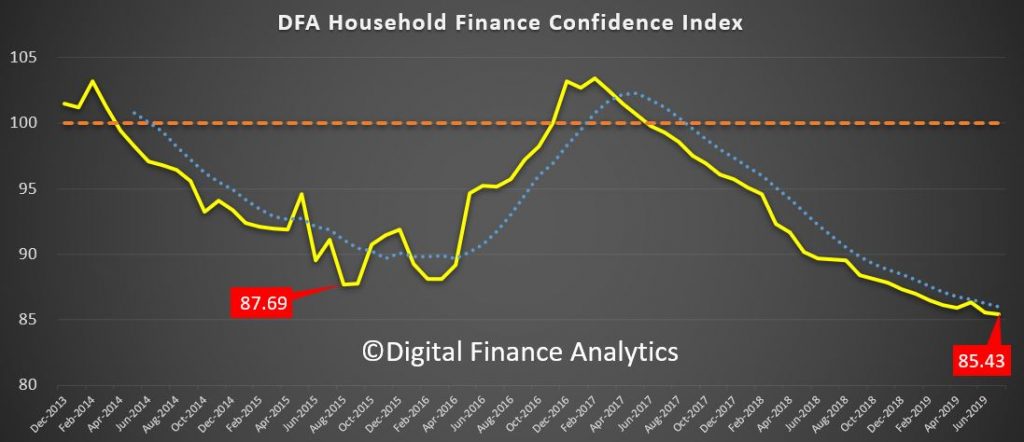

We are releasing the latest edition of our household financial confidence index today. This is an extract from our 52,000 rolling household surveys, were we ask about their level of confidence, compared with a year back.

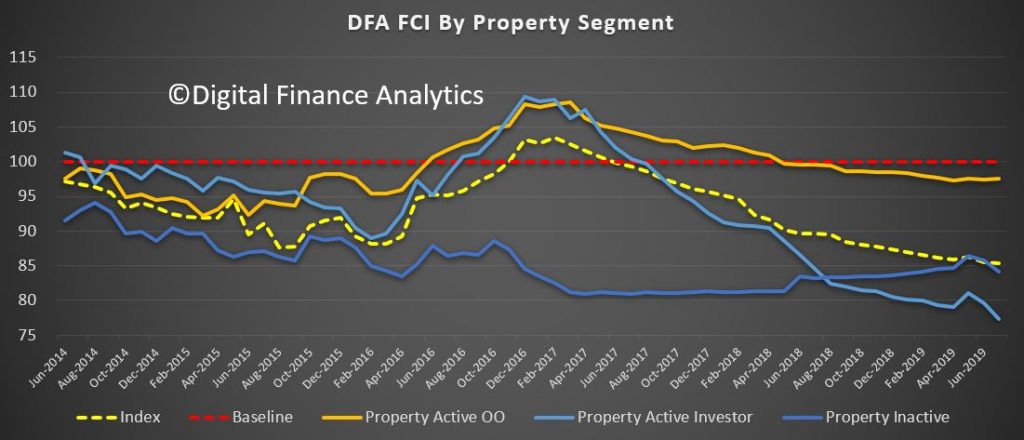

Any post election bounce is well past, as the two interest rate cuts are seen as a negative, first because it signals higher risks, and second, while mortgage holders may see some reduction in their monthly repayments, those relying on income from deposits – more than three million households – are seeing their incomes being clipped. Many of these are unwilling to switch to higher risk saving vehicles so they just adjust their spending and life-style down to match.

The index hit a new low of 85.43, well below the neutral level, and significantly below the previous low of 87.69 in 2015.

