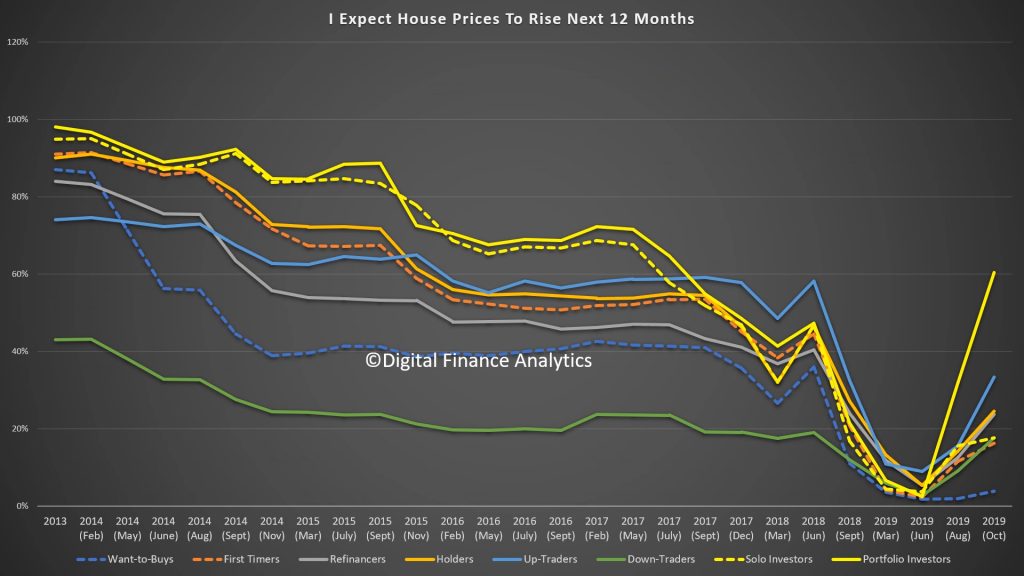

We start with the cross-segment trends. First there is a significant hike in those expecting home prices to be higher in the next 12 months. It reached a low around the election, and has been rising since the cash rate cuts. Portfolio Investors (those with multiple investor properties are the most bullish). But the expectations are there across the board.

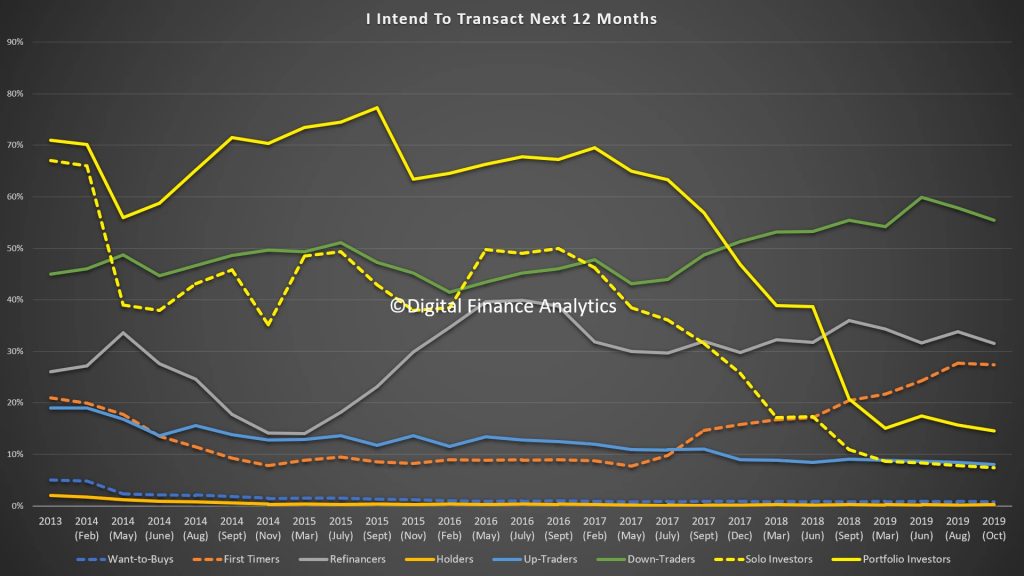

However, this does not necessarily translate into intention to transact. First Time Buyers and Down Traders (around 900k) are most likely to be in the market, the former aided by the extra incentives available and the latter by the need to pull equity from existing properties. Property investors remain largely on the sidelines. There is also a slight downward inflection in the past quarter.

