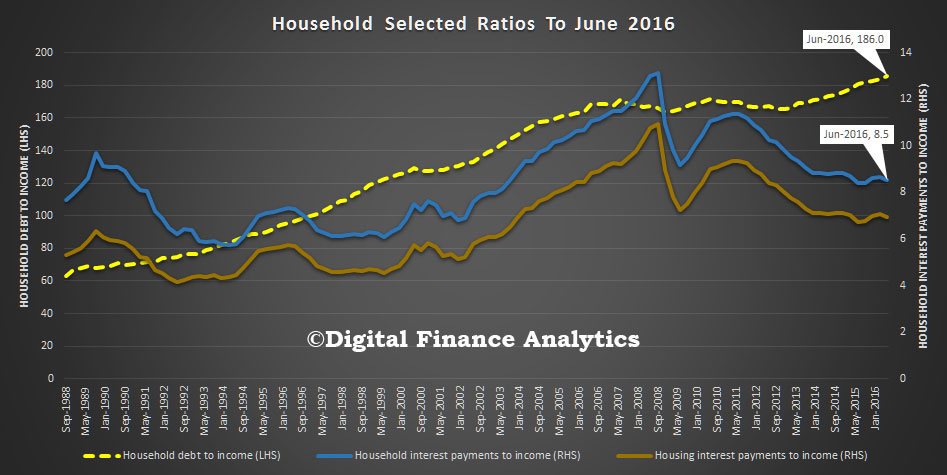

The latest statistical release from the RBA includes data of some key household ratios. Of particular interest is the ratio between income and debt, and income to repayments.

The ratio of household debt to income has risen again now standing at 186, as high as it has ever been. The ratio of income to debt is on average 8.5, and has been tracking lower as interest rates fall.

The ratio of household debt to income has risen again now standing at 186, as high as it has ever been. The ratio of income to debt is on average 8.5, and has been tracking lower as interest rates fall.

Or to put it another way, as interest rates fall, households are borrowing more. As we saw yesterday, “other personal credit” fell in August, whilst mortgage debt rose again.

This debt to income ratio puts Australia at the top of league and highlights the potential risks which exist due to excessive leverage should rates rise, employment fall, or from some external shock (e.g. a European bank failing!).

The regulators need to start tightening credit availability, so total household debt begins to align better to income growth. Current credit growth rates, be they lower than last year, are still too high.