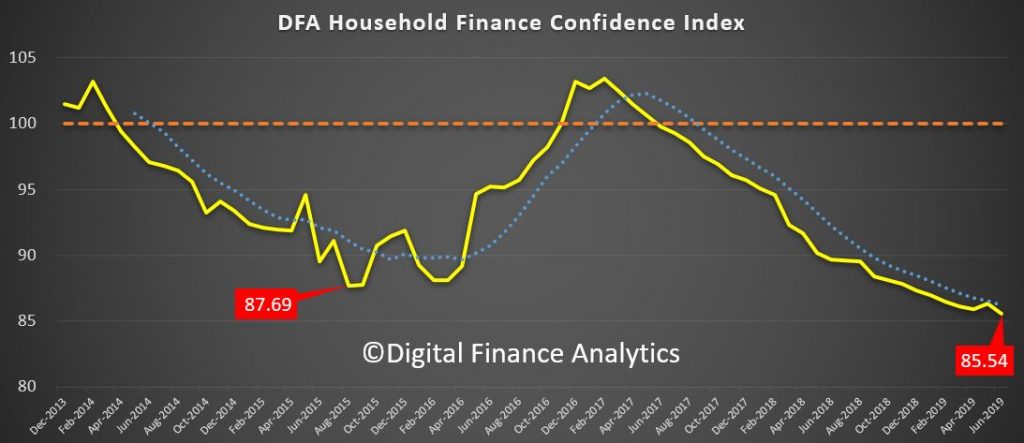

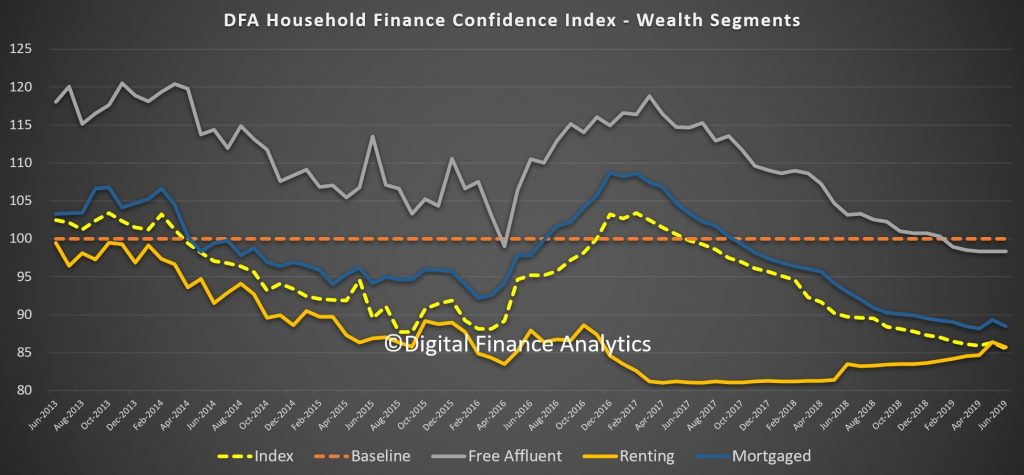

After the slight twitch of positive sentiment following the election in May, the DFA Household Finance Confidence Index fell again, to a new low of 85.54.

Whilst the RBA rate cut may offer some borrowers the prospect of improved cash flow (when the changes propagate through to the regular repayment), just as many households bemoan the continued cuts in savings rates. So, net, net there is no improvement in financial outcomes, and in fact more are concerned that lower RBA rates signals more trouble ahead.

