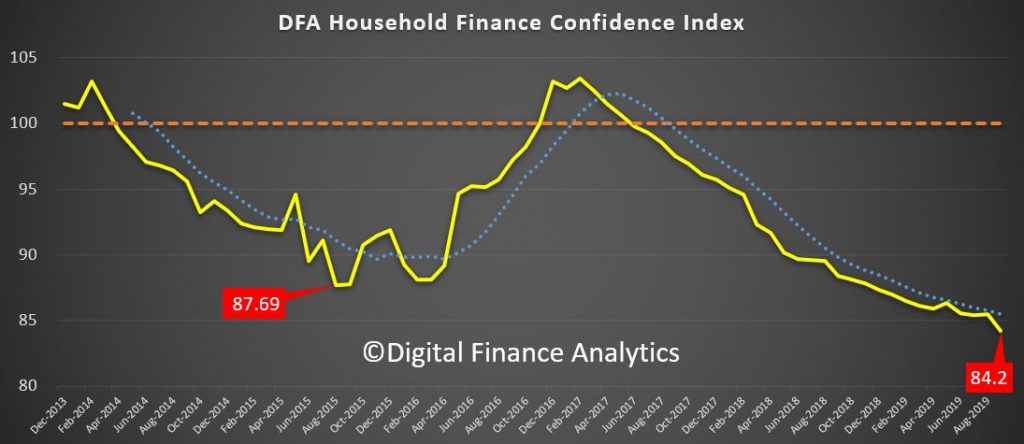

In our latest release to September 2019, the DFA Household Financial Confidence Index fell again, having move sideways more recently. In essence households are simply reflecting that rate cuts, a lower dollar and the international bad news from Trump’s Trade Wars, Brexit and Hong Kong are all making them more concerned, and less willing or able to spend. On top of that the local pressure on wages and rising costs, plus the heavy toll on savers with funds on bank deposit are also hitting. Finally, property is not in recovery mode and buying intentions are down again, after being a little higher after the election. The economy is in deep trouble. The Government and Regulatory response is not cutting the mustard from a household and small business perspective.

Overall the index fell to a new low of 84.2, compared with 85.5 last time, this is a significant one month fall.

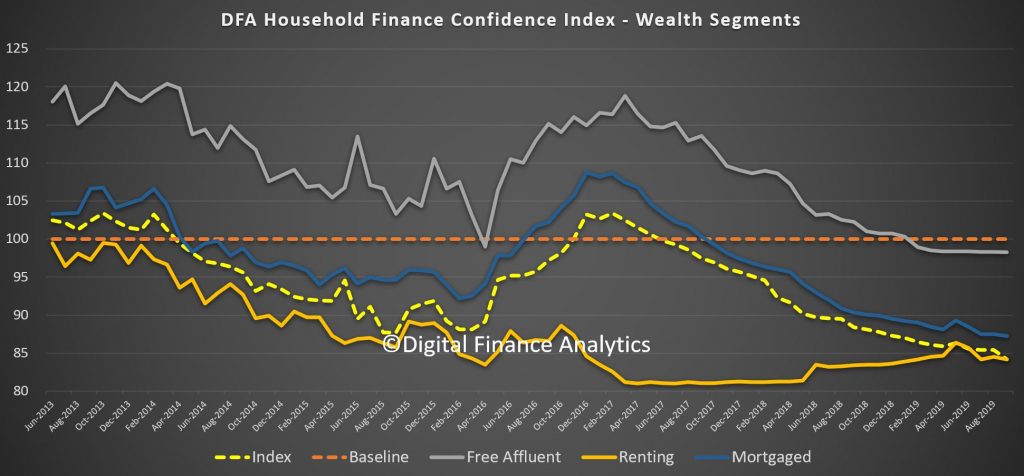

All wealth segments faded, but those holding property without mortgage, and with market investment (stocks and shares) did a little better than those with a mortgage and those renting. All three segments are below their 100 neutral setting.

