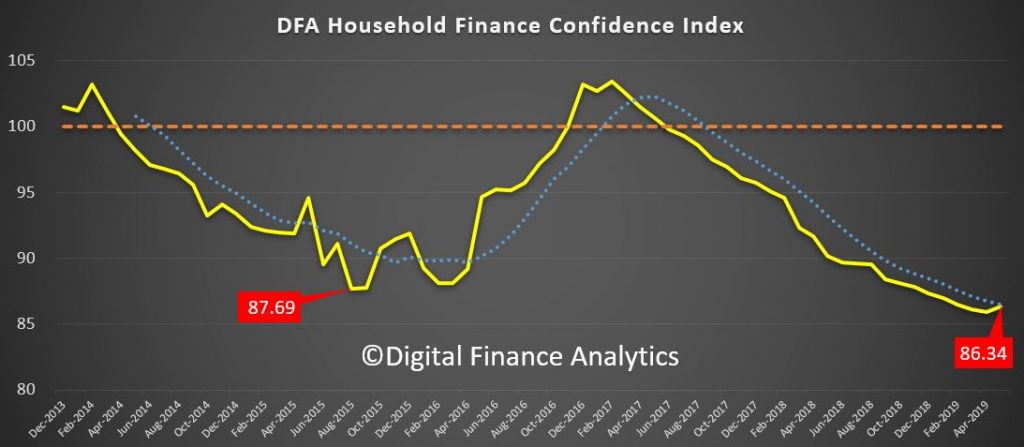

We have released our latest financial confidence index which is derived from our rolling 52,000 household surveys. The index moved a little higher since the election, reflecting some more positive vibes from property investors, at the margin, and from those holding property more generally.

It is all relative however, as the current read of 86.34 is up from April’s 85.9, but the overall measure is still in deeply negative territory.

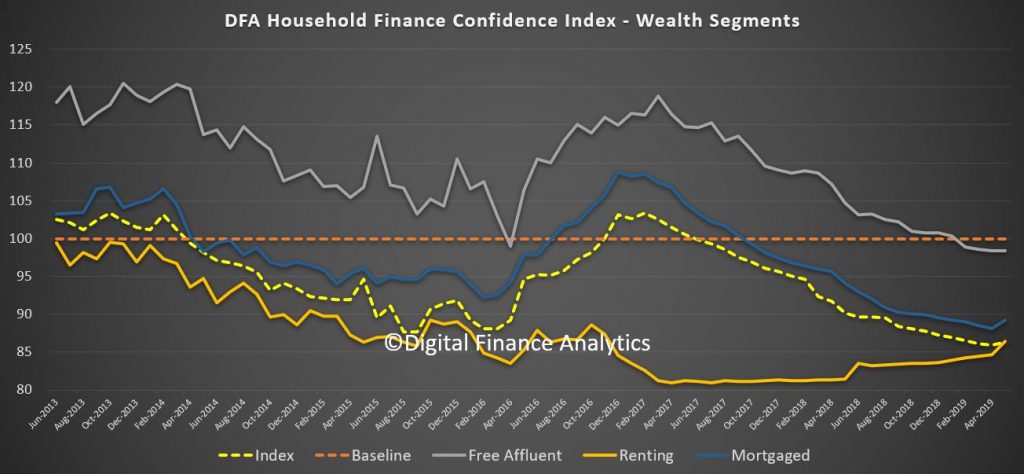

Looking at the segments by wealth, there was a bounce in those with mortgages, and also those renting or living with family or friends – but again still in negative territory. Those with property, and no mortgage hardly reacted at all.