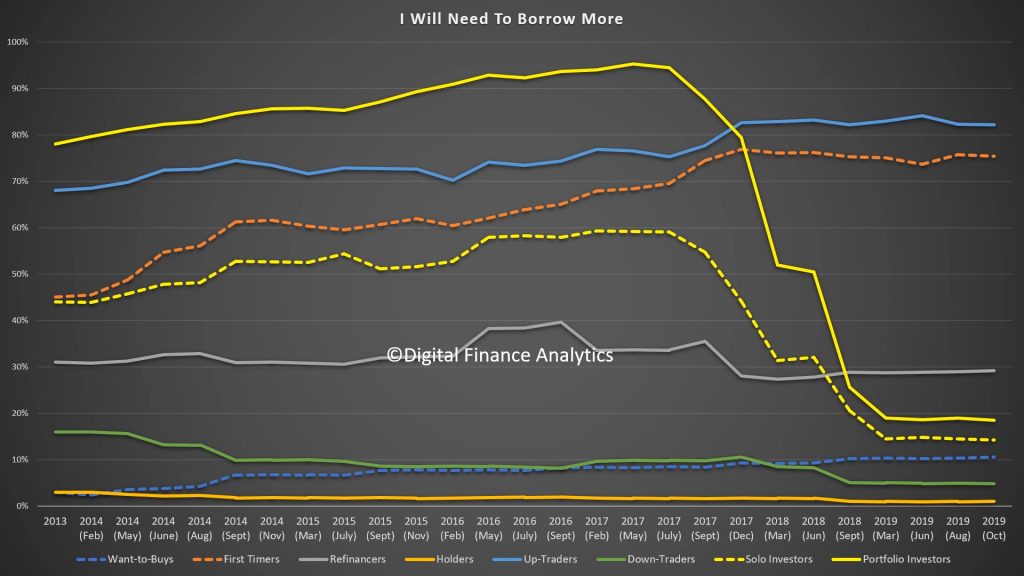

Another lens is demand for credit which shows stubborn resistance other than from First Time Buyers ~around 150k actively looking) and Up Traders (around 550k actively looking). Refinancing is tracking at levels we have seen for some time. This suggests that banks will have to compete hard for meager pickings, and refinancing and first time buyers will be the targets for special deals.

Those Wanting to Buy say that availability of finance (40%) and costs of living (30%) are the main barriers, although high home prices at 16% still registers. Interest rates and fear of unemployment are low relatively speaking.