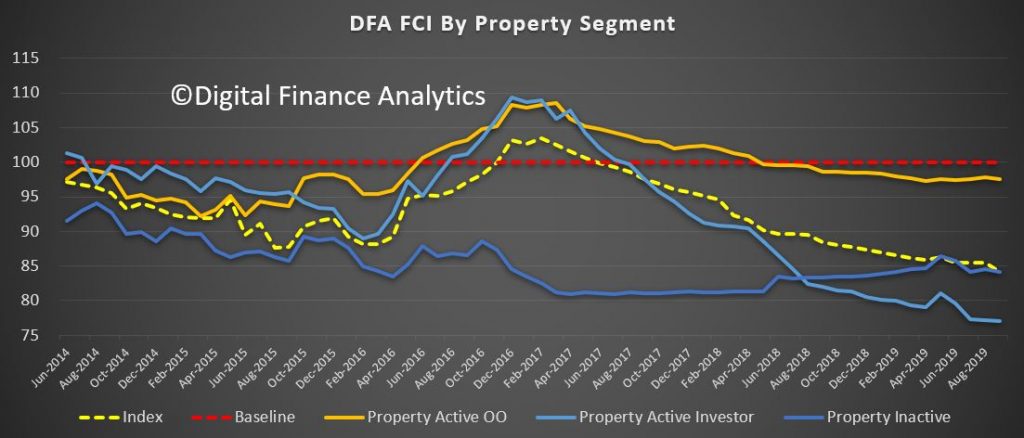

Across the property segments, those owner occupied households with a mortgage are relatively more positive compared with property investors who continue to see their rental streams under pressure, and now even those renting or living with family or friends are also reacting to costs of living rises, and flat incomes. We also registered a number who say landlords recently lifted their rental agreements, adding to the pain.

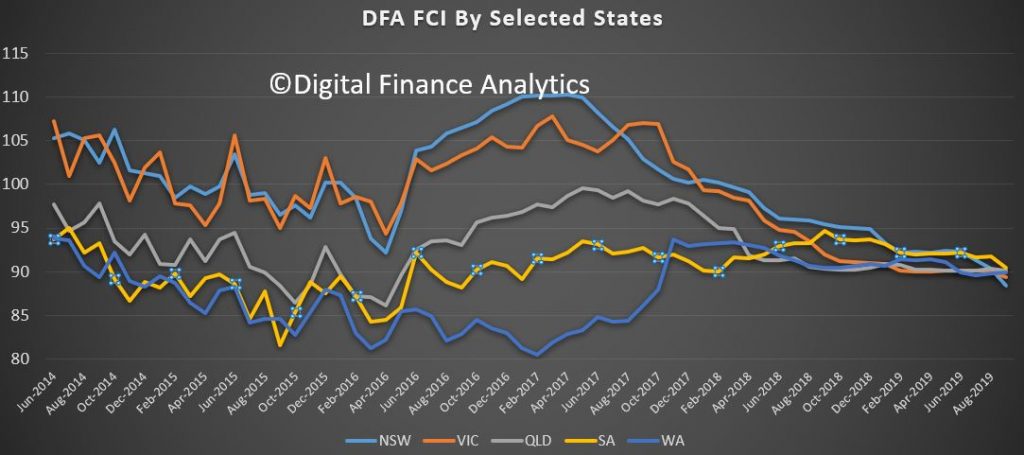

Across the states, the falls are relatively uniform, with the confidence levels bunching at low values in the eastern states. Falls in SA and QLD were offset by a slight rise in WA. But NSW and VIC both fell.