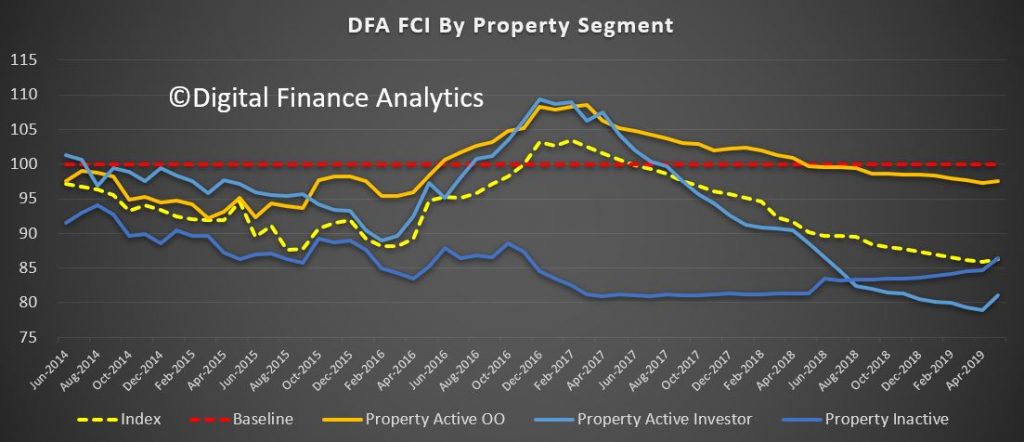

Analysis across our property segments shows a move up from property investors (now expecting no changes to capital gains and negative gearing), a slight improvement from owner occupied borrowers, and a kick up from those renting.

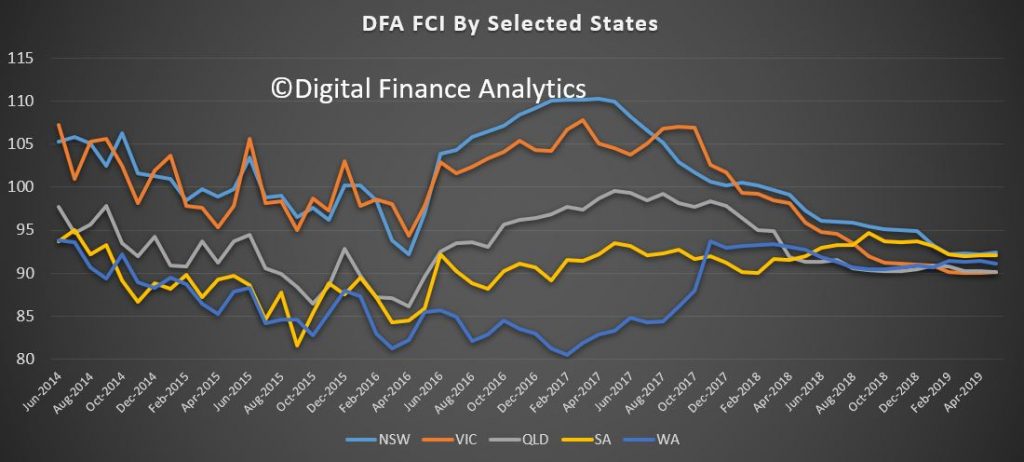

By states, the convergence of recent times continues, although NSW and VIC saw a slight improvement, while WA and QLD saw a deterioration (linked to higher default rates in these states).