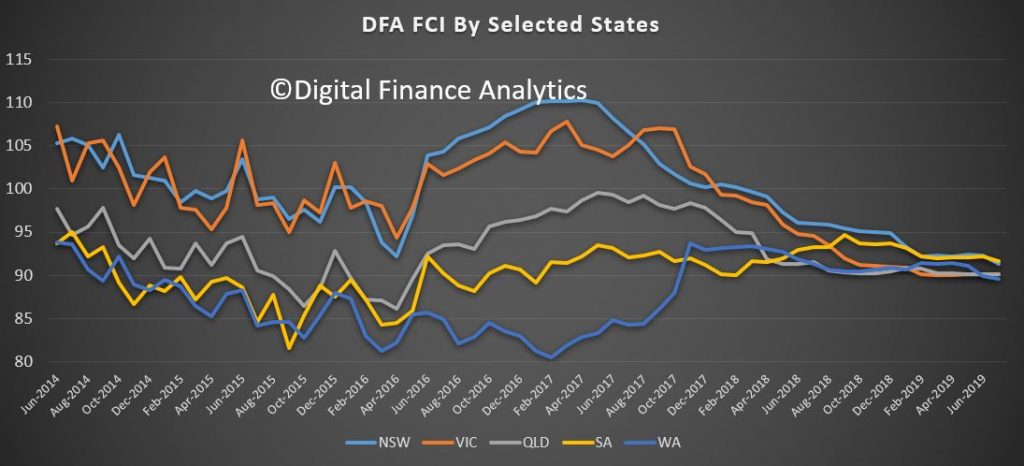

The performance across the states continues to bunch together, as NSW and VIC continue their slide. WA, which had been improving a little, also reversed. SA also fell this month.

Across the Property Segments, owner occupied property owners are relatively more confident thanks to reduced mortgage repayments and some patchy better news on home prices, but property investors are concerned about falling rents, the emerging high-rise building defects issue and little prospect of capital gains. More than 20% of property investors are now in negative equity, especially those holding relatively new high-rise units in the high-growth corridors.

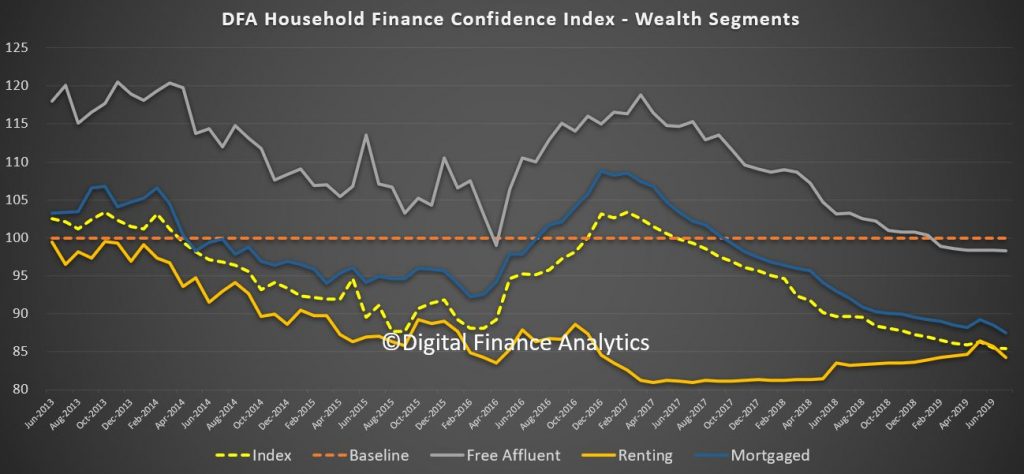

Across our wealth segments (those holding property with no mortgage, those with a mortgage and those renting) all three are under the neutral setting. The recent gyrations on the stock markets have also shaken confidence further.

