The latest edition of our Financial Confidence Index, just released, reveals further weakness as COVID shut downs and constraints bite in VIC and NSW.

We discussed this on our recent live stream event.

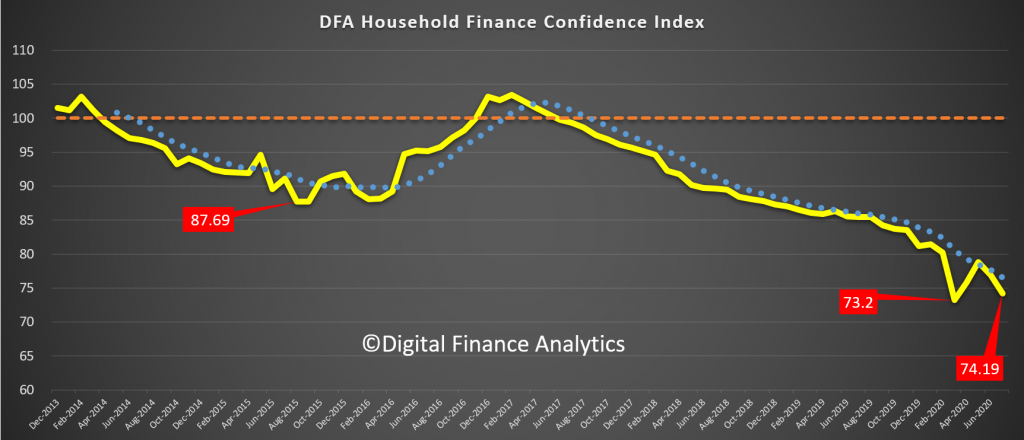

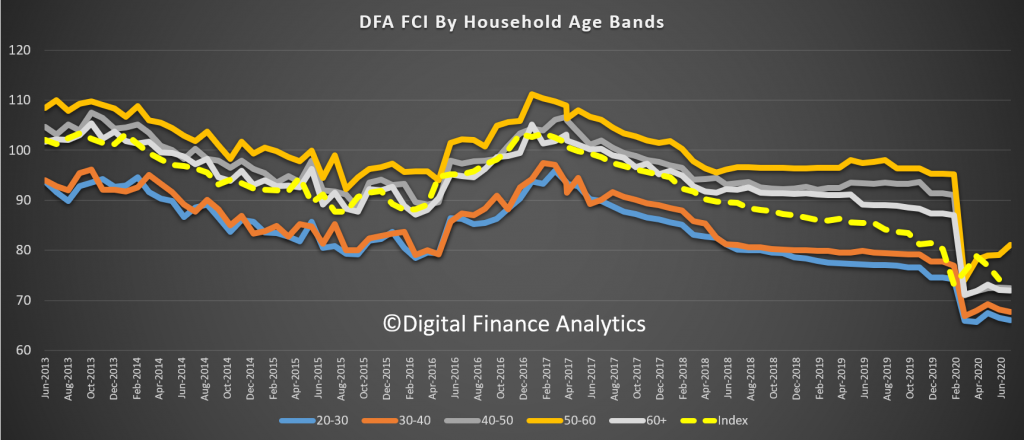

We had been tracking some positive movements after the March fall, but in July we dropped back to 74.19, well below the 100 neutral setting. This is based on data from our rolling 52,000 household surveys, and examines their expectations on jobs, income, costs, savings, loans and net worth. The data is collected at a post code level.

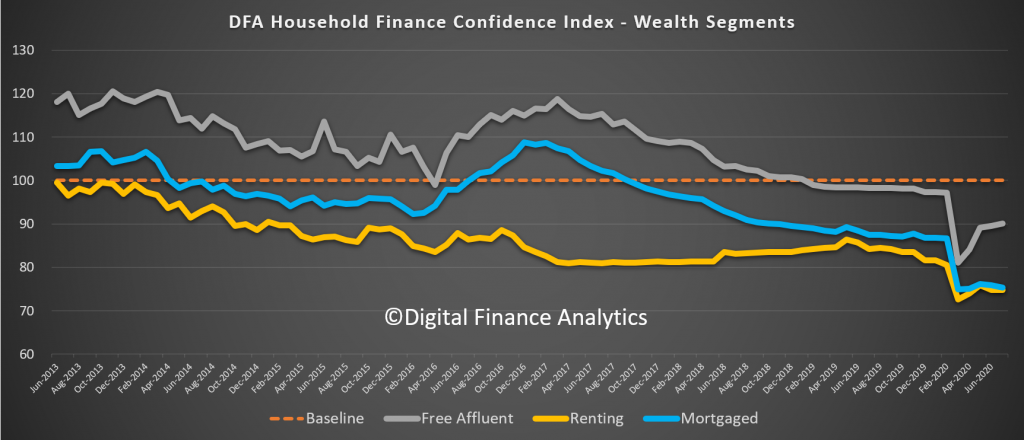

In the past month households without mortgages but holding stocks have done better than those with a mortgage or those renting without market exposure. This highlights an important division between some households and others in terms of their finances.

