The ABS has released their 2015-16 Household Expenditure Survey (HES).

More than half the money Australian households spend on goods and services per week goes on basics – on average, $846 out of $1,425 spent.

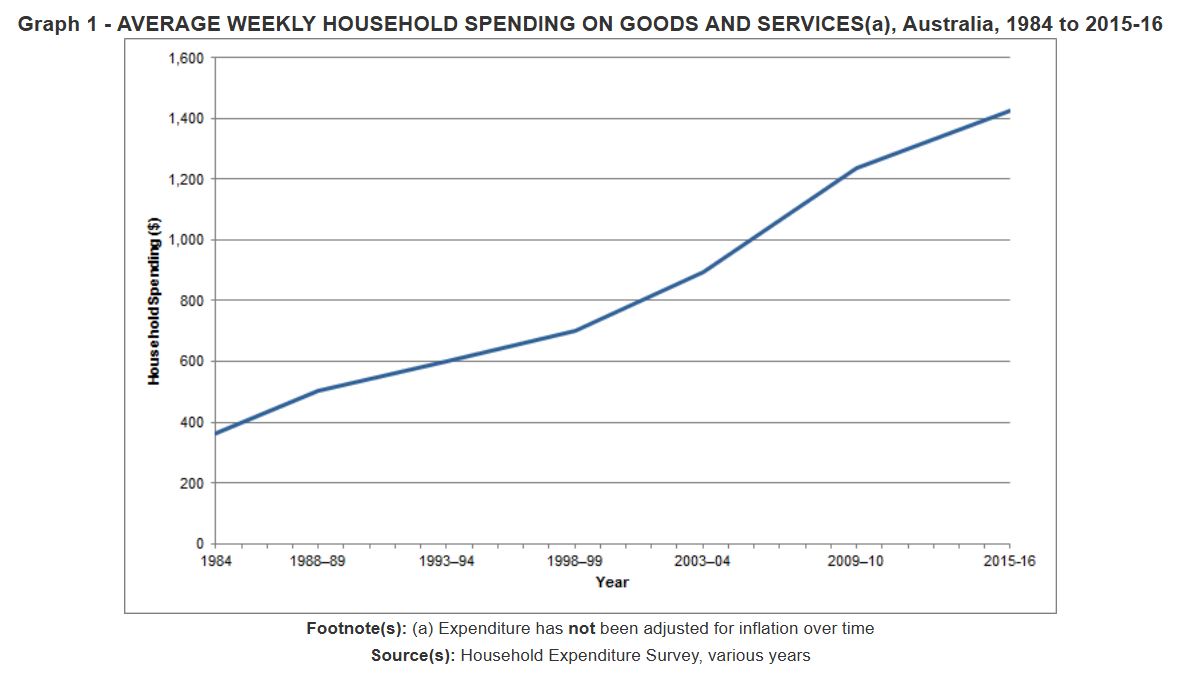

Australian household spending on goods and services increased by 15% between 2009-10 and 2015-16, going from an average of $1,236 per week to $1,425.

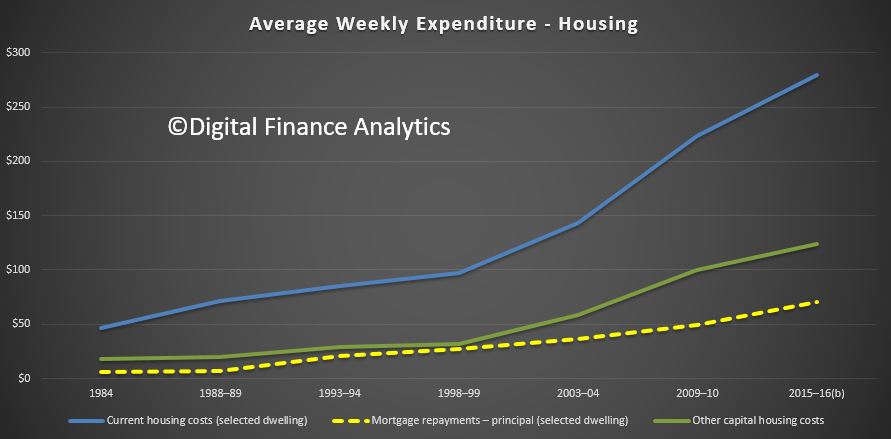

Housing costs have accelerated significantly.