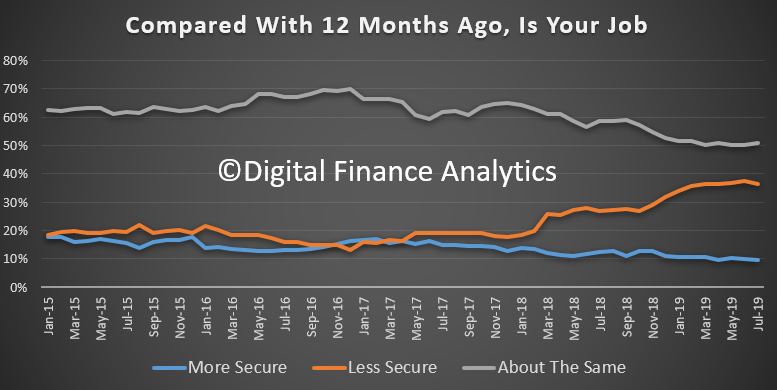

Looking at the drivers of the index, job security remains an issue with 9.7% of households feeling more confident, 36.6% feeling less confident, and 51% reporting no change. The structure of employment continues to fragment, with households reporting more part-time jobs, including some in the gig-economy.

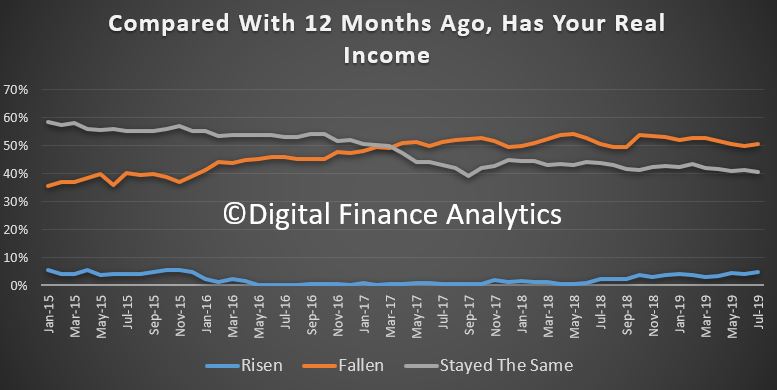

Income remains under pressure with 4.75% reporting a rise (including some low-paid sectors), up from last month, but 50.5% report a fall in real terms (further validation of the recent HILDA report that there has been no real wages growth in many years), and 40.7% said there had been no change.

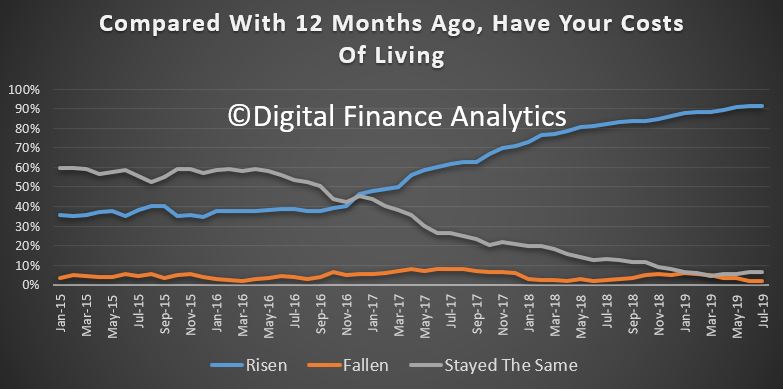

On the other hand the costs of living continue to outstrip wages growth, so the pincer movement continues. 91.4% said their costs were higher than a year ago, 6.6% said no change and 1.7% said costs had fallen. Categories of spend which have risen include child care costs, health insurance (more are cancelling this spend as a result), fuel costs, electricity costs and council rates.