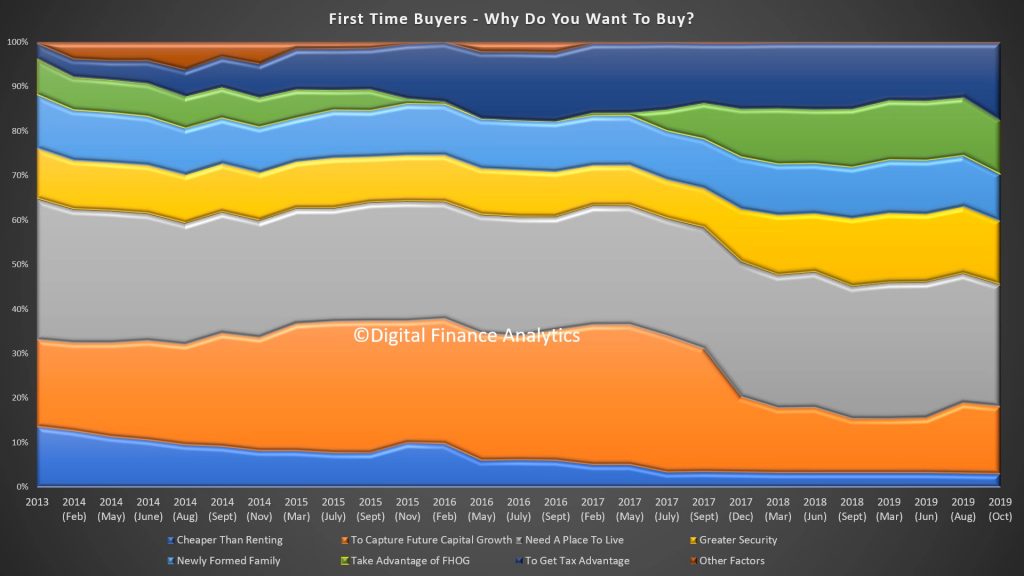

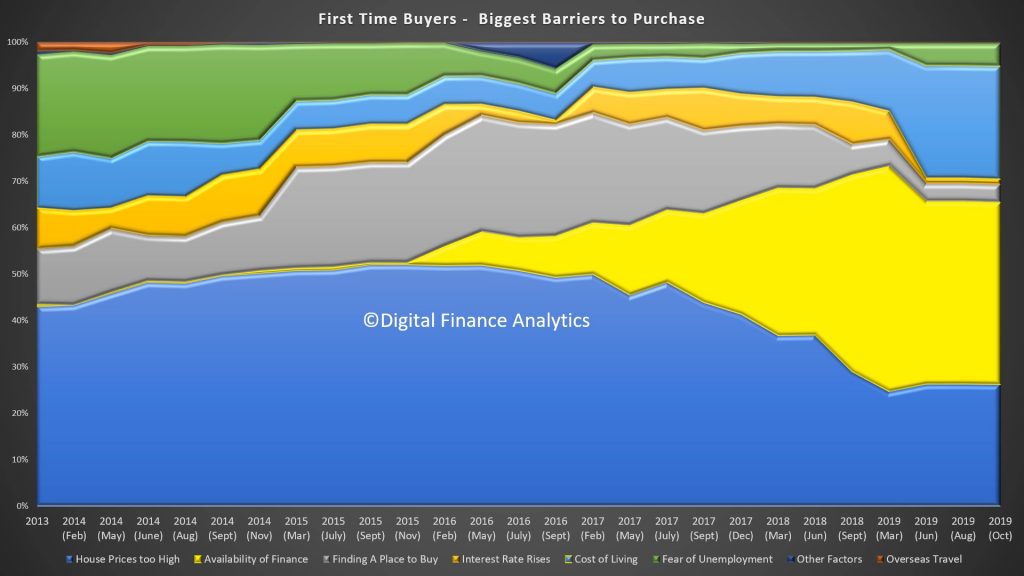

First time buyers are being driven by a range of factors including the need for shelter and a place to live (28%), greater security (14%), tax advantage (17%) and to take advantage of the FHOG (12%). But that said there are significant barriers as well.

Barriers include home prices too high (26%), availability of finance (39%) and costs of living (24%). On the other hand finding a place to buy and rising interest rates hardly registered.

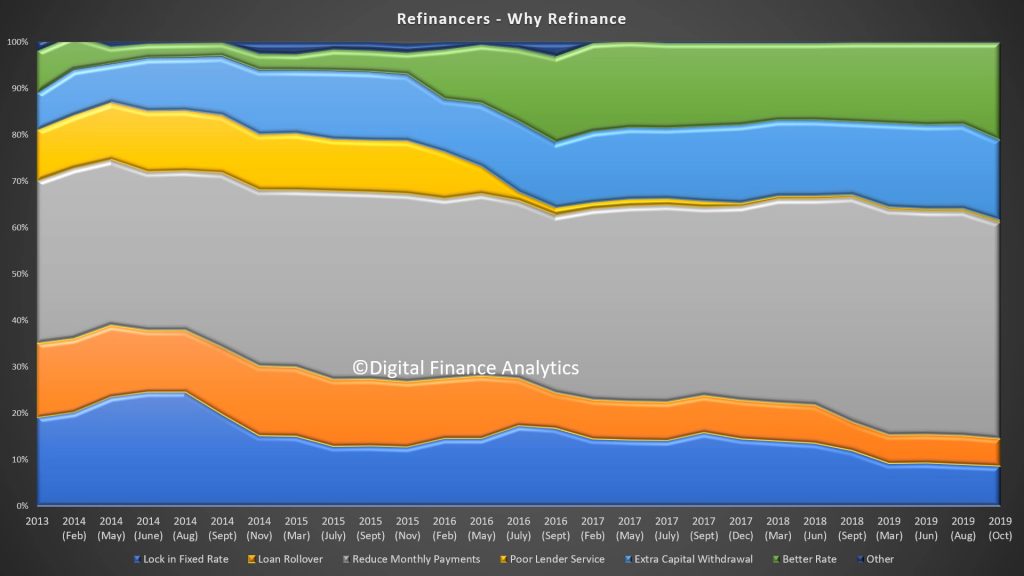

Household seeking to refinance are being driven by reducing monthly repayments (50%), for a better rate (22%) and extra capital withdrawal 20%.

