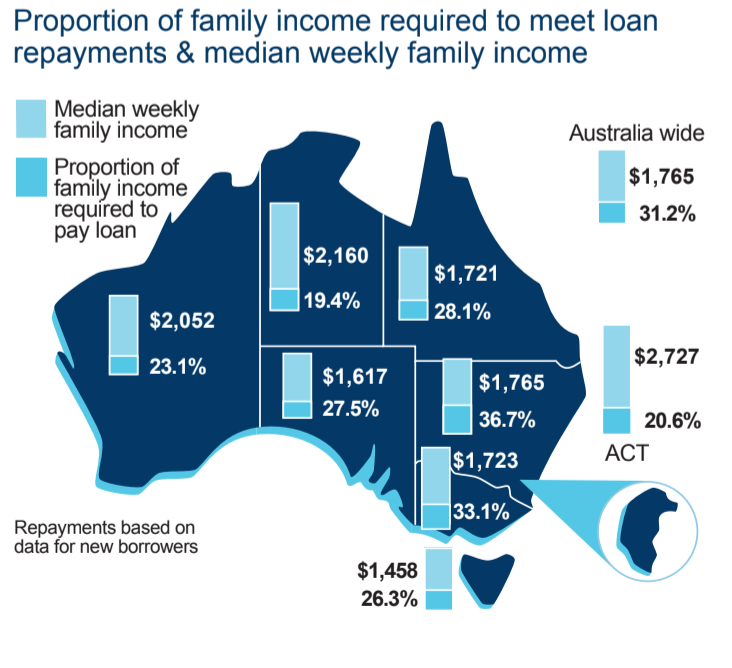

Housing affordability declined in all states and territories, with the exception of Victoria and the Northern Territory, according to the December quarter 2018 edition of the Adelaide Bank/REIA Housing Affordability Report, via The Real Estate Conversation.

“The slight downtick in housing affordability nationally for the quarter is disappointing,” Darren Kasehagen, Head of Third Party Banking, Adelaide Bank said.

Adelaide Bank/REIA Housing Affordability Report at a glance:

- Victoria leads first home buyer numbers

- Australian Capital Territory first home buyers up 34 per cent

- New South Wales shows the biggest improvement for renters

- Queensland shows the largest decrease in new loans

- South Australia had the largest increase in loan size

- Western Australia rents up 0.5 per cent (but still nations most affordable at 16.6 per cent of family income)

- Tasmania had the largest rise in monthly loan repayments

- Northern Territory housing affordability improves by 1.5 per cent

Mr Kasehagen said the decline in affordability in the quarter is attributable to an increase in average mortgage payments through increases in interest rates.

“These negated the drop in house prices and an increase in household payments.”

The largest decline was in Tasmania, with the proportion of income required to meet loan repayments increasing to 26.3 per cent.

Source: Adelaide Bank