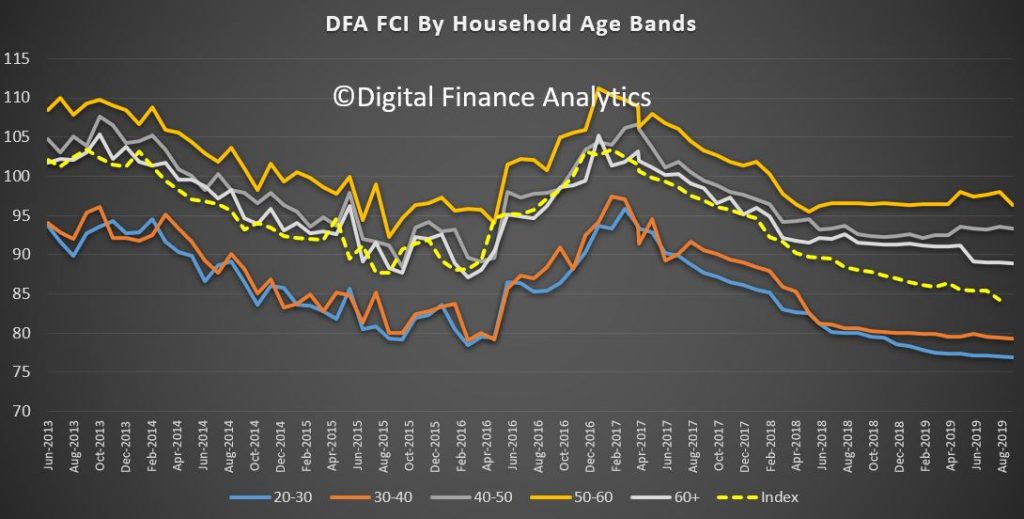

Across the age bands, those aged 50-60 registered a significant decline as falling income from bank deposits hit home following the recent cash rate cuts. All other segments fell too. This is a broad based decline.

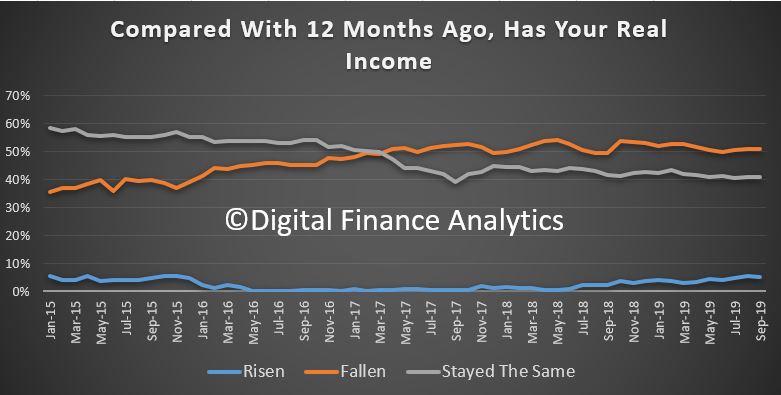

Turning to the moving parts, household incomes remain under pressure, with little evidence of any recovery in the system. More than half have real incomes lower than a year ago.

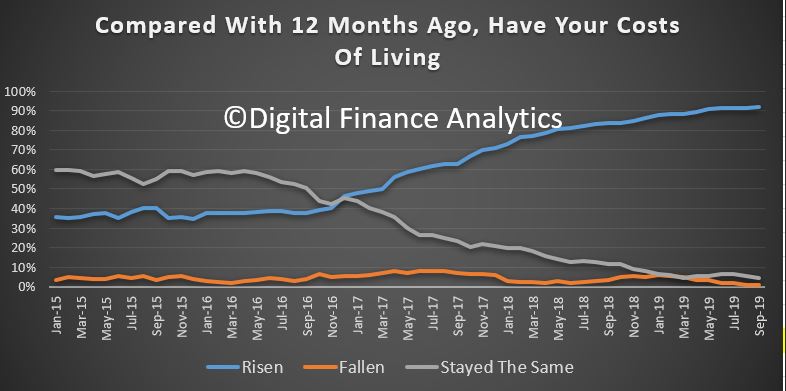

Costs of living continue to rise, and recent petrol prices are making an impact, along with council rates and childcare costs. Food bills are also rising and here the impact of the drought is hitting some costs hard now. 92% of households reported a rise in living costs compared with one year ago.

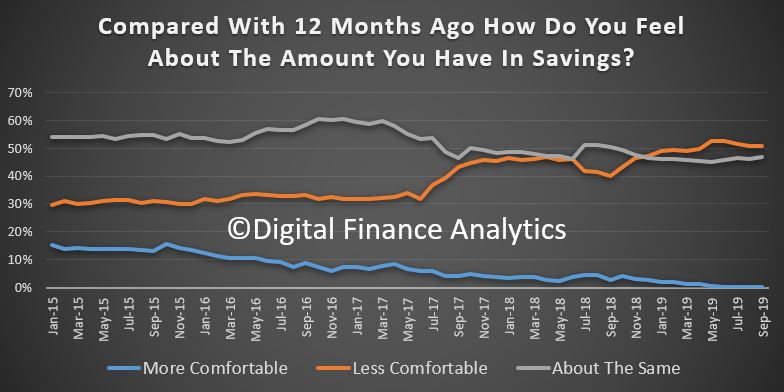

Savings are under pressure, as many households continue to tap into their savings to support their life-styles. But those with savings in bank deposits continue to see rates falling, meaning that incomes from deposits are being crushed. That said, of the 3 million relying on income from savings, less than one third are considering seeking out higher risk saving options to boost returns. The rest are moderating their spending patterns to suit the new low rate environment. However, there are limits to this approach as rates continue to tumble. Those on fixed term rates are facing a real challenge when their funds are due to roll next!

