Further evidence in the lending slow down came through in spades today with the ABS releasing their housing finance statistics to September 2018.

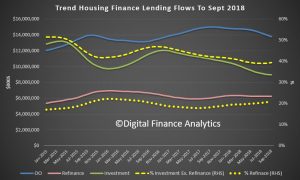

Looking at the trend flows first, new lending for owner occupation fell 1.7% compared with last month, down $235 million to $13.78 billion. Investment lending flows fell 0.8%, down $69 million to $8.96 billion, and owner occupied refinanced loans were flat at $6.24 billion.

Refinanced loans as a proportion of all flows rose to 20.8% and we continue to see this sector of the market the main battleground for lenders who are trying to attract lower risk existing borrowers with keen rates. Investment loans, were 39.4% of all new loans, up again from last month as owner occupied lending demand eases.

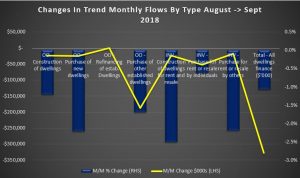

Looking at all the categories of loans month on month, we see lending for owner occupied construction down 1.2%, lending for the purchase of new dwellings down 2.2%, lending for the purchase of other existing dwellings down 1.7%, while investment lending for the construction of new property fell 2.5%, investment property for individuals fell 0.6% and investment lending for other entities, such as self managed super funds, dropped 2.2%. As a result total flows were down 1.1% compared with last month.

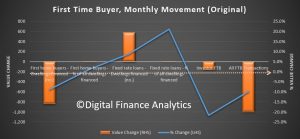

First time buyers were also down in number in September, falling by 8.8% to 8,693 new loans. This was 18% of all loans, up from 17.8% last month.

Looking at the individual elements, overall first time buyers were down, although overall more loans were written with a fixed rate, in response to the battery of cheap rate deals which were on offer.

Our first time buyer tracker shows the lower trends, especially as the number of new first time buyer property investors continue to slide.

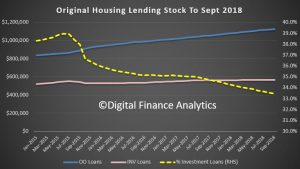

Finally, the overall loan stock rose in the month, in original terms, with owner occupied loans up 0.3% or $3.4 billion, and investment loans were flat, giving a total of $1.68 trillion, up 0.2%, and continuing the slowing trends.

We think lending growth will continue to slow, as prices fall further, and lending standards continue to tighten. Whilst some slack is being taken up by the non-bank sector, reduced credit means lower home prices ahead. We are entering the danger zone.