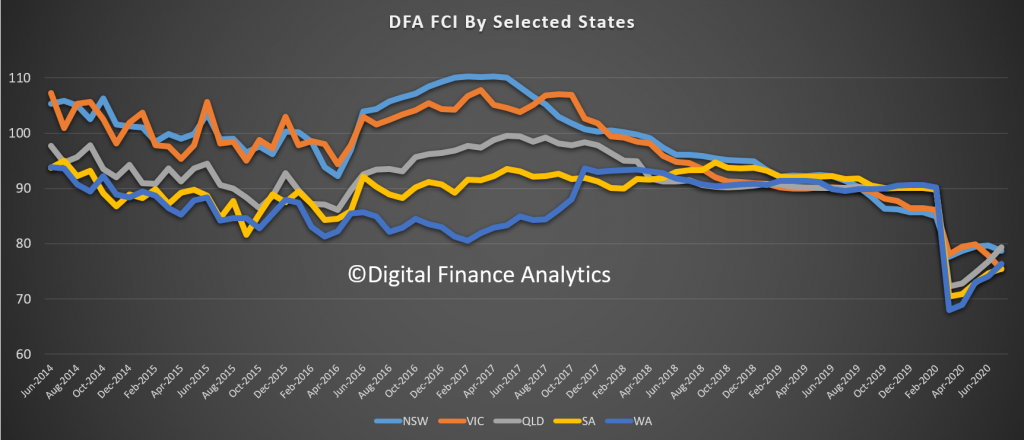

Across the states, VIC and NSW are pulling the FCI down, while smaller (now more isolated) states are doing a little better. The lock down in VIC is having a significant negative impact.

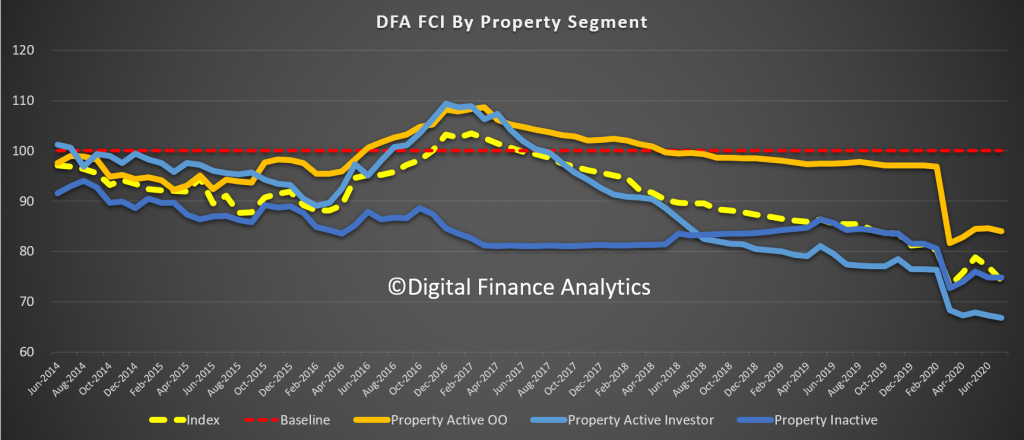

All property segments eased back, although property investors continue to be most negative, fretting about falling capital values and lower rental returns. JobKeeper and JobSeeker are wired into many households budgets now and as support eases, more are concerned about what is ahead.

Age band analysis reveals that those younger and older remain more concerned, while those in the middle bands, with lower mortgage commitments and more market exposure are more positive, though easing down.