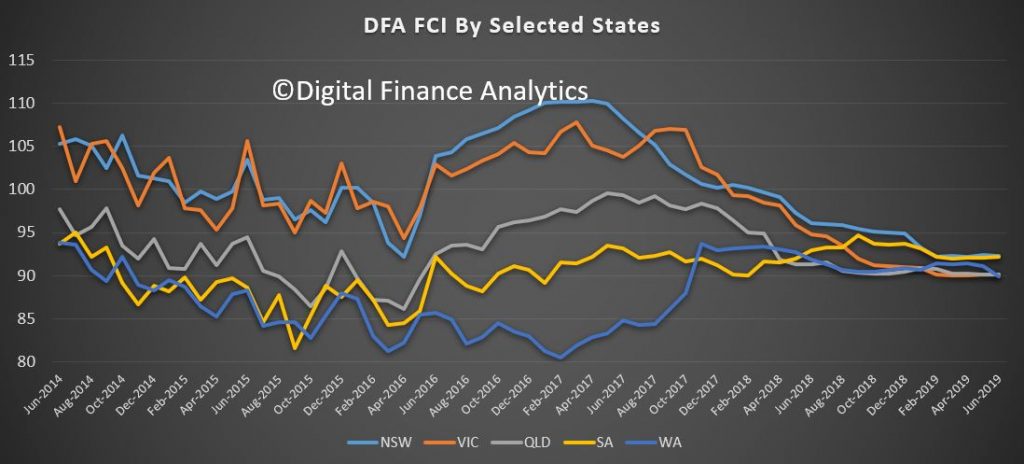

Across the states, WA showed a significant slide in confidence thanks in part to rising mortgage default and delinquencies, and very high underemployment. Most other states are bunched together, whereas a year or two back, VIC and NSW were streets ahead.

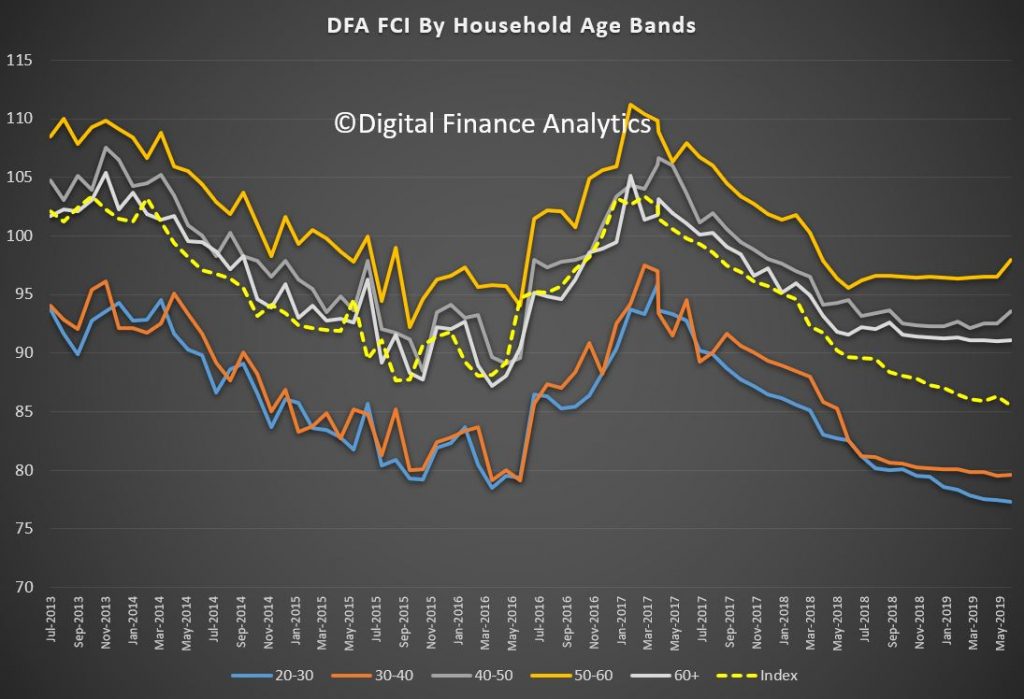

By age, younger households with mortgage debt registered a small improvement, while older households with savings went the other way on lower bank term deposit rates. Many of these will simply hunker down, and spend less, and will not largely benefit from the upcoming tax cuts. Older households resist the temptation to move to higher risk alternative savings vehicles, they too just spend less.

