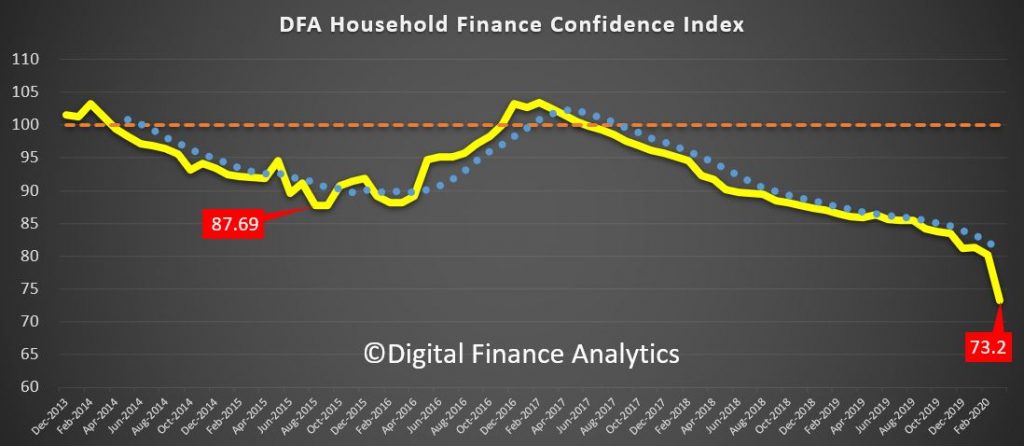

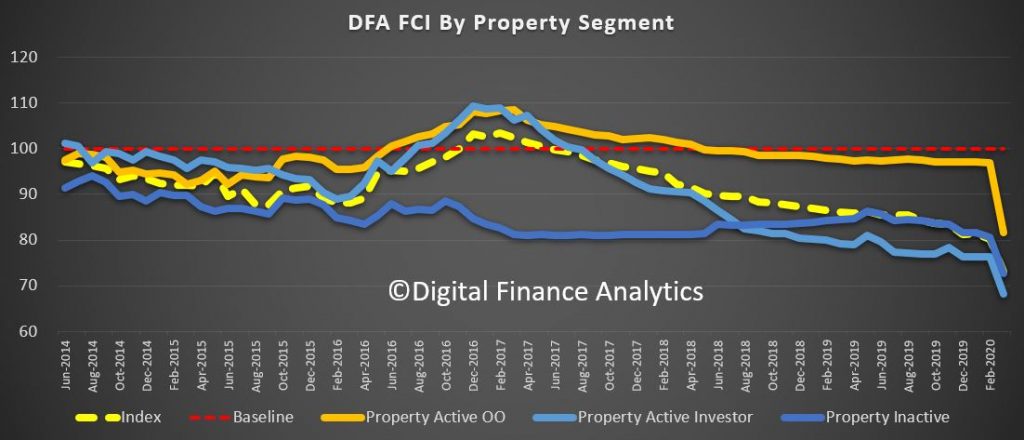

The latest edition of the DFA household surveys, up to 31st March 2020 reveals in painful detail the impact of the current health emergency. Not that confidence was particularly strong beforehand, thanks to the high costs of living, and flat real incomes for several years.