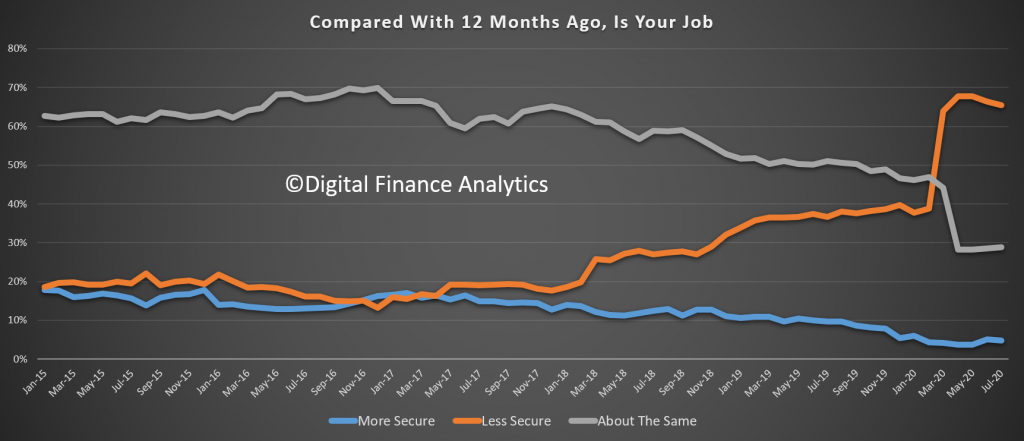

Looking at the elements of the survey, job prospects continue to worry though there is a slight fall from nearly 70% of households who see employment as less secure. This is being driven by what I call structural unemployment, and middle management jobs in large corporations across the country fact the axe. I discussed this on ABC RN yesterday

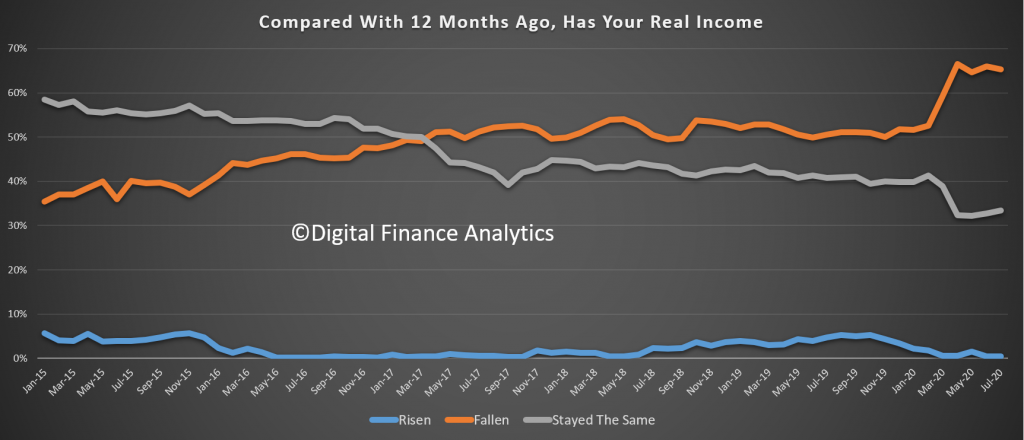

Incomes remain under severe pressure, despite JobKeeper and JobSeeker. As these are scaled back, pressures are likely to intensify.

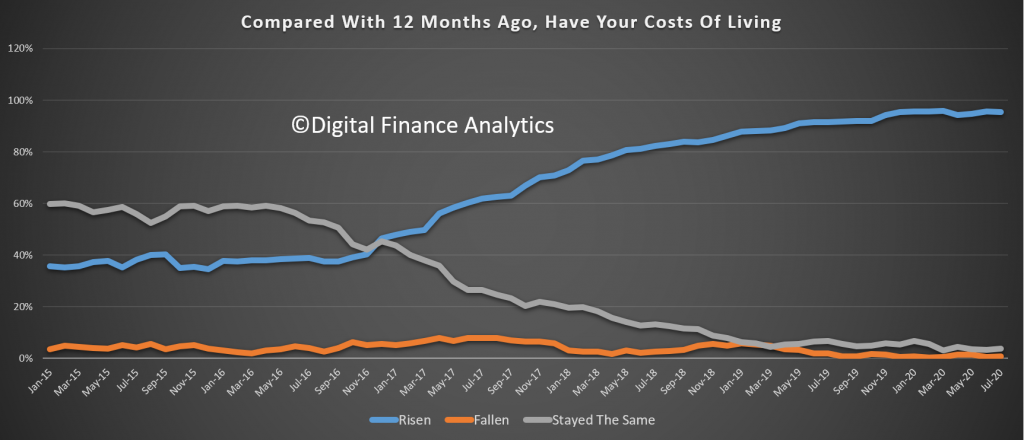

Costs of living continue to accelerate, with households observing the rising costs of basic essentials at the supermarkets. While traveling less is common thanks to restrictions, net-net most are feeling the pinch.