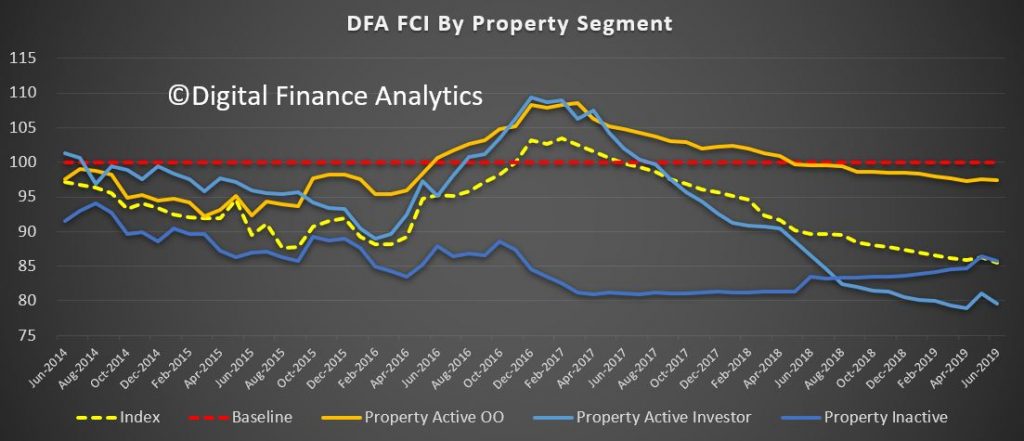

The property segmentation reveals that property inactive and investor households both reported lower levels of confidence, while owner occupied home owners were slightly more positive on the rate cuts news.

All three of our wealth segments remain below neutral on the index, indicating a significant deterioration over the past couple of years. Even those with property and no mortgage remain below the neutral 100 setting.

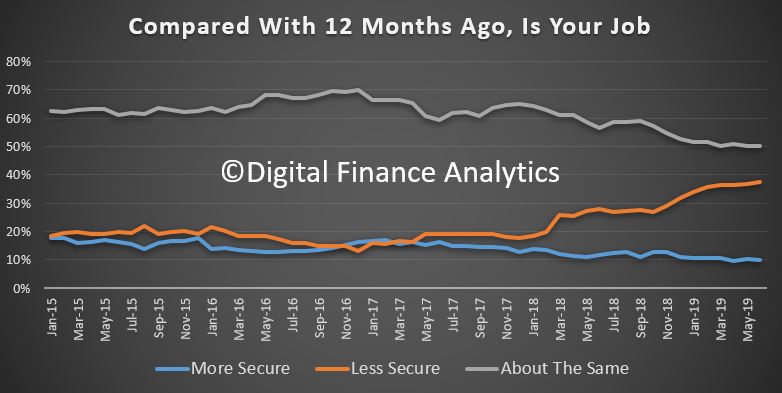

Within the moving parts of the index, job insecurity increased, with 37.4% reported as less secure than a year back, up 0.64% on the previous month. Around half of households saw no change, though underemployment continues to push higher.

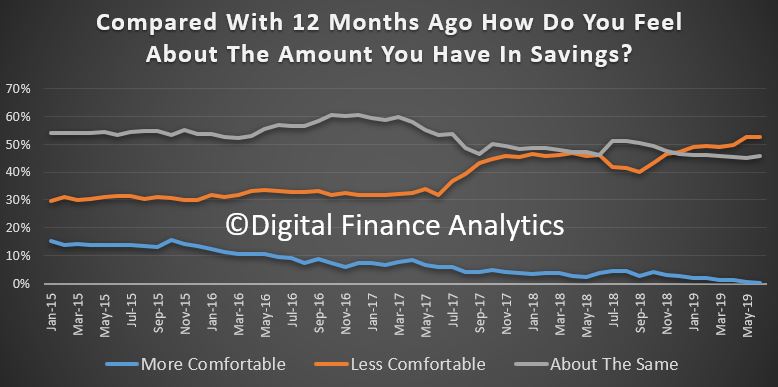

Savings continue to take a battering with more households dipping into them to secure their budgets, and lower returns on bank deposits – especially term deposits. On the other hand, share portfolio holders are fairing a little better – though with higher risks of course. Over 52% are less comfortable than a year ago.

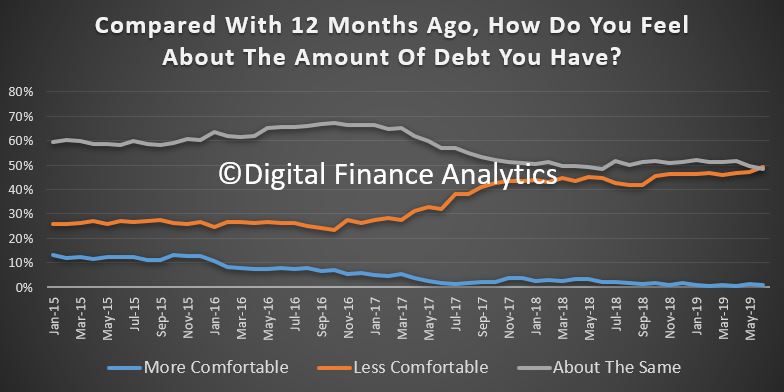

In terms of the debt burden nearly half are less comfortable, despite the rate cuts, while 48% are about the same as a year ago – down 1.46% on last month.