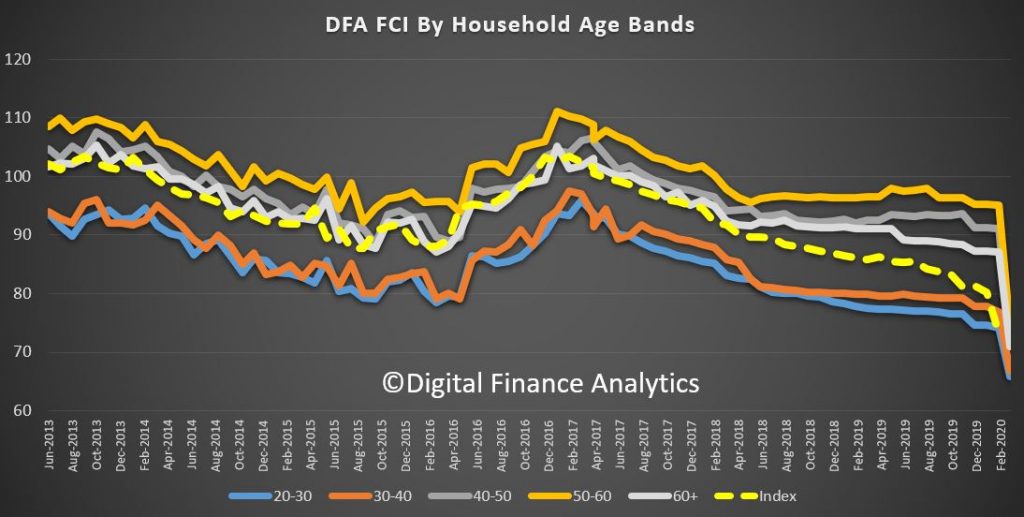

But the shock of the economic freeze, and rising joblessness has dropped the index to levels I never expected to see. Last month it had fallen to 80.2, the latest read is 73.2, well below the average 100 level last seen back in May 2017.

The 52,000 household surveys asks whether their employment prospects, income, costs, loans, savings, and net worth were higher or lower than 12 months ago. Coupled with the other demographic data we collect, we are able to examine the results across a range of dimensions – though this month, it hardly makes a difference, as every age group, state, property status, and more were down. We normally display the results, before looking at the drivers, but this time we examine the individual elements first.

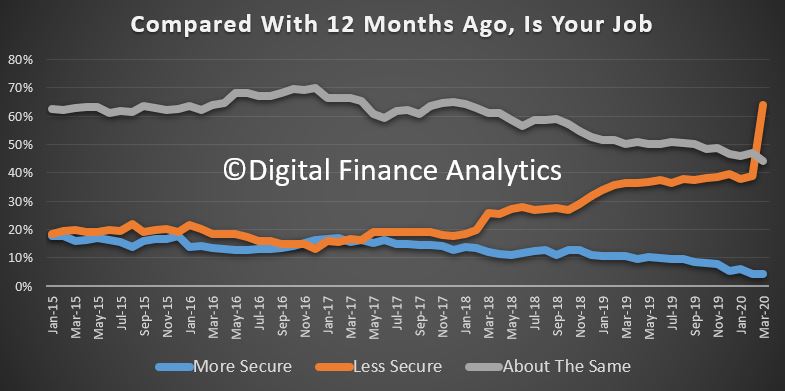

Job security fell by 25% compared with the previous month, with 64% of households now less secure than a year ago, and 4% more secure. The economic freeze which has impacted over this period explains the sharp movements.

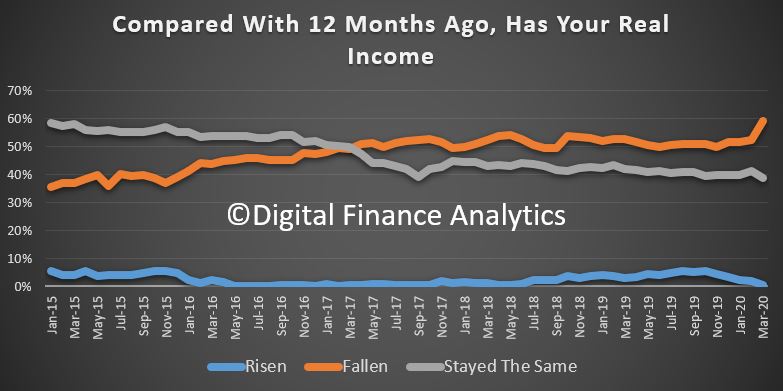

There was also a spike in those indicating a fall in incomes, with 60% of households reporting a real fall, up 7%. 38% saw no change, but this was down 3%.