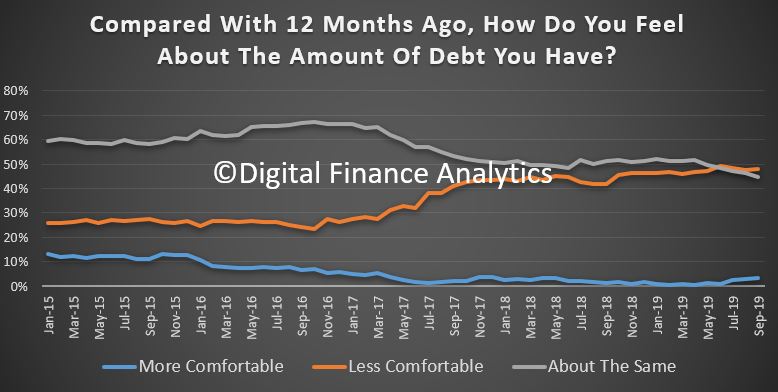

Rate cuts have helped at the margin, but there was a further rise in those feeling less comfortable about their level of debt. We see a rise in concern about making monthly repayments on time, but also an issue with paying off debt in due course (given home price growth is anemic at best). Many continue to pay down credit card debt, though a minority continue to accumulate more debt, in order to balance their budgets.

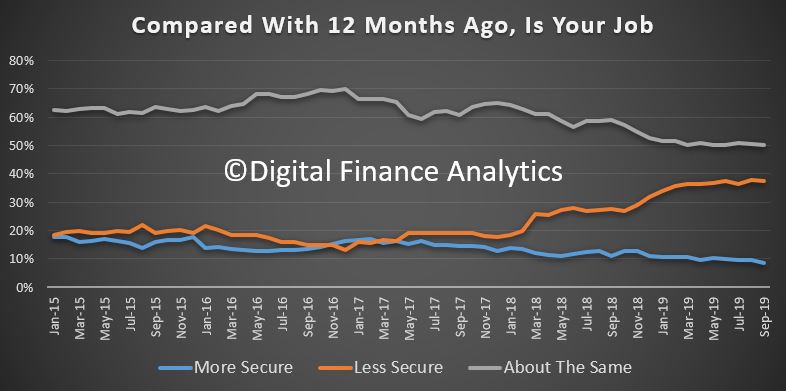

Employment prospects are under pressure in the retail and construction sectors, across all states. There was a 1% fall in those feeling more comfortable, to 8.6%. But there is a marked fall in NSW and VIC and there residential construction has stalled. Employment prospects are brighter in the Public Sector, so Canberra is showing more positive news here.

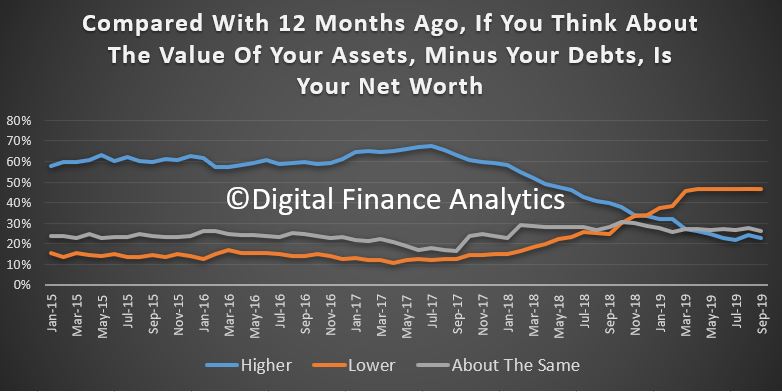

Finally, net worth has taken a hit again, as property values are not rising for many (and the evidence of negative equity is growing). The oft quoted recent rises in Sydney and Melbourne clearly do not tell the full story. Property investors with units across the country are increasingly nervous about the true value of their property in the light of the poor quality certification and construction issues which are rife in the sector.

So, there is really little here to offset the gloom. Whilst lower cash rates may translate to lower mortgage rates for some, this is not sufficient to counter the negative news. And more households are seeking to pay down debt in an attempt to protect themselves ahead.

This signals more economic weakness ahead.