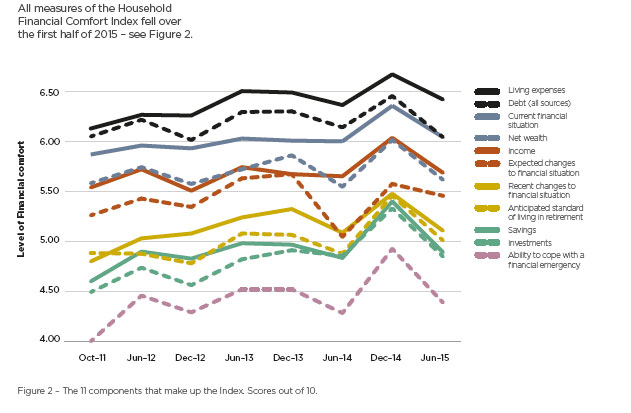

Household confidence in coping with a financial emergency (loss of income) fell 11% in the six months to June 2015, largely contributing to a 6% fall in overall household financial comfort, according to ME’s latest Household Financial Comfort Report. The findings are similar to DFA’s Household Finance Confidence Index, which fell to a new low in June.

Linked to the fall in financial emergency-preparedness are big falls in comfort with cash savings(down 9%) and income (down 6%) in the six months to June 2015. A lack of comfort about cash savings and the ability to cope with a financial emergency is particularly evident among single parents whose overall financial comfort fell 20% to 4.46 out of 10 during the first half of 2015. Decreased comfort with cash savings is likely to be caused by weak income growth – with only a third of respondents reporting household income gains in the past year – together with increased concerns about the job market. While job-security has remained steady at 71%, job availability fell 9 points with 56% of the workforce indicating it would be difficult finding another job within two months if they became unemployed, compared to 47% six months ago. Concern about savings and incomes has also resulted in a rise in the number of households citing ‘the cost of necessities’ as their biggest worry, up 3 points to 50% of households. Other major worries for households were ‘having enough cash on hand’, rising 3 points to 37% and ‘being able to make ends meet’ rising 5 points to 34% of households.

Linked to the fall in financial emergency-preparedness are big falls in comfort with cash savings(down 9%) and income (down 6%) in the six months to June 2015. A lack of comfort about cash savings and the ability to cope with a financial emergency is particularly evident among single parents whose overall financial comfort fell 20% to 4.46 out of 10 during the first half of 2015. Decreased comfort with cash savings is likely to be caused by weak income growth – with only a third of respondents reporting household income gains in the past year – together with increased concerns about the job market. While job-security has remained steady at 71%, job availability fell 9 points with 56% of the workforce indicating it would be difficult finding another job within two months if they became unemployed, compared to 47% six months ago. Concern about savings and incomes has also resulted in a rise in the number of households citing ‘the cost of necessities’ as their biggest worry, up 3 points to 50% of households. Other major worries for households were ‘having enough cash on hand’, rising 3 points to 37% and ‘being able to make ends meet’ rising 5 points to 34% of households.

Renters feeling the financial pinch. Overall financial comfort is down 12% among renters to 4.35 out of 10, to remain well below the comfort of home-owners (down5% to 6.52) and households paying off mortgages (down 3% to 5.28). The fall in comfort among renters may be a reflection of the financial difficulty first home buyers are experiencing getting into the property market, coupled with a continued rise in rents across many states, particularly in some major capital cities.

A tale of two generations. The latest data also tells a tale of two generations, with Gen Ys (aged 18-34) and pre-retirees (aged 50-59) reporting the biggest falls in overall financial comfort (both down 10%), but for very different reasons. While Gen Ys (and single parents) are more concerned about their available cash savings, at the other end of the age spectrum, pre-retirees are most concerned about their expected standard of living in retirement as well as their investments. Falling financial comfort for older generations is also linked to falls in comfort with investments (down 9% on average, with the largest fall of 13% for Builders (aged 75+)) and increased risk aversion in the current low interest environment. A corollary of this is a fall in financial comfort in anticipated standard of living in retirement, down across all households by 8% to 5 out of 10, but by 16% to 4.5 among pre-retirees, with very high levels of comfort expected by self-funded retirees (7.14 out of 10) and significantly lower comfort levels reported among those totally/partly dependent on government pensions (3.38 and 5.15 out of 10 respectively).

Other findings include:

The labour-force: Self-employed workers reported the biggest fall in financial comfort (more than 20%) to the lowest level seen for this group since the survey commenced in late 2011, compared to a drop of 7% among full-time employees.

Regional variations: Comfort across all mainland states fell with relatively bigger falls in SA (down 10%), WA (down 9%) and NSW (down 8%). After a relatively small fall of 4%, comfort in Victoria was highest of the mainland states reflecting relatively higher levels of comfort across a range of drivers and in particular the ability to handle a financial emergency and comfort with cash savings.

Metro vs regional: After a fall of 9%, those living in regional areas continue to report significantly lower comfort (index of 5.18 out of 10), than city households (down 5% to an index of 5.52), with the highest comfort households located in Melbourne and Sydney.

Risk adverse: There has been a significant increase in financial risk aversion – with those people avoiding risk (39%) exceeding those willing to take risk (17%) by 22 percentage points – equal to its previous highest level in recorded in December 2012.