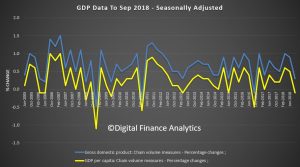

The Australian economy grew 0.3 per cent in seasonally adjusted chain volume terms in the September quarter 2018, according to figures released by the Australian Bureau of Statistics (ABS) today. But this was below expectations, and confirms the weaker performance of the economy. The household sector contribution is weakening, on the back of the weaker housing market, weak wages growth and higher costs. Government spending and commodity prices helped support the weaker numbers.

The RBA was forecasting an annual 3.5% to December 2018, based on the recent Statement on Monetary Policy. With the first three quarters of the year reaching just 2.2%, it would require a December quarter of 1.3%, which seems unlikely. So they will need to adjust their forecasts down.

All this looks to signal RBA cash rate cuts ahead.

In addition, the per-capita data went negative in September at – 0.1 % meaning that it is population growth alone which is responsible for lifting the GDP.

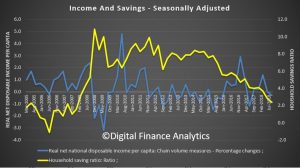

The per capita income and savings ratios also were negative, with the savings ratio back to lows not seen since 2007, as people dip into reserves to maintain lifestyle and pay the bills – as expected given our household financial confidence index.

And net disposable income per capita fell 0.3% in the last quarter.

We continue to see the economy quite differently from the RBA’s rose tinted windows in Martin Place. Had it not been for strong commodity prices the story would have been worse still. But the household sector growth engine is misfiring badly now, as the markets have recognised.

The ASX was down 1.14% at lunchtime to 4,642 on the back of the weak GDP and falls overnight on Wall Street.

The local fear index was higher, up 8.66% t0 16.11, indicating increasing uncertainty.

The Aussie slide against the USD, down 0.34% to 73.14.

And the DOW was down 3.1% overnight, on renewed fears about US recession as the yield curve inversion looks more likely, and trade talks with China continue, and Bexit uncertainty grows.

Signals from the Federal Reserve last week that it may be nearing an end to its three-year rate hike cycle has pushed the 10-year U.S. Treasury yield to three-month lows below 3 percent. The spread between the two-year and 10-year Treasury yields was at its flattest level in over a decade.

Concerns about slowing U.S. growth have accelerated the flattening of the yield curve, a phenomenon in which longer-dated debt yields fall faster than their shorter-dated counterparts.

A flatter curve is seen as an indicator of a recession, with lower longer-dated yields suggesting that the markets see economic weakness ahead.

This is what the ABS said:

ABS Chief Economist, Bruce Hockman, said: “The household sector drove domestic growth with increased consumption supported by moderate rises in household income.”

Household consumption rose 0.3 per cent driven by non-discretionary spending on food and housing. Spending on discretionary items slowed during the quarter. Household gross disposable income continued to grow at a slow pace due to moderate growth in household income being partially offset by a rise in income tax payable.

The subdued growth in gross disposable income coupled with an increase in household consumption resulted in the household saving ratio declining to 2.4 per cent in the September quarter. This is the lowest saving rate since December 2007.

Compensation of employees increased across all states and territories with the exception of the Northern Territory. “The increase in wages was consistent with strong employment growth as reported in the latest ABS Labour Force data, as well as a lift in wage rates.” Mr Hockman added.

Public spending was funded through increased revenue. General government final consumption expenditure increased 0.5 per cent underpinned by continued expenditure in health, aged care and disability services. Public investment remained at high levels with continued work on a number of large infrastructure projects around the nation.

Health care and social assistance output also recorded strong growth reflecting ongoing public investment in health care. Growth was also observed in services industries supporting infrastructure projects. Professional, scientific and technical services, Rental, hiring and real estate services and Administrative and support services all recorded growth during the quarter.