We have released the latest edition of our household surveys, looking specifically their attitude to property transactions and expectations. And overall demand, and intention to transact have tanked. More evidence of a weaker market ahead.

Our video provides a complete analysis of the results, but here are the main points.

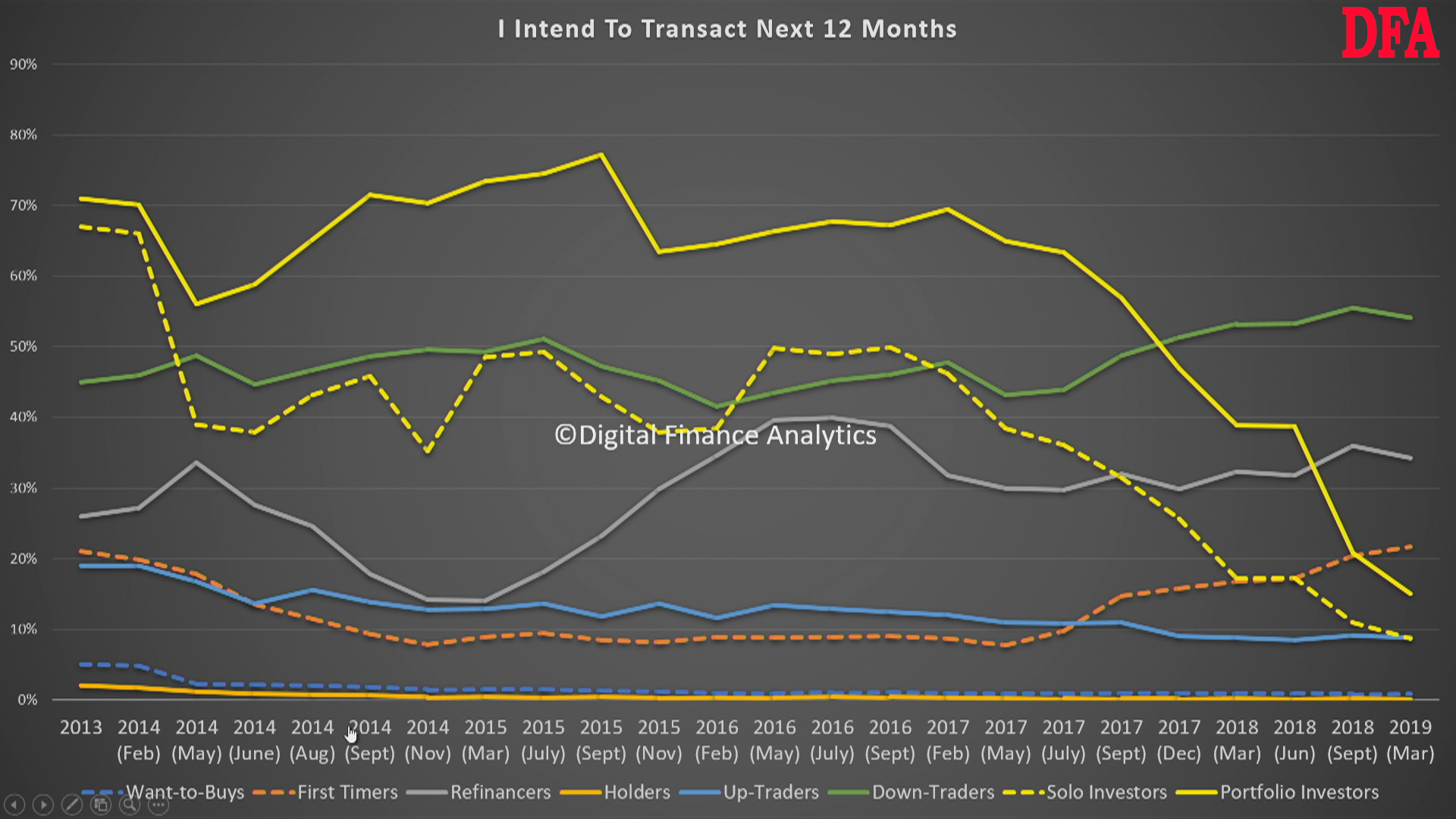

Intention to transact continues to fall, as property investors continue to step away from the market. Down Traders and First Time Buyers remain active, as do those seeking to Refinance; but overall expect lower numbers of transactions ahead.