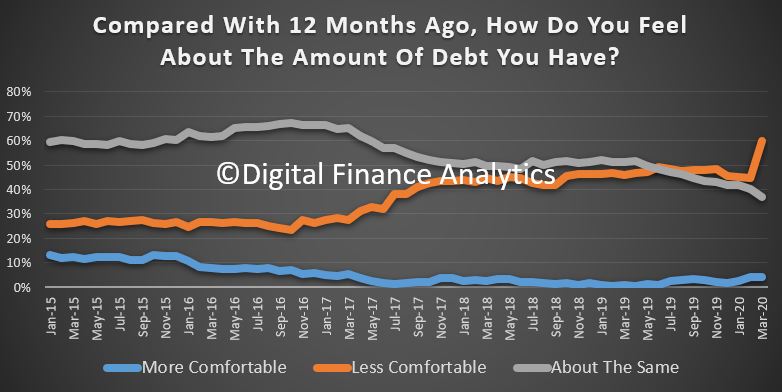

Significantly more households were concerned with their debt burden, with 60% of households now more concerned than a year ago, up 15%, 4% more comfortable and 37% about the same, down 3%. Whilst lower interest rates are helping those still employed, it is irrelevant to those who have lost employment (it would be even worse but for the Government support and mortgage repayment holidays).

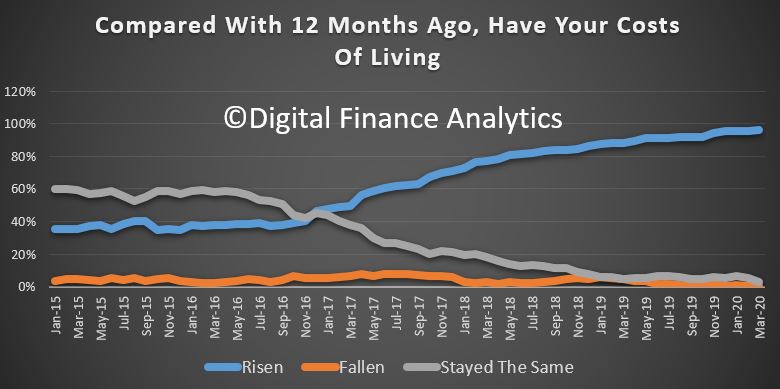

The costs of living continue to climb, with 95% of households reporting higher costs than a year ago.

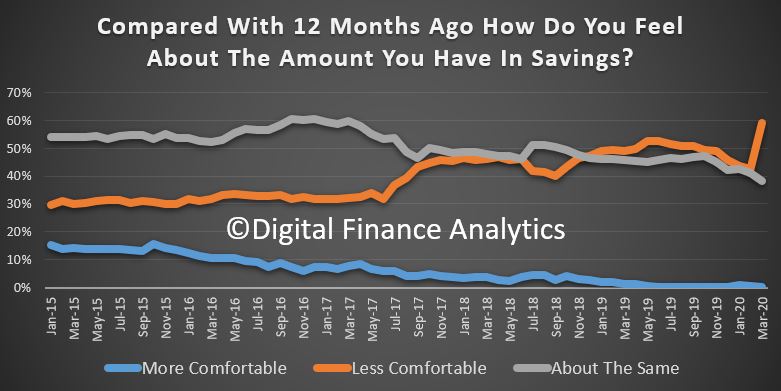

Households comfort with their level of savings dropped significantly, with 59% less comfortable (up 16%), with 37% were about the same. Not only are lower deposit rates continuing to impact, but significantly more households were caught by the sudden drop in earned income, and so are more reliant on savings. Many of those who have income said they will now save more, given the current uncertainties. More bad news for discretionary spending!

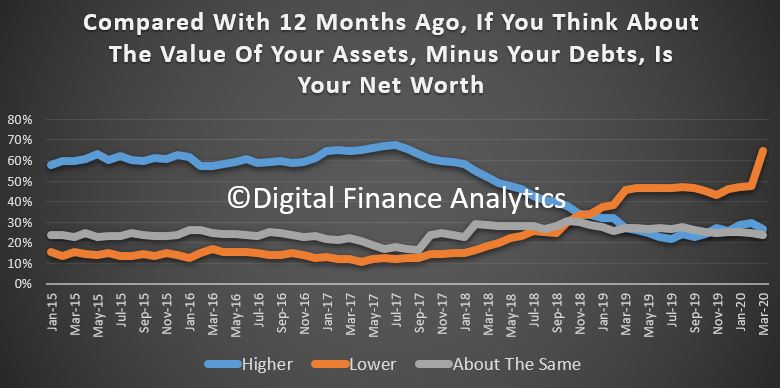

Overall net worth (assets minus loans) fell for 64% of households, thanks to drops in share market prices, falls in the value of superannuation, and some property price falls. This was a rise of 17% compared with last month. 27% stated their net worth was higher, down 3%, and this was directly connected with the still reported property price rises in the eastern states. Households tend to over estimate the value of their properties, especially given the near collapse of auction clearance rates and property sales. This may well be a case of hope over expectation!