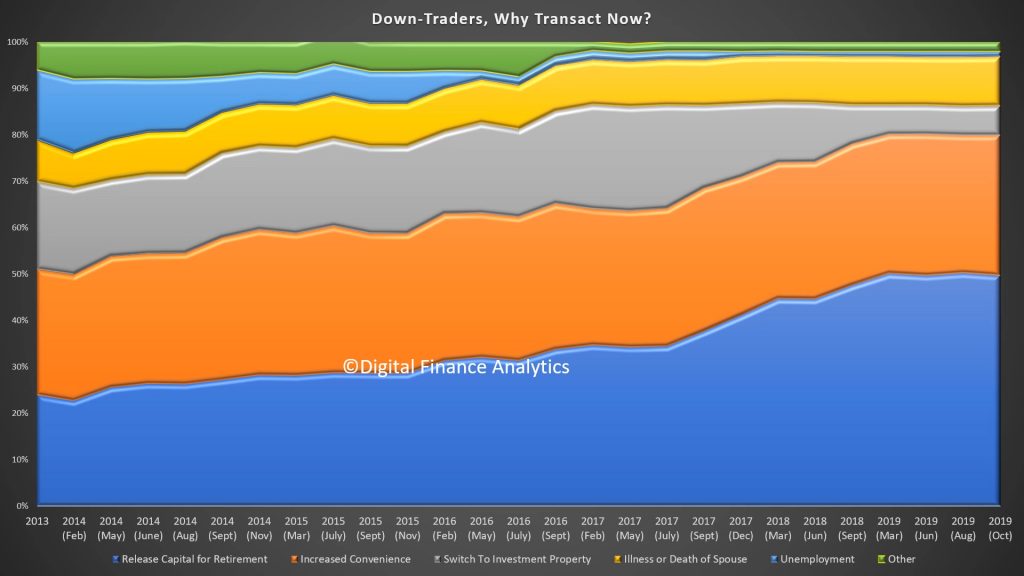

Down Traders are driven by the desire to release capital for retirement (50%), increased convenience (30%) and illness or death of spouse (11%). Interest in investment property has faded to 6%.

Up Traders are being driven by the desire for more space (41%), job change (16%), property investment (22%) and life-style changes 20%).

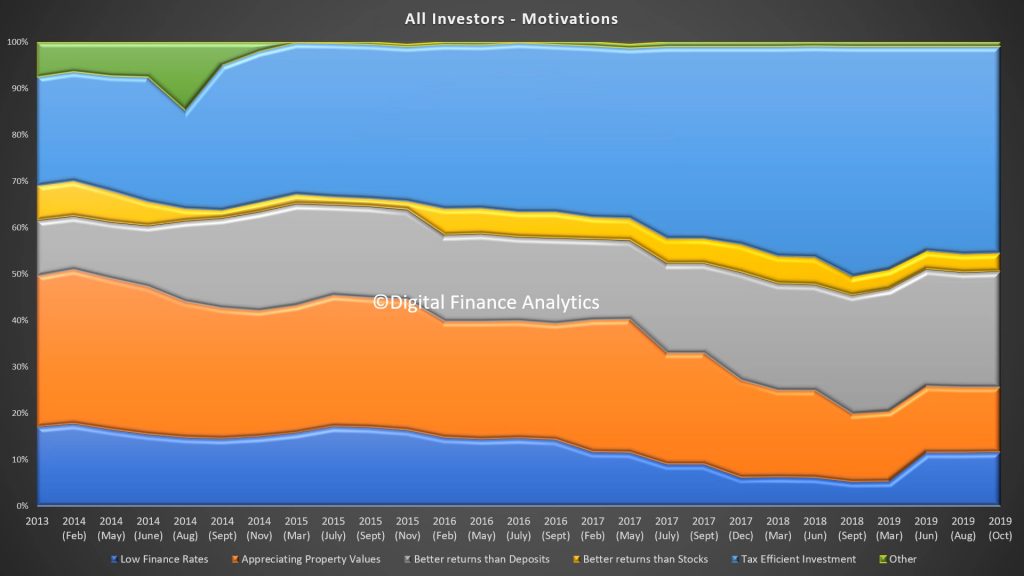

Turning to investors 45% are driven by tax benefits, better returns than deposits (25%) and appreciating property values (14%).