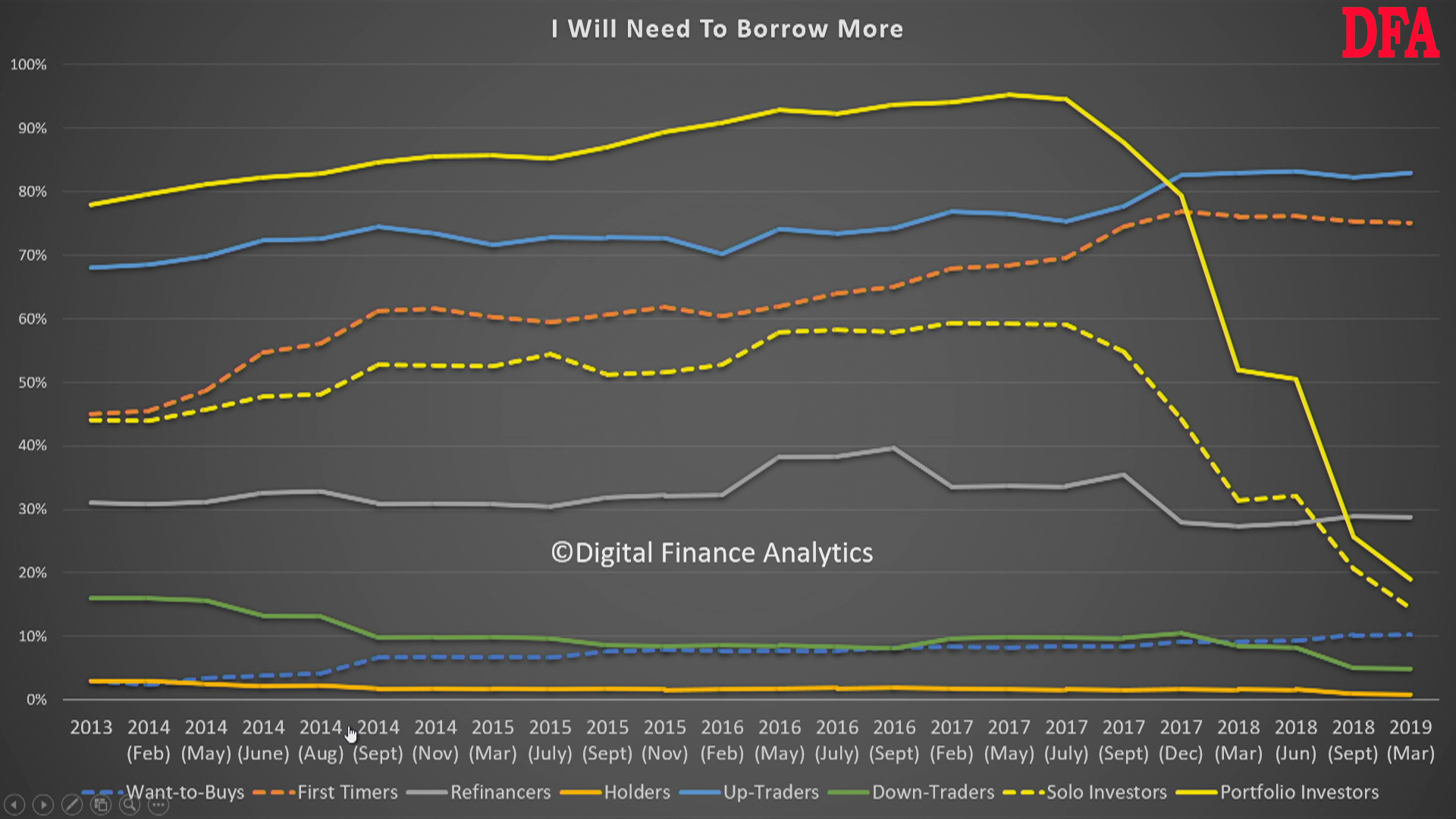

As a result, demand for credit is also likely to fall further, as investors walk. Up Traders and First Time Buyers are the main cohorts likely to want a loan, plus some refinancing.