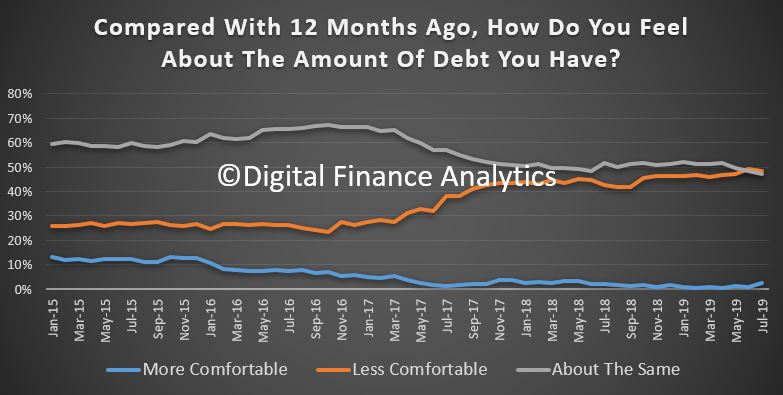

Households are carrying significant debt burdens, from mortgages, credit cards and personal loans. The recent rate cuts have triggered a quest for cheap loans, and mortgage refinancing (and equity extraction). 2.4% of households are more comfortable than a year ago, 48.6% are less comfortable (despite falling rates) and 47.3% have stayed the same. We continue to see some households who are locked out of switching to a less expensive mortgage thanks to negative equity, or because they fall outside current lending standards.

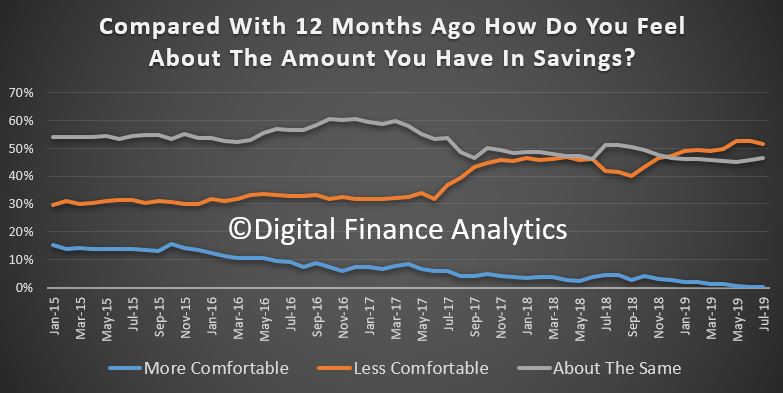

Savings rates continue to fall for many households, especially some older Australians who have moved into self-funded retirement. Many hold funds on deposit with the banks outside superannuation arrangements. The falls in returns on deposits is now highly significant and many are under pressure. In addition other households are dipping into savings to manage their budgets. 51.58% of households are less comfortable than a year ago, 46.3% about the same and 0.27% more comfortable. In addition, households with share market investments are worried by the recent gyrations and increased volatility and the prospect of lower dividends from the financial sector.

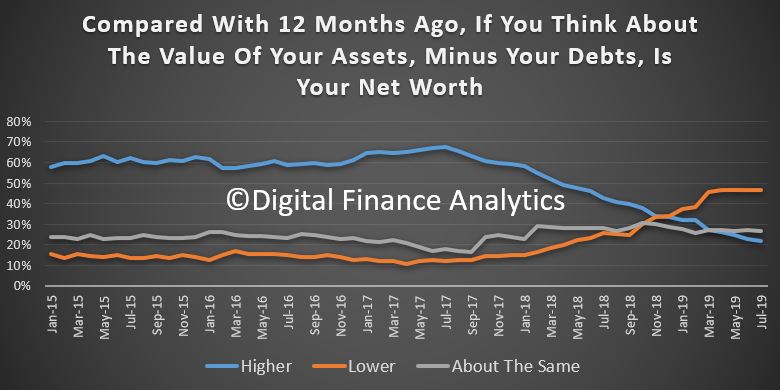

Finally, looking at changes in net worth (assets less liabilities, including loans), 21.8% reported an improvement, mainly thanks to stock market and precious metal price rises, 26.4% reported no real change, while 46.6% reported a drop in net worth. Falls in property values, plus some refinancing and equity removal are the main reasons for these falls. Some property values are down for than 30% and this is creating an significant erosion of confidence. That said, those holding real property are still relatively more confident, and their faith in property in as yet undiminished as the best place to put their money. As we will show in our upcoming survey results, expectation to transact in the next 12 months is rising now.