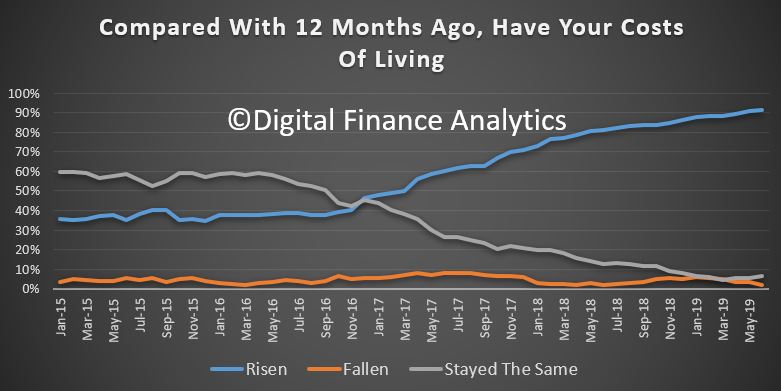

In terms of costs of living, the pain continues, with 91% saying their costs, in real terms are higher than a year ago. Only 1.33% said their costs of living had fallen. Households specifically mentioned higher council rates, fuel costs, electricity, school fees and child care costs.

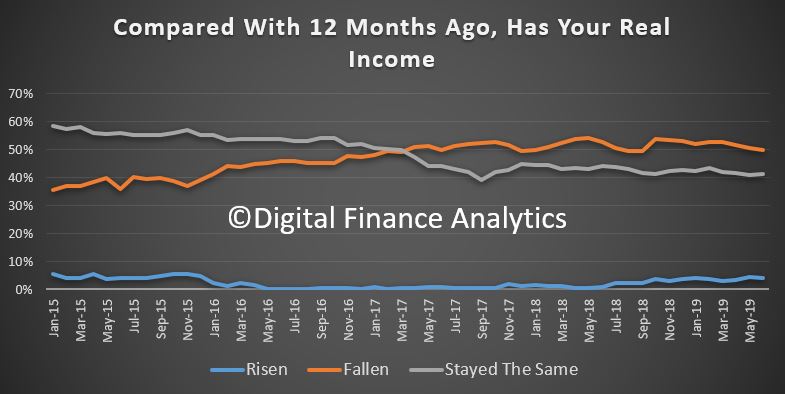

Income remains under pressure, with 4% saying their incomes had increased in real terms in the past year, compared with 50% saying their real incomes had fallen. 41% said their incomes were about the same.

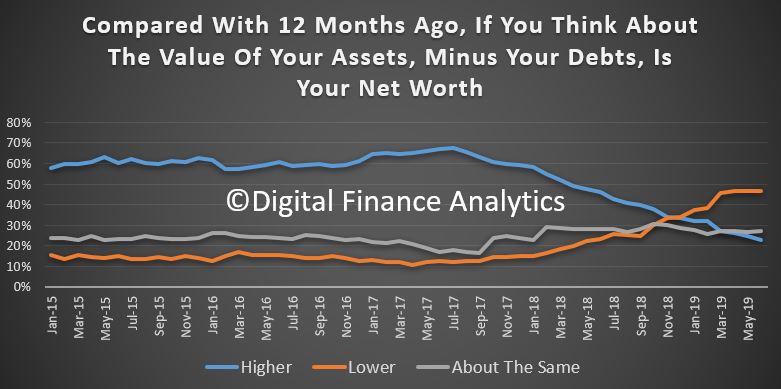

And overall net worth (assets less loans) rose for 23% of households – thanks to higher share prices mainly, while 47% reported a fall in net worth – thanks to property price falls, and reduced savings. 27% reported no change. As yet any recovery in home prices has not fed through into more positive results.

So, more evidence of the pressure on households, and so far the measures taken by the RBA and the Government have had no net positive impact on household confidence. As noted above, even those with property and no mortgage remain below the neutral 100 setting.

As a reminder this data comes from our rolling 52,000 household surveys, with 1,000 new added each week. This is data up to Monday 8th July.