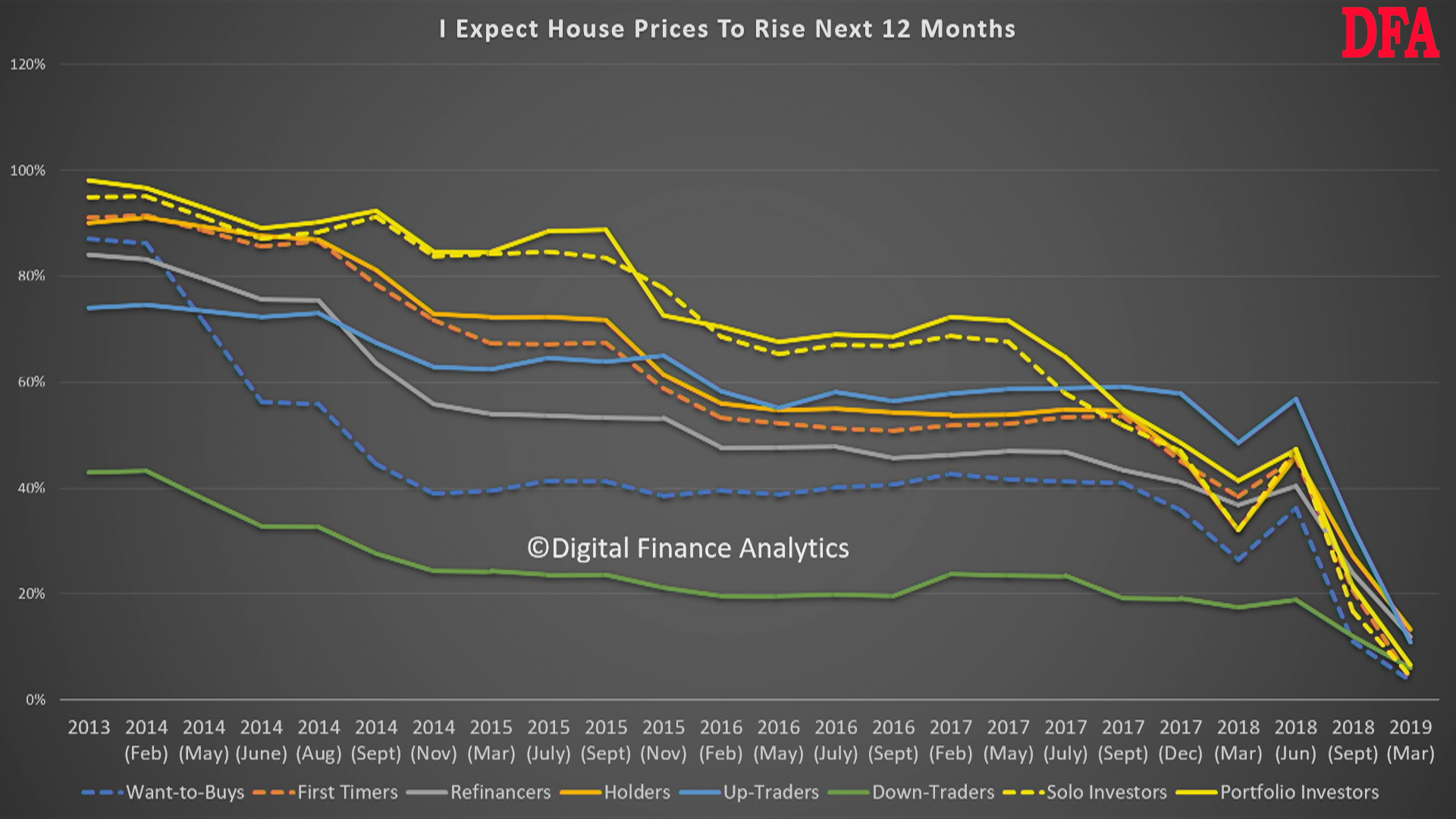

Home price expectations are diving, across all segments, these are the lowest results I have ever seen in the data series. This is a significant shift compared with even 18 months ago. People think property is likely to fall further.