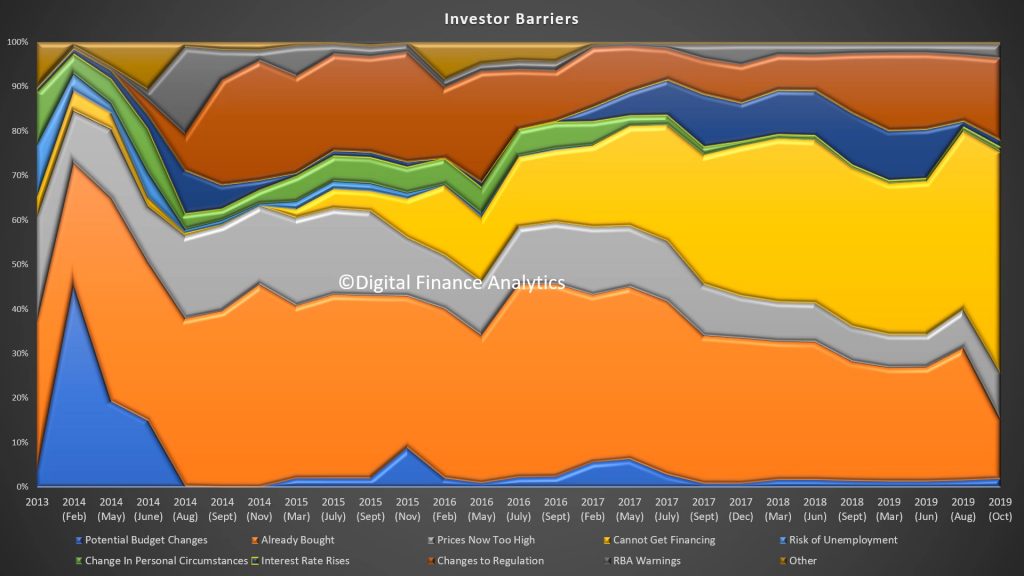

On the other hand, investors face a number of barriers including cannot getting finance (49%), and they have already bought (13%).

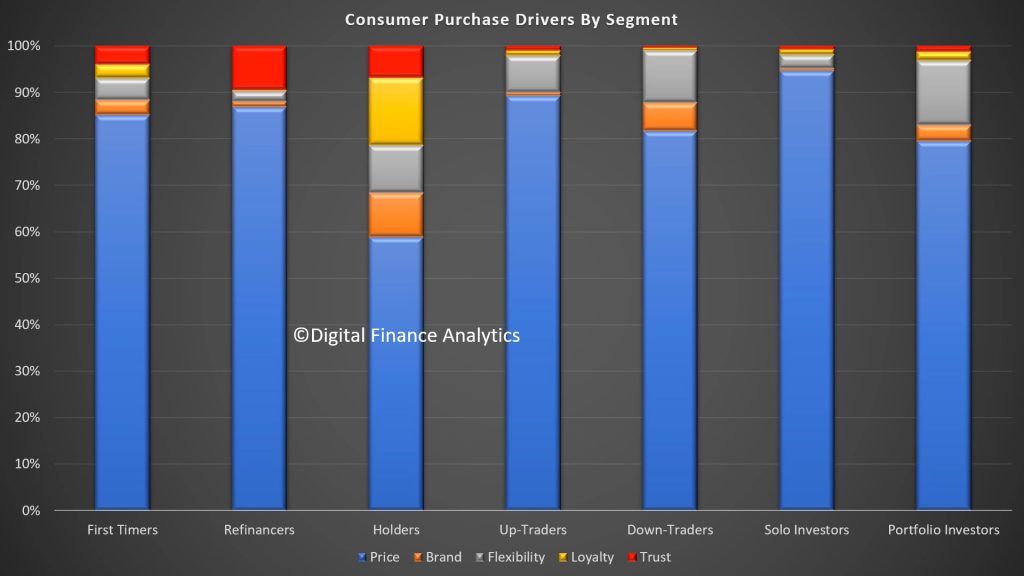

And finally across the segments the prime selection point is price, although it varies, and loyalty is not seen as significant or rewarded.

Standing back, it appears that property sector momentum is likely to remain patchy at best, with more action at the more expensive end of the value spectrum, and first time buyers remaining as the primary “canon fodder” with regards to new transactions. It will be interesting to see how the Government scheme due in January changes the picture.