Housing costs have accelerated significantly.

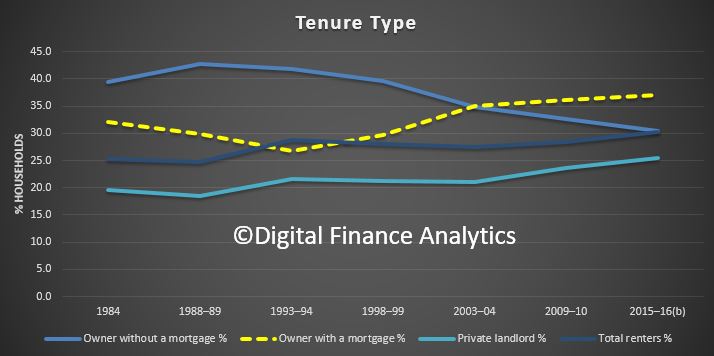

The data shows that more households now have a mortgage, while less are mortgage free. Rental rates remain reasonably stable, despite a rise in private landlords.

The data shows that more households now have a mortgage, while less are mortgage free. Rental rates remain reasonably stable, despite a rise in private landlords.

The goods and services that Australian households were spending the most on in 2015-16 were current housing costs ($279 per week), food and non-alcoholic beverages ($237 per week) and transport ($207 per week).

The goods and services that Australian households were spending the most on in 2015-16 were current housing costs ($279 per week), food and non-alcoholic beverages ($237 per week) and transport ($207 per week).

Average weekly spending on goods and services was highest in the Northern Territory and Australian Capital Territory ($1,700 and $1,670) and lowest in Tasmania and South Australia ($1,141 and $1,192).

“We can broadly think about household spending as either being for ‘basics’ or for ‘discretionary’ purchases – with basics covering essentials such as housing, food, energy, health care and transport,” ABS Chief Economist, Bruce Hockman said.

Today’s release shows that a growing portion of weekly outlays is spent on basics. Spending on basics accounted for 56 per cent of weekly household spending in 1984, growing to 59 per cent in 2015-16.

“The survey also shows that since 1984, the pattern of household spending has changed considerably,” explained Mr Hockman.

“In 1984, the largest contributors to household spending were food (20 per cent), then transport (16 per cent) and housing (13 per cent).”

“Jump forward to 2015-16, and housing is now the largest contributor (20 per cent), followed by food (17 per cent), and transport costs (15 per cent).”

More recently, since the last survey in 2009-10, the biggest increases in spending on goods and services by households have been in education (44 per cent), household services and operations, such as cleaning products and pest control services (30 per cent), energy (26 per cent), health care (26 per cent) and housing (25 per cent).

On the other hand, spending on alcohol, tobacco, clothing and footwear and household furnishings have not changed significantly from six years ago.

Mr Hockman added that, in 2015-16, 1.3 million Australian households (15 per cent) reported 4 or more markers of financial stress, down from 16 per cent in 2009-10. In addition, the proportion of Australian households who did not report experiencing any markers of financial stress has steadily increased, from 54 per cent in 2009-10, to 59 per cent in 2015-16.

- ‘Housing’ includes expenditure on rent, interest payments on mortgages, rates, home and content insurance and repairs and maintenance. Principle repayments on mortgages are reported separately.

- ‘Food’ also includes expenditure on non-alcoholic beverages and meals out. Expenditure on alcoholic beverages are reported separately.

- ‘Energy’ includes domestic fuel and power costs such as gas and electricity.

- ‘Health care’ includes expenditure on health practitioner’s fees, accident and health insurance, and medicines, pharmaceutical produces and therapeutic appliances.

- ‘Transport’ includes vehicle purchases and their ongoing running costs, public transport, taxi and ride sharing fares.

- Proportions of spending are based on total goods and services expenditure. This excludes items which increase household wealth (such as the principal component of mortgage repayments).

- Financial stress indicators include a range of items, such as not being able to raise emergency funds.

- Estimates are for people who reside in private dwellings in Australia, excluding Very Remote areas.