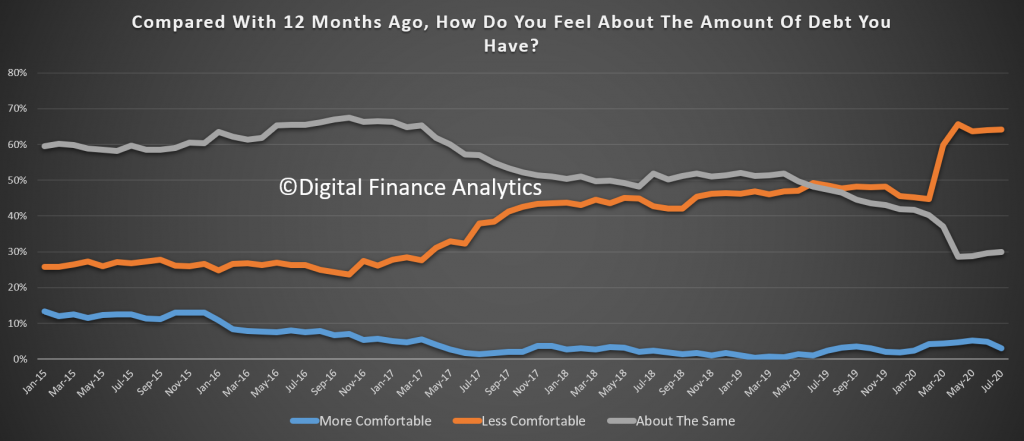

Debts are a worry for more households, especially mortgage debt. Where people are in receipt of Government support, and even superannuation draw downs, around half are looking to pay debt down. Lower interest rates on mortgages are helping some but we see evidence of higher LVR loans and households with income pressures finding it more difficult to refinance to lower cost alternatives.

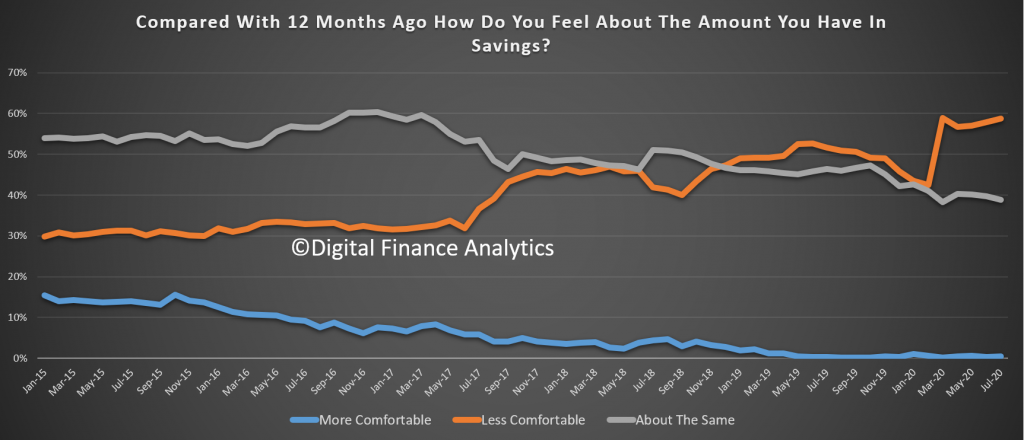

The collapse of interest rates on bank deposits continues to bite, with more switching from term deposits. Some are choosing to place funds into the financial markets, or buying gold etc. instead. But this does not necessarily assist with income flow, especially as dividends are also under pressure ahead.

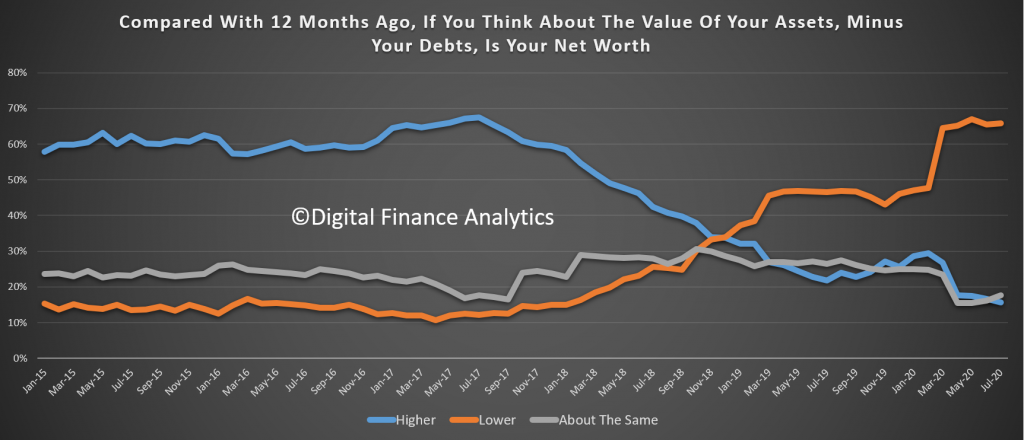

Finally, net worth continues to be supported by financial market rises, while property falls have been slight so far. That said, the proportion saying their net worth is lower remains significant.

If Government support is unwound before the economy picks up, our view is household financial confidence will continue to suffer; not good for investment, spending or overall economic growth.