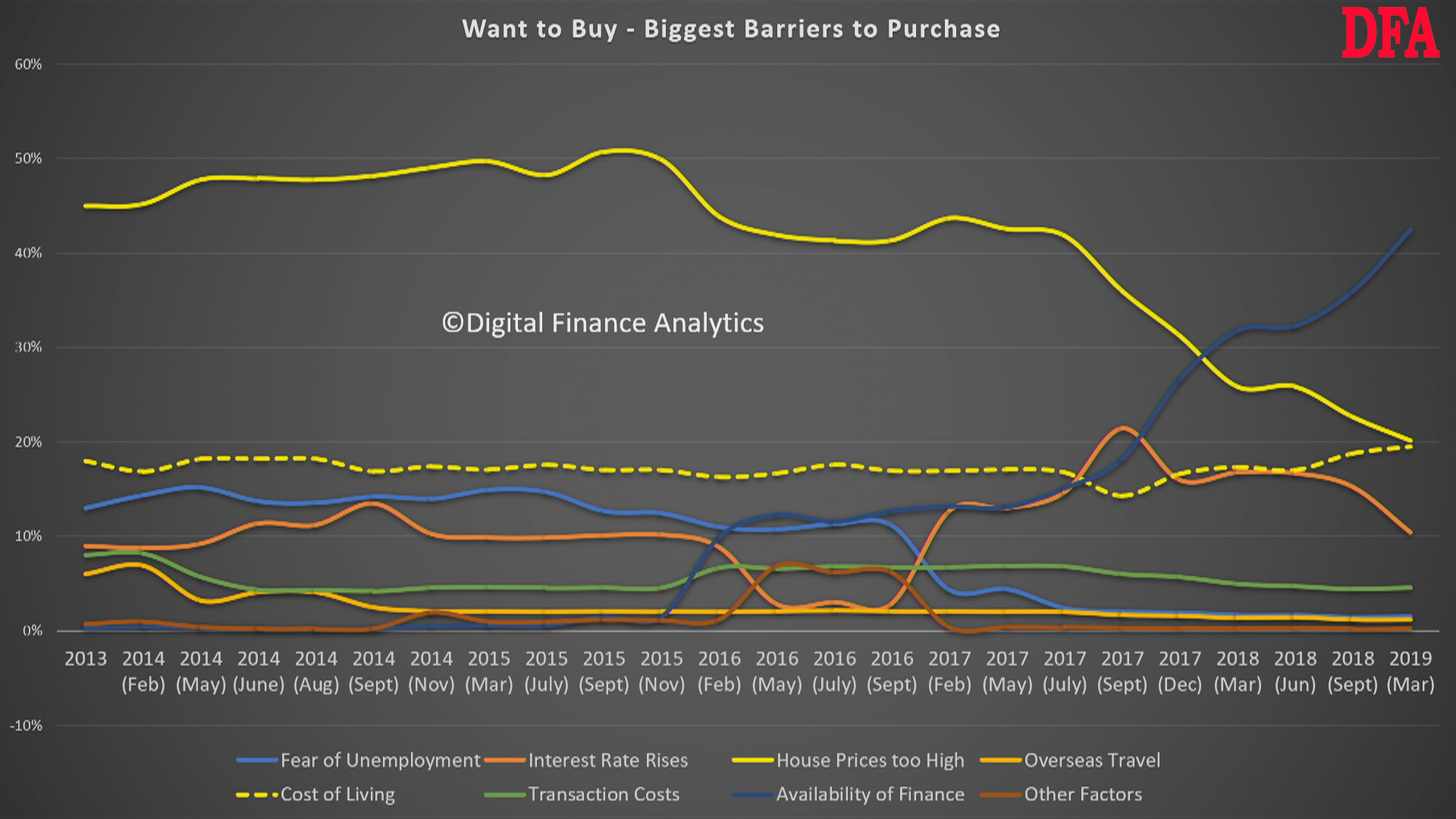

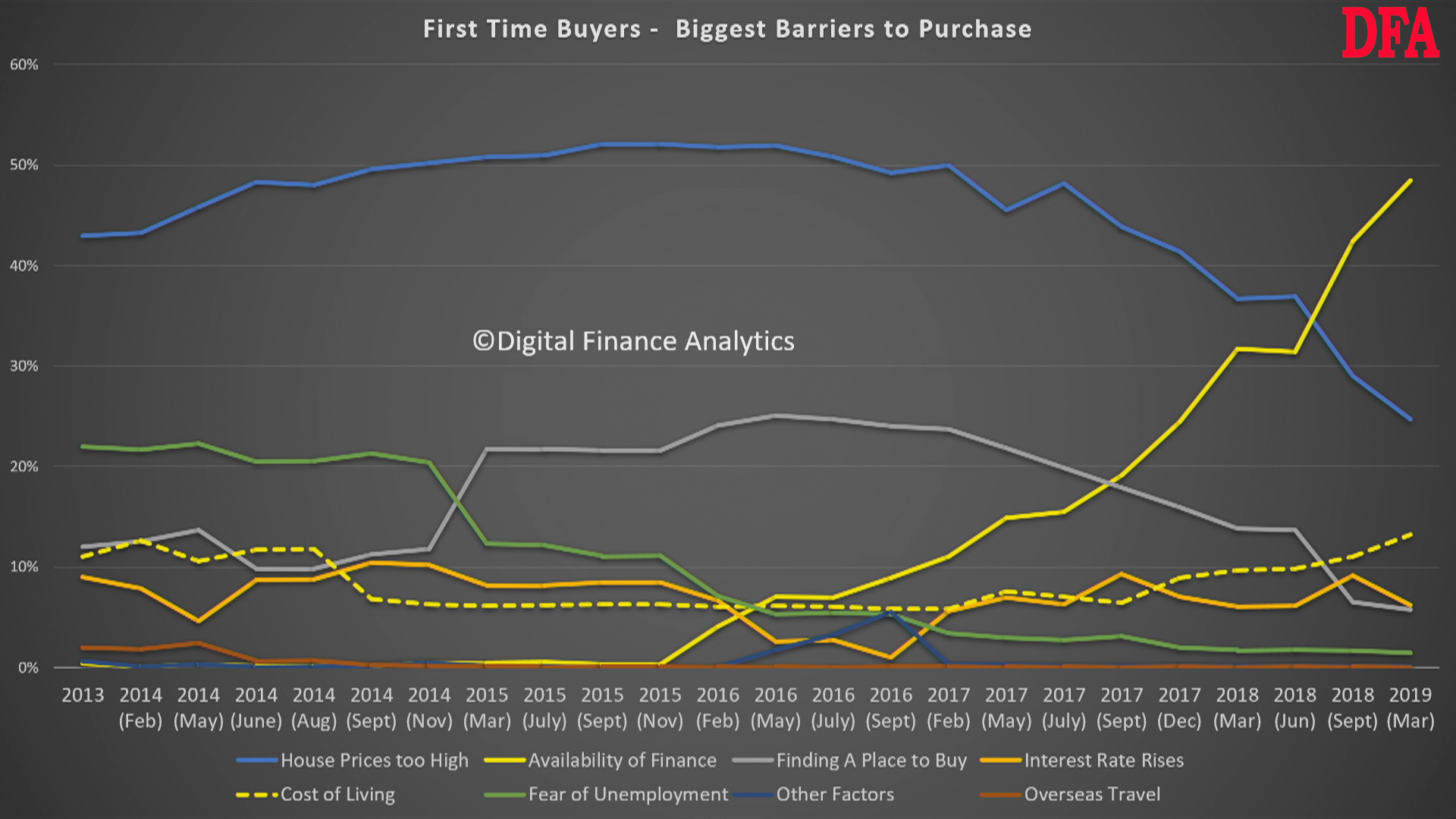

Looking at the barriers to transacting, there are some common themes emerging. Those wanting to buy are being constrained