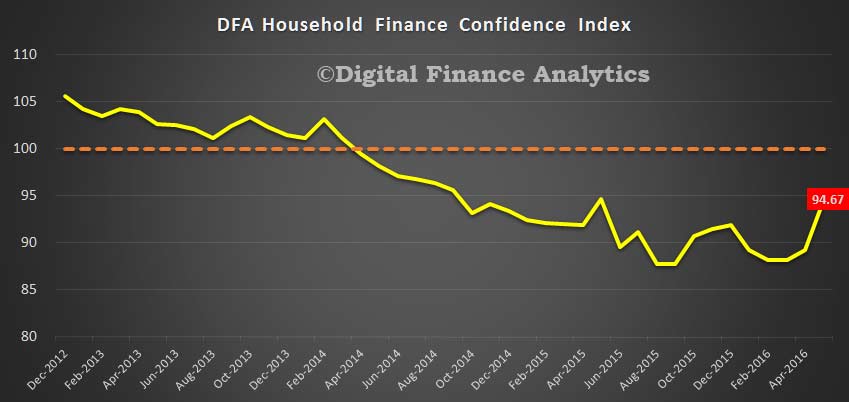

The latest edition of the Digital Finance Analytics Household Financial Security Confidence Index (FCI) is released today, to end May 2016. It shows a significant rise in overall confidence levels, up from 89.2, to 94.7 although this is still below the neutral score of 100, which we fell below in 2014.

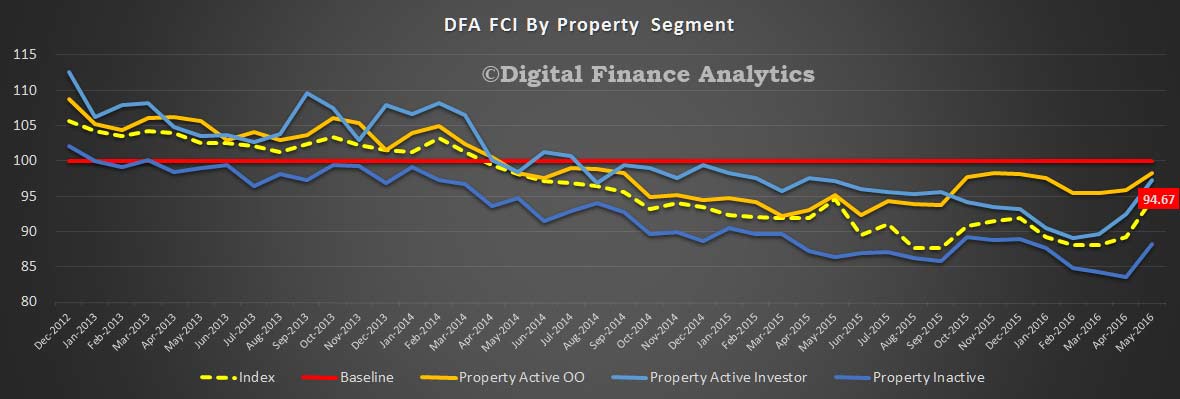

A number of elements explain the improvement. Looking first at the index by property segment, we see that the property active investor’s score continue to improve, thanks to rising home prices, the likely negation of changes to negative gearing post the election, and falling interest rates on loans. This reflects the heightened demand we identified in our last set of survey results. The owner occupied home owners score also bounced back, thanks to the cash rate interest rate cut in May feeding through into prospective lower mortgage repayments. Even property inactive households were more confident, and this is associated with recent more positive economic news, and lower rental rates. This break-out trajectory suggests we could be above the long term neutral position soon.

A number of elements explain the improvement. Looking first at the index by property segment, we see that the property active investor’s score continue to improve, thanks to rising home prices, the likely negation of changes to negative gearing post the election, and falling interest rates on loans. This reflects the heightened demand we identified in our last set of survey results. The owner occupied home owners score also bounced back, thanks to the cash rate interest rate cut in May feeding through into prospective lower mortgage repayments. Even property inactive households were more confident, and this is associated with recent more positive economic news, and lower rental rates. This break-out trajectory suggests we could be above the long term neutral position soon.

This video blog goes though the main points:

This video blog goes though the main points:

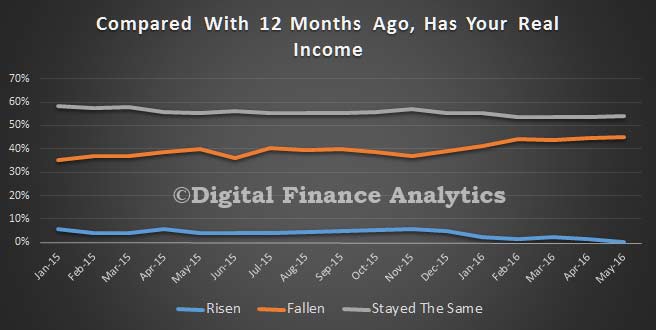

But, then again, within the index, we see some more concerning signs. First, stagnant incomes are confirmed, with almost no households reporting real income growth, and around 45% saying their real incomes have fallen.

We also noted concerns about the level of income from bank deposits as rates fall, and banks try to manage their net interest margin. I am surprise there is so little coverage of the real impact of falling interest rates on those relying on savings, despite the large number of households which are impacted; all the focus is on property and shares. This fall in rates proportionally impacts more older households.

We also noted concerns about the level of income from bank deposits as rates fall, and banks try to manage their net interest margin. I am surprise there is so little coverage of the real impact of falling interest rates on those relying on savings, despite the large number of households which are impacted; all the focus is on property and shares. This fall in rates proportionally impacts more older households.

We also see rising child care costs hitting large numbers of younger households as the latest changes work through.

Finally, we see that households in regional WA and QLD are significantly less confident thanks to pressure on home prices and higher levels of mortgage stress, whereas in NSW and VIC households are relatively more confident. Here they are close to crossing the 100 point Rubicon.

By way of background, these results are derived from our household surveys, averaged across Australia. We have 26,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. The index measures how households are feeling about their financial health. To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.