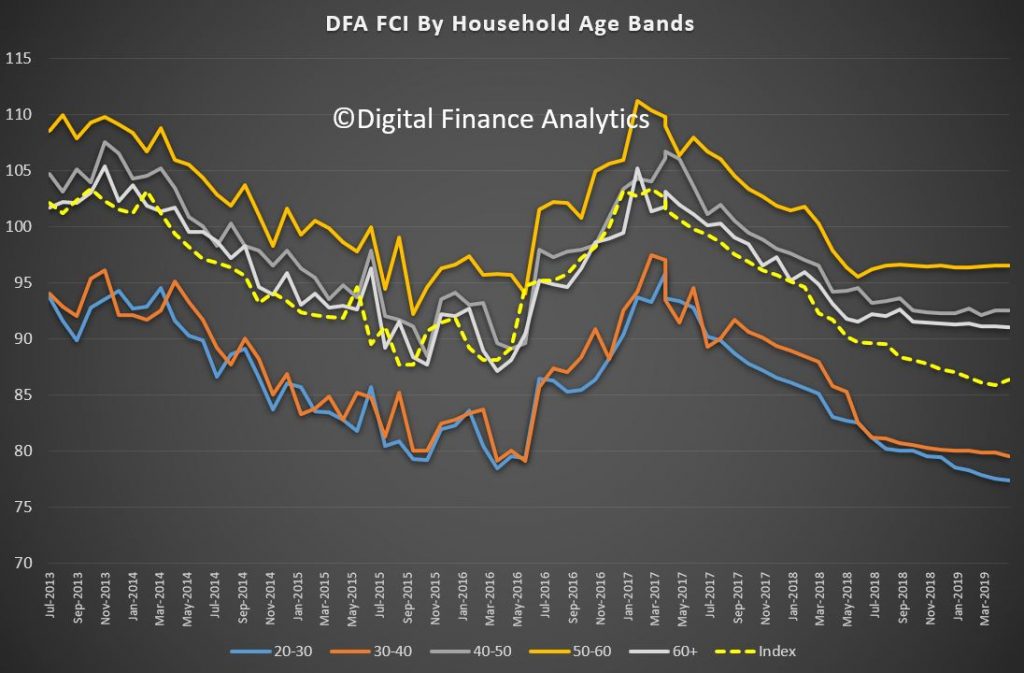

Younger household scores fell again, but there was a bounce in those aged 40-50 and 50-60, directly linked to the slight change in property investment sentiment.

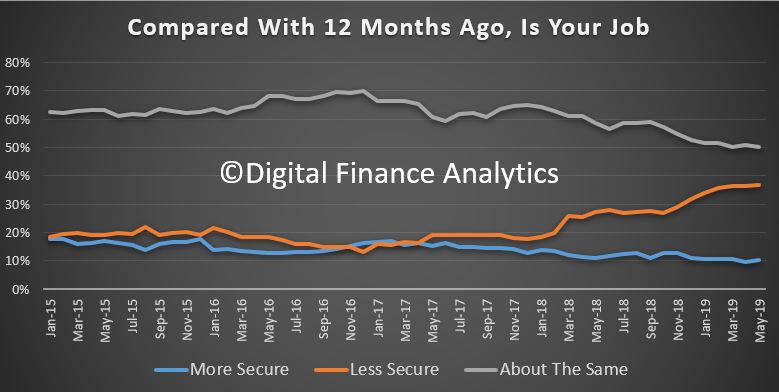

Within the moving parts, there was little movement in job security, with 36% still feeling less secure than a year ago. Public sector jobs look less secure now.

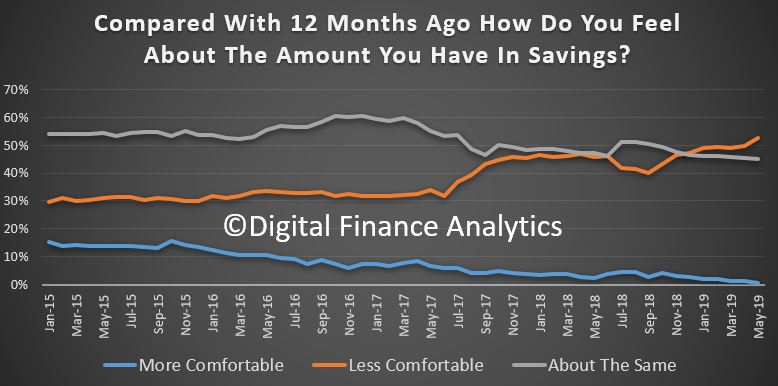

Savings remain under pressure, with lower rates on bank deposits, though higher returns from shares. The prospect of lower deposit rates took the “less comfortable” rating down 2.88% compared with the previous month.

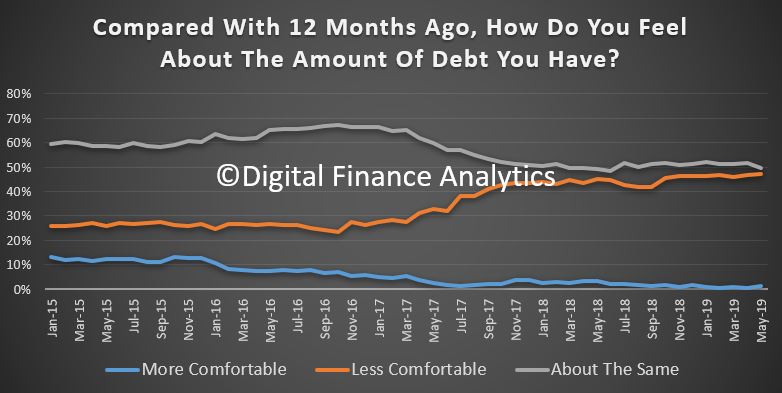

Debt remains a concern, with 47% worried by the amount of credit they hold, while 49% are feeling about the same as a year ago, down 2.16% on the month before.