by the lack of available finance. Rising costs of living are also not helping.

First Time Buyers are also finding getting a loan tougher as underwriting standards have tightened. High prices as a barrier have slid a little.

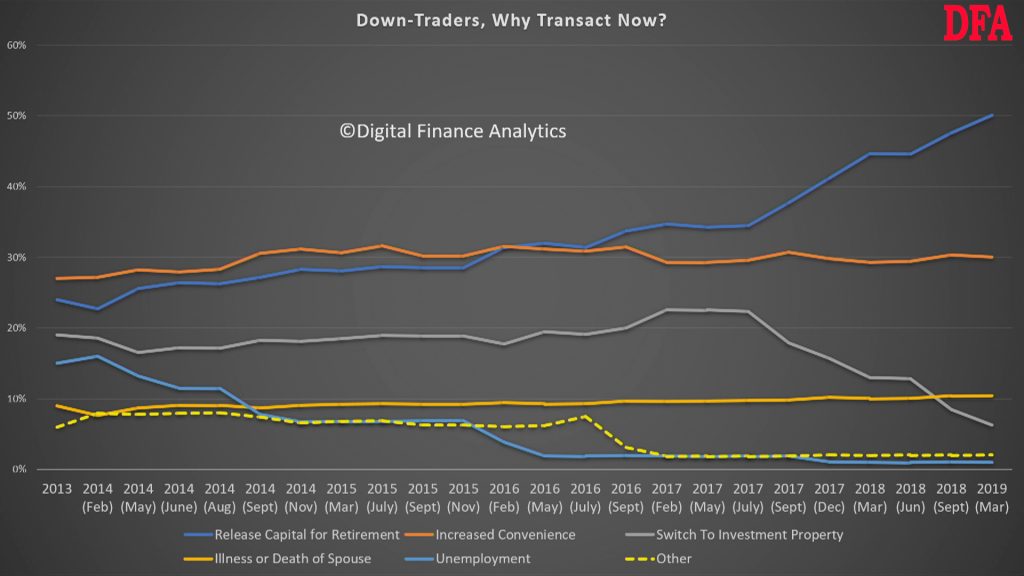

Down Traders are seeking to release equity before prices slide further. This is a big cohort and they are becoming more desperate to sell.