So in summary, the moving parts have showing a shocking shift in a short period. This translates to significant adjustments to the index results.

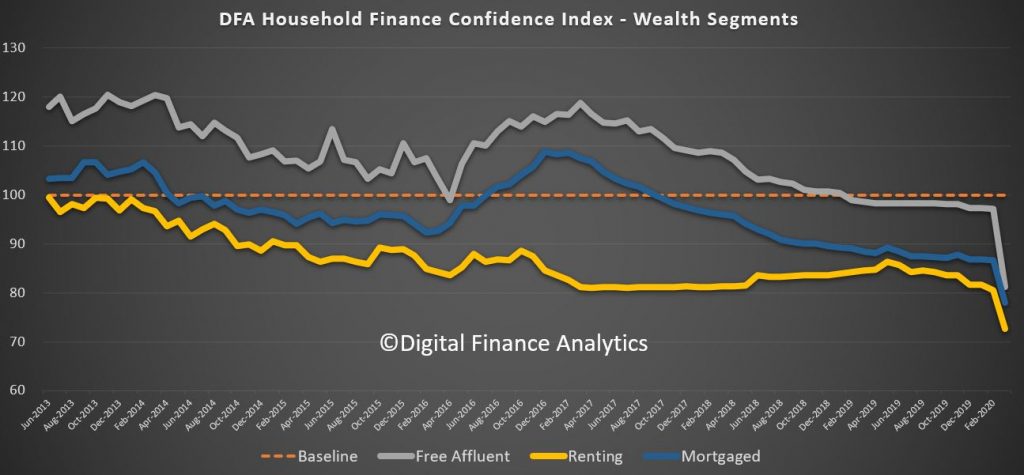

All property owning segments reported a significant drop, with owner occupied property holders reporting the biggest fall, as they had been relatively more optimistic than other groups, until now.

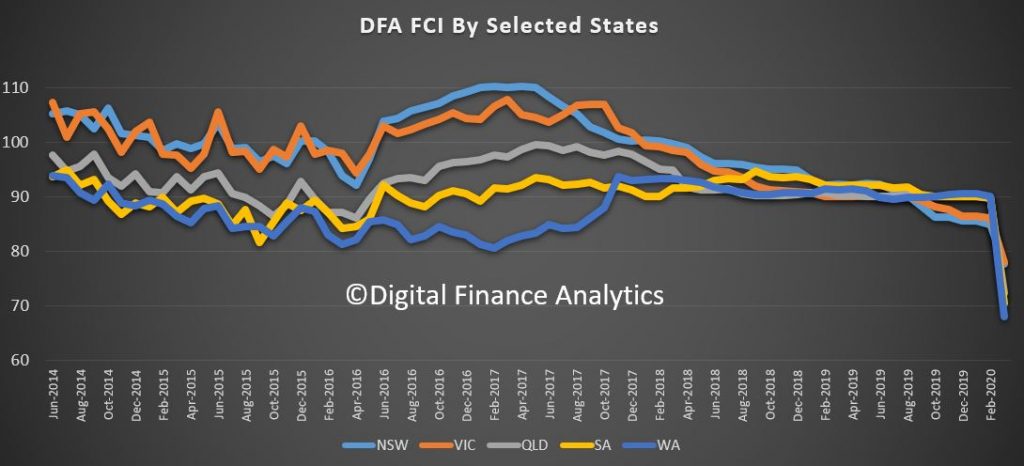

Across the states, they all fell, though NSW and VIC reported the largest new reductions in confidence. No state was immune from the falls.

All age groups reported a fall, with older aged groups showing greater falls – not least because of the stock market falls, and risk of job loss. People above 50 were more concerned about never getting another job, with all the implications for retirement, and many said they will need to work for longer before retiring.

Finally, our wealth segments all reported a fall in confidence, but the “free affluent” group, those without a mortgage, with property and market investment dropped the most. This was the segment which was most insulated from events up to this point.

You can also catch up on my discussion with Nucleus Wealth from yesterday where we discuss these results in context.

The full mortgage stress results will be released next week.