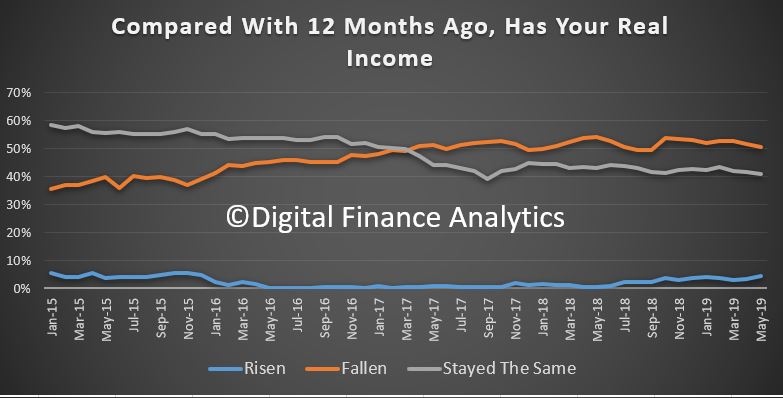

Income remains under pressure. Given the lack of real wages growth this should be of no surprise. 40% said they had seen no change in the past year, and 50.5% said, in real terms their income had fallen.

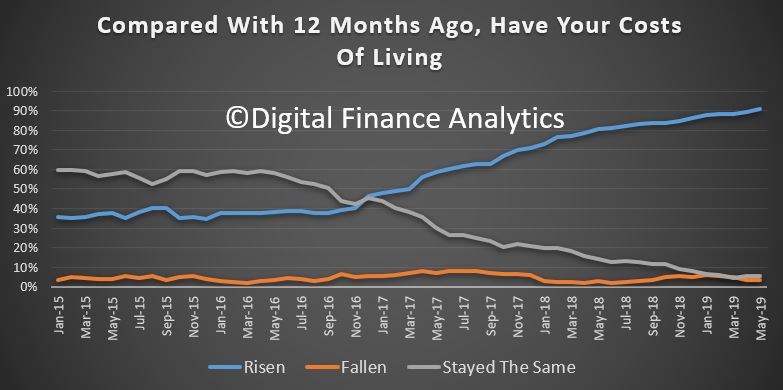

On the other hand, costs of living remain a challenge, with 91% saying costs have risen over the part year. Electricity, child care, health costs, rates, and food all registered, suggesting the CPI continues to understate the real experience of many households.

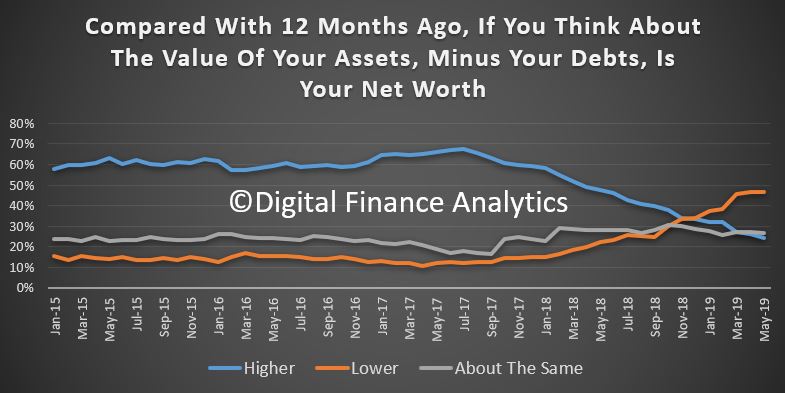

And finally, net wealth deteriorated for 46% of households compared with a year ago, thanks to falling property prices. 26% said there was no change and 24% higher ( down 1.63% on last month). Stock market performance helped to offset the property falls.

So the question becomes, will the slight tick-up in property related sentiment stick, or is the overall index set to fall further, as reality dawns – low income, rising costs, big mortgages, compressed returns on bank deposits, and weaker job prospects?

Put like that, the small falls in mortgage monthly repayments, and income uplifts for some may not be sufficient to support the index ahead. We will see.