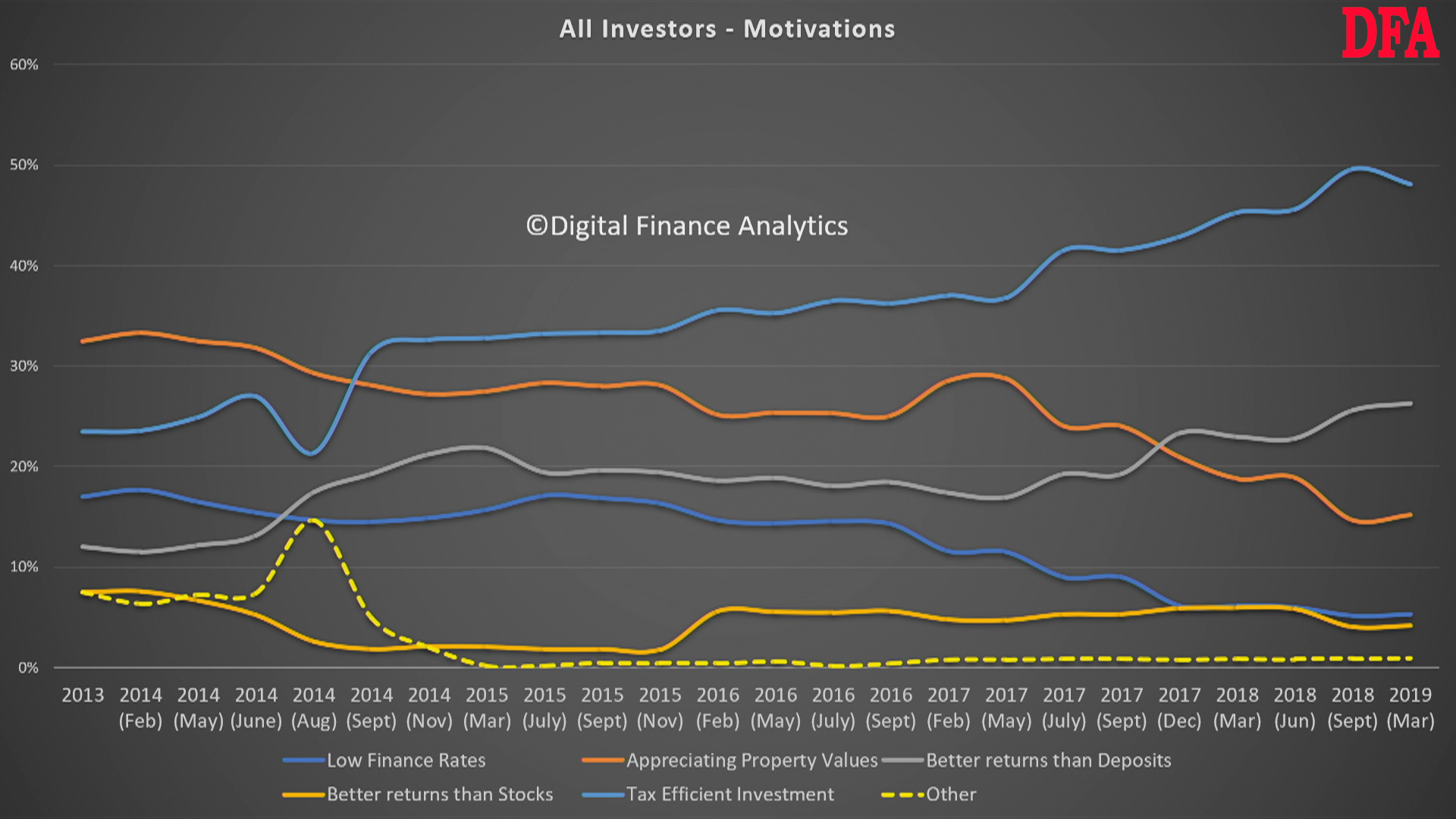

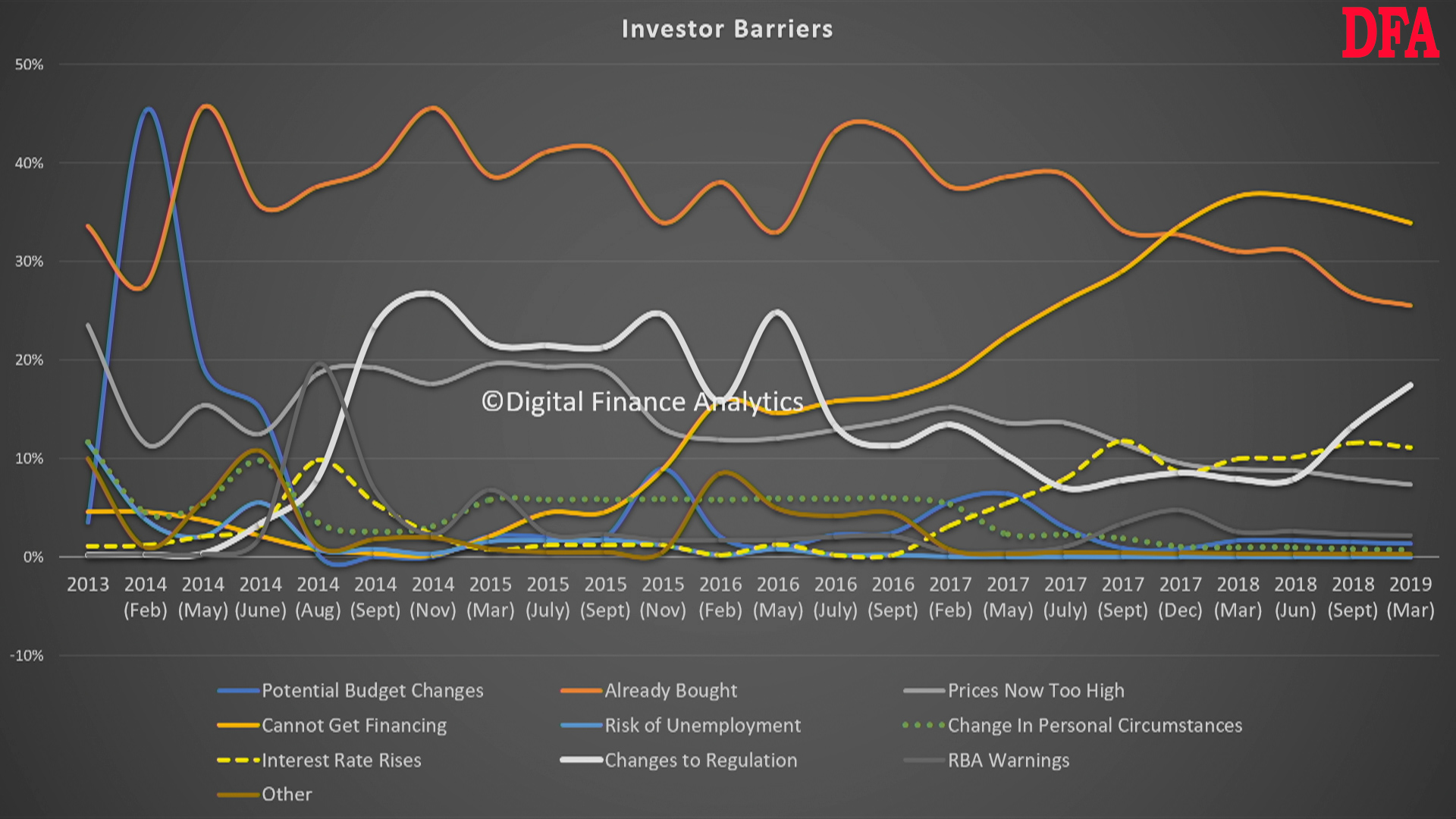

Investors are less convinced by future capital appreciation. Its mainly now tax efficiency which they cling to. Some will be forced to sell, but many are sitting on the sidelines and waiting to see how this plays out.

And barriers now include concerns around regulatory changes and finance avaliability.

So in summary there is nothing here which suggests any type of recovery in home prices. The collapse in prices has already been sufficient to put many households off from future purchases, and those who need finance are finding it hard to get funds. More falls to come.

Nothing here changes our scenarios. More falls. Period.